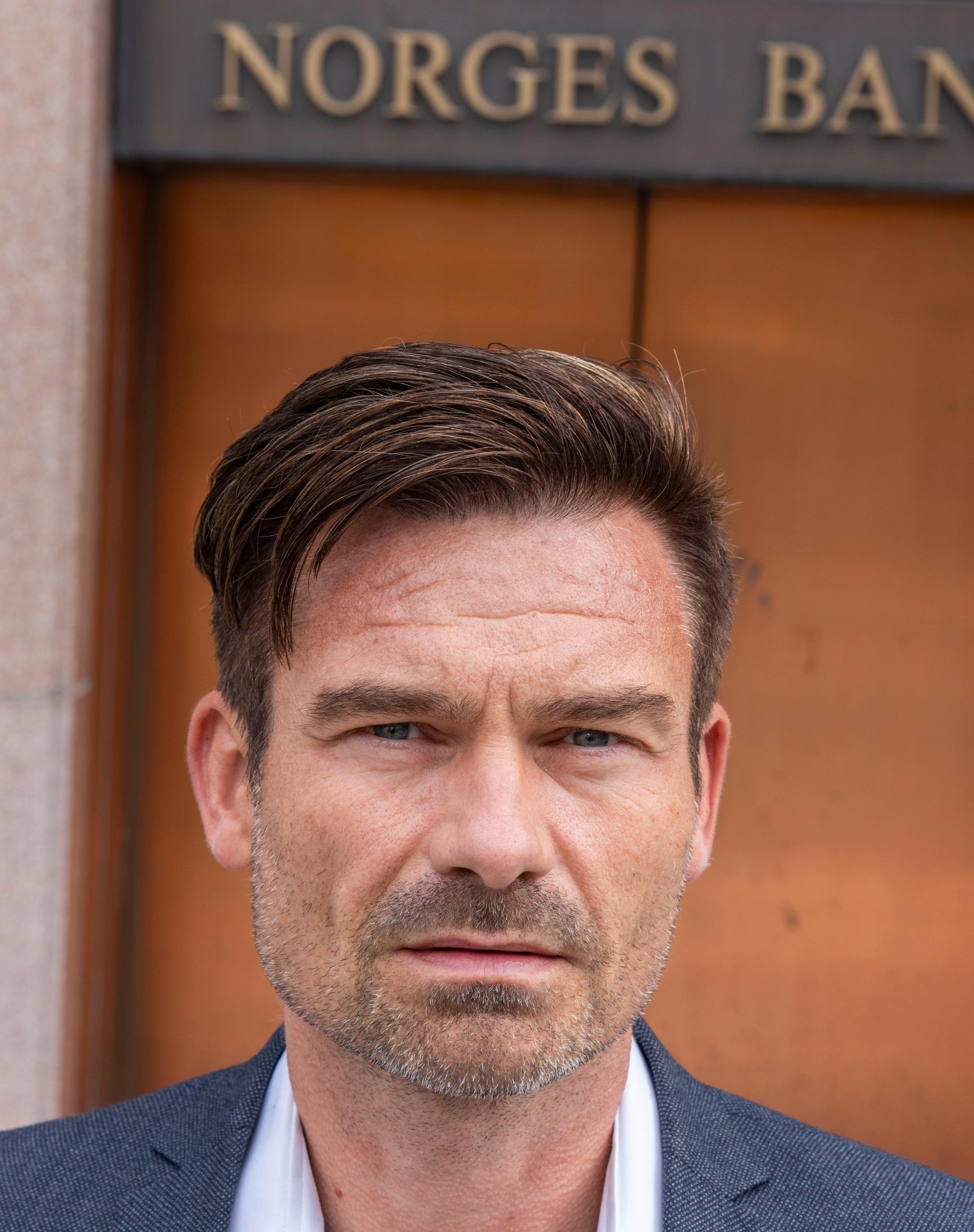

Chief economist Roger Bjørnstad in LO accuses Norges Bank of assuming an incorrect line in interest rate setting.

Less than 10 minutes ago

–

– They contribute unnecessarily to higher interest rates, says Bjørnstad

He receives partial professional support from Professor Steinar Holden.

– I do not think it will be necessary or desirable to raise interest rates as much as Norges Bank has announced, Holden says.

Norges Bank announced on Thursday that there will be no interest rate increase now, but that the interest rate path they announced in March is fixed:

They then announced that there could be seven interest rate increases by the end of next year, so that the key interest rate will increase from 0.75 today to 2.5 per cent by the end of 2023.

– They argue that high inflation is a main reason for the announced interest rate increases. I think this is the wrong monetary policy, because wage formation in Norway handles such a type of inflation, says Bjørnstad.

– Not right

He says that Norges Bank looks too much at what is happening abroad.

– Norges Bank contributes to stifling employment growth in Norway due to imported inflation. It is not the right monetary policy.

–

–He continues:

– I would go so far as to say that if this is unclear in Norges Bank’s mandate, my message to the government is that then they must clarify the mandate.

– You say that Norges Bank pays too little attention to the economic situation in Norway and places too much emphasis on the international economic situation, as a result of the current situation in Europe and the Ukraine war?

