Since January 2019 I have been publishing one regularly P2P lending monthly review. The format is one of the oldest and most established on my blog. The monthly review is divided into two areas:

- I regularly report on the updates of my personal P2P portfolio (income, performance, transactions, value development)

- In addition, I look back on the most important developments and updates of the individual P2P platforms and try to evaluate and classify them for you.

The P2P loan monthly review for September 2021 is about the record recoveries at Bondora, the successful licensing at VIAINVEST and Debitum, as well as the resilience of the PeerBerry platform.

My P2P portfolio in September 2021

First, an overview of how my P2P portfolio developed in September 2021.

revenue

- In September 2021, I was able to record interest income of EUR 203.85.

- The income has increased for the fifth month in a row.

- At the same time, the interest income generated represents the highest value since April 2020 (219.01 euros).

- Particularly noteworthy in this month are the negative net interest received at Bondora Portfolio Pro, which were as low as last in April 2020 (-31.33 euros)

Performance

- Although my portfolio is at NEO Finance has been released for 19 months, the return has only fallen from 11% to 10.81%. Borrower repayments are stable and strong attributed to my most recently conservative strategy.

- Having my total return on VIAINVEST last went up every month, in the last month – after a long time – there was another setback. Namely from 10.97% to 10.96%. Luxury problems.

Transactions

In September 2021 I have 1,000 euros with VIAINVEST and 400 euros via Bondora Go & Grow invested. Otherwise no further transactions have been made.

P2P Portfolio

The value of my P2P portfolio has increased increased from 41,331 euros to 42,924 euros. In perspective, this value should increase a little further every month and be over 45,000 euros by the end of 2021.

Road to 160k

In September 2021, I announced that I was pursuing the goal to build up a EUR 160,000 P2P portfolio by March 2027. For this I would have to pay 1,000 euros every month and achieve an annual return development of 10%. A very ambitious project, which I would like to face. As of the end of September 2021, I am 249 euros above the given target.

Bondora with a record month in recoveries

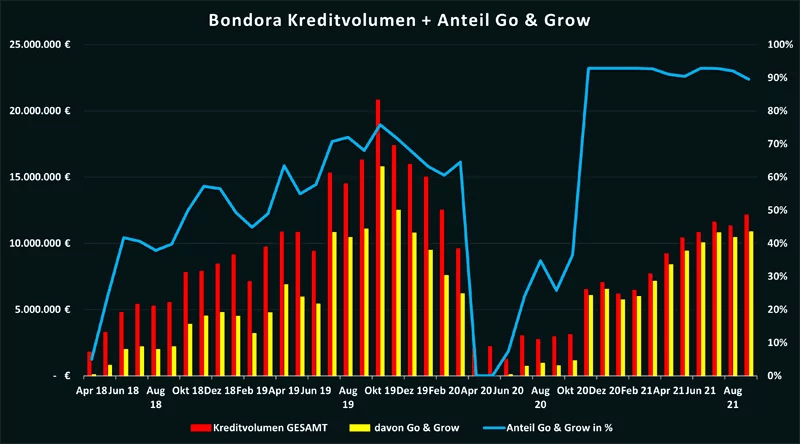

Bondora (5 EUR Bonus) financed loans of EUR 12.15 million in September. This corresponds to the highest value since February 2020 (12.51 million euros). The part that is paid via Bondora Go & Grow was financed (EUR 10.88 million), fell below 90% (89.51%) for the first time in ten months.

The strong recovery on the platform in September was more than gratifying. According to Bondora, 2.35 million euros were recovered last month, which corresponds to a significant increase compared to the previous record month (March 2021: 1.25 million euros). Personally, I was able to recover 164.40 euros in September, which was more than twice as much as in my second best month (November 2020: 79.98 euros).

As the reason for this development, several investors have pointed out that many Estonians probably got early access to their pension fund and thus outstanding debts could be settled. If this is the case, it is more likely to be an exceptionally high one-time effect. The first trend in October already suggests this.

If you want, you can think of it recently updated experience report on Bondora Portfolio Pro read through, which just went online last week.

