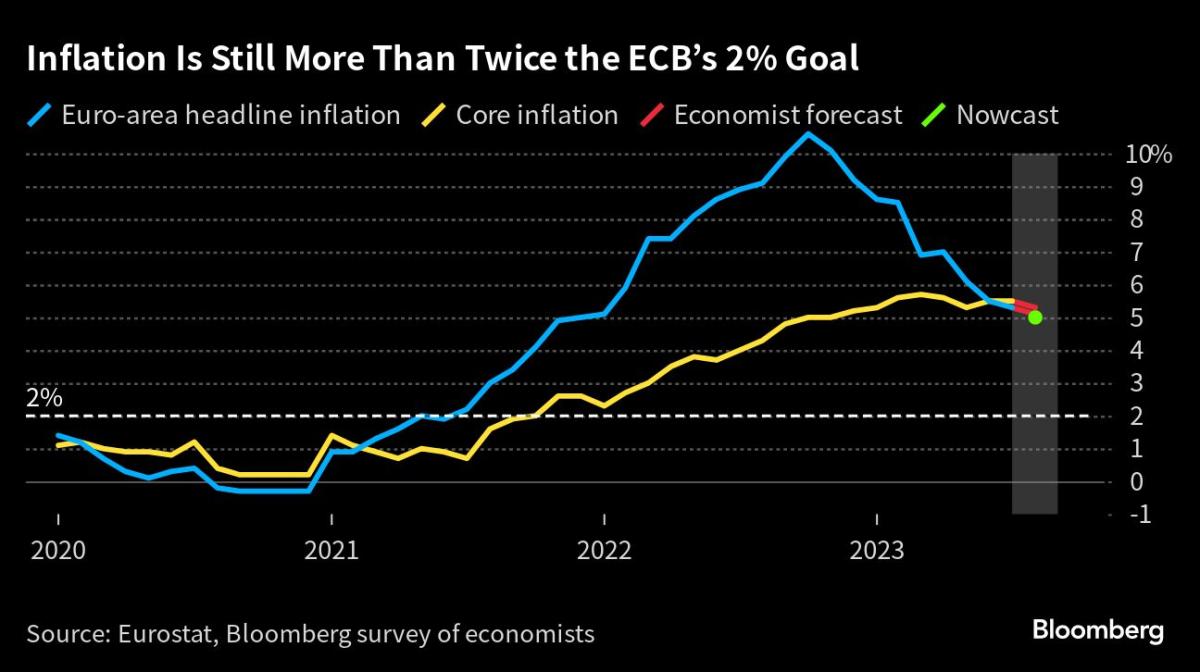

The European Central Bank has not been able to beat inflation, and probably will have to raise interest rates again in September, according to Council member Robert Holzmans.

Most read from Bloomberg

In an interview with fellow hawks who are also calling for another increase in borrowing costs, the Austrian conservative said the economy was not in danger of recession and a tight labor market meant unions could come up with big wage increases.

“We don’t have clarity on inflation yet,” Holtzman said, adding that he would monitor all incoming information to assess risks to prices. “If there are no big surprises, then I see the need to move forward without a pause with raising rates.”

The remarks in the Austrian mountain village of Alpbach are fueling a heated debate over one of the most tense decisions since the European Central Bank began raising interest rates last July as officials judge whether the economy will weaken enough to suppress inflation. they need. provide another hike.

Holtzman has long been one of the most partisan policy makers. Colleagues from Germany and Latvia – Joachim Nägels and Mārtiņš Kazačs – said in Bloomberg TV interviews last week in Jackson Hole, Wyoming, that they too are leaning towards another increase.

Mario Centeno of Portugal, a more pessimistic official, responded that potential downside risks called for caution. But Holzman believes that this is not the time for indecision.

“We’d better get to the cap rate sooner, which also means we can eventually start going lower earlier,” he said. “It is difficult for markets to understand the stop-and-go price path.”

The story continues

He added that the ECB is still “a bit behind” in the fight against inflation. Asked if that meant rate hikes could continue beyond September, he said: “Once we get to 4%, we’ll discuss it again.”

President Christine Lagarde avoided sending clear signals about the ECB’s next decision in a keynote speech in Jackson Hole on Friday, although she acknowledged that inflation in the euro zone remains unrelenting.

Updated consumer price data for August will be released on Thursday, while a final assessment of the region’s economic performance in the second quarter will be available a week later.

“The economy is not in as good shape as we had hoped, but at the same time the decline is not so great that we have to talk about a recession,” Holtzman said. “We’re looking at a stagnant economy.”

Against this background, he added, the ECB should consider accelerating the balance sheet liquidation process. While bonds bought under the legacy program are currently allowed to be released, reinvestment under the pandemic program – PEPP – is expected to continue until at least the end of 2024.

“I am a big supporter of starting the discussion on ending reinvestment in PEPP sooner than currently planned,” said Holtzman. “I appreciate his ability to deal with tensions in financial markets, but it is time to step up” quantitative tightening.

Most read from Bloomberg Businessweek

©2023 Bloomberg LP

2023-08-28 12:22:05

#ECBs #Holzmann #sees #reason #raise #rates #surprises