– Yes, they warn of interest rate increases for that type of price increase. Such an interest rate policy is not correct. And if Norges Bank thinks so, then the mandate must be changed because they then do more harm than good.

He calls for political debate.

– We are experiencing a completely extraordinary situation with inflation that comes from international conditions and not the Norwegian economy. Then it is important that Norges Bank receives a clear message about how such inflation is to be handled within the inflation target.

Power and war

Norway had an inflation target of 2.5 per cent as a management target in monetary policy from 2001. The inflation target has been in place since March 2018 been set at 2 percent.

He points out that what was in Norges Bank’s mandate before the Solberg government changed this in 2018; that one should not act on «separate, temporary disturbances» in price development. It was replaced by a goal of high production and employment.

– It should be interpreted as not to counteract the type of inflation that we have now, which is of a more short-term nature and which has no main basis in the Norwegian economy, but which is largely linked to the consequences of the war in Ukraine and power shortages in Europe .

– Political influence?

– But that wording was removed in 2018?

– Yes, but it must be seen in connection with the change to a goal of high production and employment that also does not speak in favor of counteracting such inflation, as we see now.

– This may appear as you are suggesting something that is unwanted; a political influence on Norges Bank’s interest rate setting?

– No, but we want political influence over the goals for setting interest rates – the mandate. It is incumbent on the government to formulate the goals for sensible monetary policy, which assumes that wage formation handles such inflation, so that we can have high employment.

He adds:

–

–– It would have been different if we had been like many other countries, where you have wage settlements that do not take into account the negative aspects of inflation. But in Norway, wage settlements are an important tool, which means that there is no need to use interest rate changes to the same extent as a price growth regulator.

Bjørnstad says the interest rate does not have to be as high as Norges Bank plans.

– When the inflation we are now experiencing appears to be of a temporary nature, then we do not need all the interest rate increases that Norges Bank is planning, he says.

Get professor support

Steinar Holden, professor and head of department at the Department of Economics at the University of Oslo, says he has been supporting Bjørnstad’s professional assessments for some time, but he does not agree with the criticism of Norges Bank.

– I agree with what Bjørnstad says that one should not stifle employment growth in Norway, due to imported inflation, Holden says and elaborates:

– It is important not to place too much emphasis on the consideration of keeping inflation down, in a situation with high imported inflation. A central bank that places great emphasis on the inflation target could raise interest rates too much, and this could significantly weaken the economy.

–

–He also believes that Norway does not need all the announced interest rate jumps.

– I do not think it will be necessary or desirable to raise interest rates as much as Norges Bank has announced. Norges Bank’s interest rate path coincides with an assumption that employment will continue to be high. If higher interest rates and other factors contribute to weaker-than-expected employment growth, I expect Norges Bank to downgrade the interest rate path.

– You support him in his professional message, but believe that Norges Bank will handle the challenge of imported inflation?

– Agree

– I agree with him that one must not stifle employment growth due to imported inflation. I also think Norges Bank will agree with that, but the difference is that they expect employment to remain high.

He says that the uncertainty is currently too great and that these are the reasons for different weighting of what is important in the interest rate assessments.

– Norges Bank writes that higher interest rates will ease the pressure in the Norwegian economy, but that employment is expected to remain high. Simultaneous; if they raise interest rates as much as they are now, then it could lead to employment growth becoming too weak. Therefore, Bjørnstad has a good point.

– Bommer

Chief economist Øystein Dørum in the Confederation of Norwegian Enterprise (NHO) does not agree.

– I think Bjørnstad is wrong. Norges Bank will review temporary changes in inflation. What they should be concerned about is the long-term development in inflation, so that there is a balanced development in the economy.

–

–Dørum says the uncertainty is great.

– By all means, it happens that Norges Bank misses and it may well be that Roger is right, that the interest rate has been raised less than the central bank’s interest rate forecast in a couple of years. But there is no reason to criticize Norges Bank for their interest rate policy today.

– Still chooses not to cling to

He points out that the central bank estimates core inflation at 2.5 per cent and registered unemployment at 2.0 per cent.

– They believe that there is good growth and high capacity utilization in the Norwegian economy, and that they believe it will continue. And they believe that inflation will shoot above target in this period. But they still choose not to cling to announcing even more interest rate jumps, as they could have done, says Dørum.

Defends interest rate increases

Press officer Bård Ove Molberg at Norges Bank says that they choose to refer to what is stated in the assessment Norges Bank’s Committee on Monetary Policy and Financial Stability after Norges Bank’s latest interest rate decision, and in particular these two sections:

“Inflation management must be forward-looking and flexible, so that it can contribute to high and stable production and employment as well as counteract the build-up of financial imbalances.”

And:

“Monetary policy is expansive. The Committee’s assessment is that the consideration of stabilizing inflation around the target in the short term indicates a further rise in the key policy rate. Rising interest rates will ease the pressure on the Norwegian economy, but employment is expected to remain high. Uncertainty about economic developments and how households will adapt to a higher interest rate level indicates that interest rates will rise gradually ».

–