Big Shale Consolidation: Texas Oil Companies Strike $26B Deal

(Bloomberg) — In the era of Big Shale, the $26 billion combination of two Texas oil companies this week marks the latest in a series of deals reshaping the industry. Wall Street, once skeptical of the sector, now seems fully invested in its potential.

Deal Puts Big Shale in the Spotlight

Diamondback Energy Inc. has recently announced its acquisition of Endeavor Energy Resources LP, capping off a year of approximately $250 billion in oil and natural gas deals across the US. This wave of consolidation has transformed a fragmented landscape of private wildcatters into larger corporations, positioning Diamondback as a major player in America’s richest oil field.

Diamondback’s stock soared 11% following the announcement, a remarkable shift from the typical reaction to corporate acquisitions. The bullish response from investors clearly demonstrates approval for this path of consolidation

Healing the Shale Industry

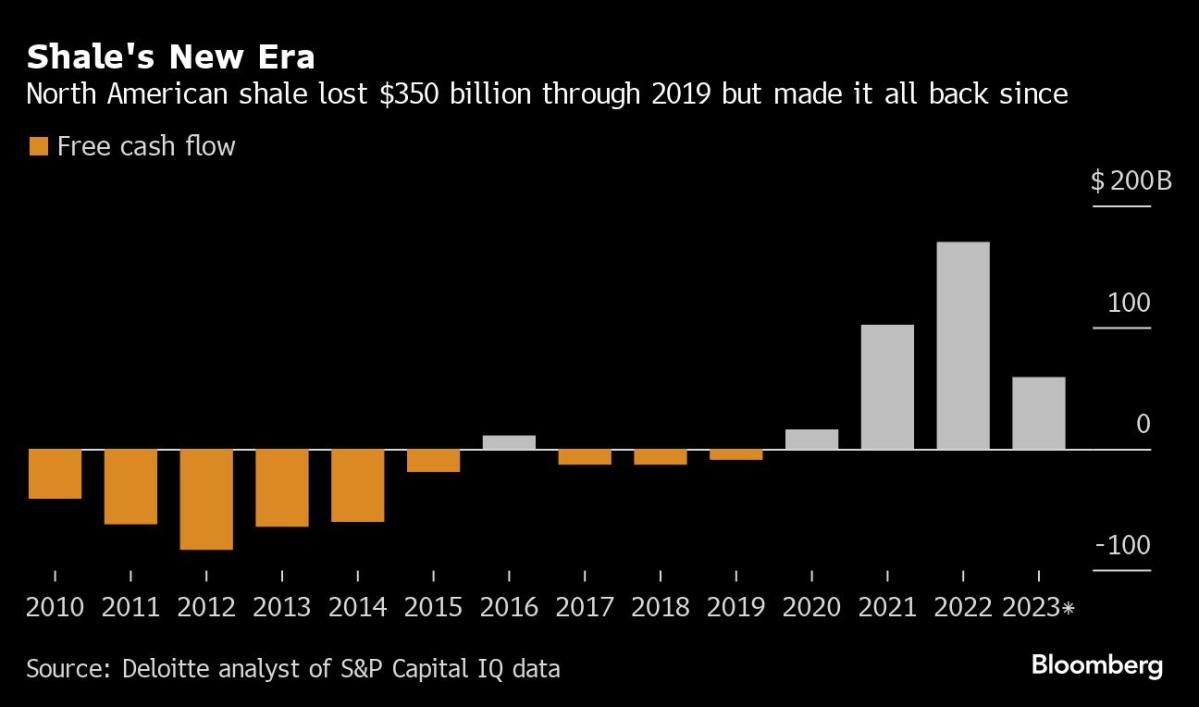

The consolidation wave sweeping through the shale sector is bringing about the recovery from years of overspending and prioritizing output growth over investor returns. While small upstarts sparked the shale revolution, the demand for scale, efficiency, and cash returns from Wall Street has transitioned the industry into a survival game for the largest players. Consequently, the industry is experiencing an arms race for operational scale and investor relevancy.

The current state of the shale industry is strikingly disproportionate to its prominence. Energy constitutes a mere 3.8% of the S&P 500 Index, despite the US surpassing Saudi Arabia as the leading global oil producer. Over the past six years, the number of publicly traded shale explorers has diminished by about 40%, shrinking the cohort to approximately 50 companies, according to Warwick Investment Group LLC.

Consolidate or Get Eaten

The consolidation trend sweeping through the shale industry has led to parallels with the 70s oil market, where only a handful of major players existed. Marking a significant step in this trajectory, Diamondback’s market value is set to double to around $60 billion, challenging EOG Resources Inc. as the leading pure-play shale stock. Diamondback’s increased market presence is an appealing prospect for investors seeking exposure to the Permian Basin, a prolific oil field straddling the Texas-New Mexico border.

Advantages of a Bigger Balance Sheet

A larger balance sheet resulting from the consolidation awards Diamondback enhanced access to capital, increased capacity for sustaining investor payouts during oil price shocks, and a more diversified drilling portfolio within the Permian region. Furthermore, Diamondback’s broader geographic footprint improves the company’s negotiation power with service providers, leading to greater operational efficiency and technological advancements.

Implications for the Industry

Apart from the obvious financial effects of this and similar consolidation deals, the market landscape is bound to change in significant ways. Such mergers historically foreshadow a slowdown in oil-production growth. Consequently, an increase in follow-on deals could potentially boost global crude prices and relieve pressure on the OPEC+ alliance’s efforts to stabilize the market by curbing output.

The changing of the executive guard is another important facet of this new era. Autry Stephens, the octogenarian founder of Endeavor Energy Resources, will soon become America’s wealthiest oil magnate following the completion of the deal. This transition represents the passing of the torch from the pioneer wildcatters who personally funded projects to a new generation playing a different game.

The Path to Investor Comfort

Investors have found solace in the recent consolidation deals, largely due to Autry Stephens retaining 40% equity in Diamondback and Warren Buffett implicitly supporting Occidental Petroleum Corp.’s acquisition of CrownRock LP. This validation has bolstered market confidence in these transformative transactions, sparking a bullish sentiment within the industry.

(Updates with comments from Petrie Partners co-founder in final paragraph.)

Read More from Bloomberg Businessweek

©2024 Bloomberg L.P.