EstateGuru introduces instant exit program

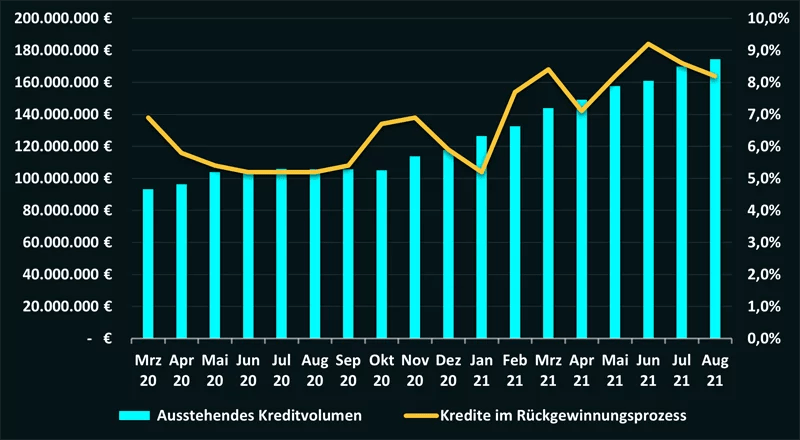

EstateGuru (0,5% Cashback) financed loans of EUR 21.2 million in August, which is historically the second highest value in the company’s history. As a result, among other things, the outstanding loan volume (as of September 13, 2021) increased to EUR 174.6 million.

At the same time, the rate of the loans in the recovery process is only 8.2%, which means a small improvement over the last two months. So growth and performance seem to continue to go hand in hand at EstateGuru, although the target of 5% that we have set for ourselves is still a bit removed.

The most important innovation concerns the Introduction of the instant exit program, which I have already devoted myself to in detail on the blog. Investors can sell their loan portfolio to EstateGuru for an immediate discount of 35%.

TWINO is planning a future IPO

at TWINO (15 Euro Bonus) There was news in September in connection with the receipt of the Latvian IBF license. Accordingly, the platform not only wants to successfully complete the transition period as a full-fledged broker next year, but also introduce a new product offering for investors outside of the classic lending business. For this purpose, both a mobile app development team and experts from the retail industry are currently being hired.

The TWINO founder and sole shareholder Armands Broks went one step further and dared to take a look into the future on his own blog. According to this, Twino should not only be transformed into a modern bank in the future, but also go public.

Our ultimate goal is to transform into a new-age bank and ring the Nasdaq bell in New York’s Times Square.

VIAINVEST receives investment brokerage license

Even VIAINVEST (10 Euro Bonus) was able to announce the receipt of the investment brokerage license in September, probably as the last Latvian P2P platform for the time being. The fact that VIAINVEST took the longest of all platforms should be acknowledged with a smile in view of the current “speed deficits”.

One news that I personally perceived with regret is the departure of P2P platform lead and VIA SMS Group press spokeswoman Simona Lucatniece. Simona has not only accompanied the start and development of the P2P platform since the end of 2016, she has also always been a constant and reliable cornerstone in the relationship and communication between companies and investors.

Her decision was by no means against VIAINVEST, but rather in favor of a new challenge, on which she does not want to comment publicly until the next few months. So much in advance: Despite some inquiries, it will not be in the P2P sector.

Debt Network

Even Debt Network (25 EUR Bonus) received a brokerage license from the FCMC in September. With this milestone, the foundation for a strong last quarter should surely be laid. In September it was already possible to finance 2.32 million euros in loans, which is the second-best value of the platform from a historical point of view.

PeerBerry continues to grow strongly, despite all adversities

PeerBerry (0,5% Cashback) has a very eventful September 2021 behind it, which despite everything, was able to close with very strong results. In the end, the investors financed almost 56 million euros, which is a new record in the company’s history.

The communication that you are withdraw from the licensing process in Latvia and register his business in Croatia instead, not only made little impression on investors, PeerBerry himself probably didn’t expect it either.

Many partners have therefore built up larger cash reserves in recent weeks in order to be able to pay off investors willing to migrate immediately. But because this did not happen, these funds were now used to invest in the lending business themselves. The result is that due to the already greater demand, the interest rates had to be lowered with several lenders.

Our partners have accumulated higher cash reserves in their accounts in advance, to settle with all investors immediately. However, no move from investors happened […] Currently, our partners have large amounts of accumulated reserves in their accounts and the first thing they will do is reinvest their profits into the business. This will temporarily lead to a lower need to borrow through the platform and correspondingly lower interest rates for investing in loans.

One wonders now what would have to happen that PeerBerry could not continue this growth. In my opinion, the platform is and will remain one of the most popular and popular platforms among P2P investors.