China lowered its vital lending price in an exertion to bolster development as the world’s next premier economy suffers from relentless lockdowns and a worsening authentic estate downturn.

The People’s Bank of China on Monday reduced the medium-expression lending rate at which it offers annual financial loans to the banking process by 10 foundation details to 2.75%, bringing it to 2.75%, the 1st lower considering that January. Analysts interviewed by Bloomberg had expected the central bank to go away premiums unchanged.

The conclusion underscored expanding unease in Beijing as it struggles to combat a month-extensive decrease in purchaser desire brought on by its long-standing zero-Covid policy, as effectively as the fallout from funds-strapped true estate builders and a slowdown in global expansion.

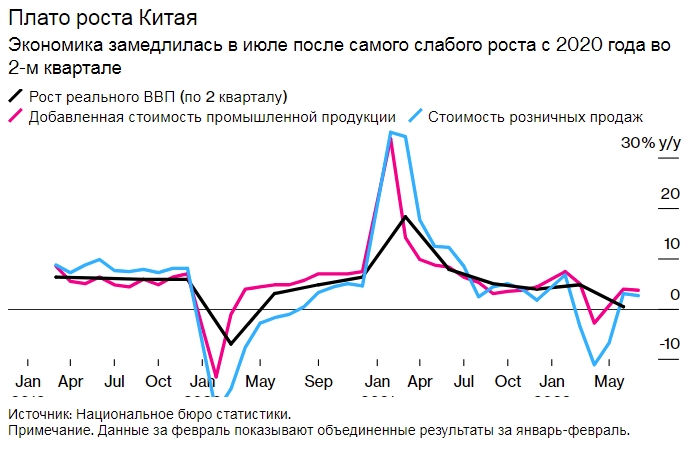

Regardless of Beijing’s designs to dedicate hundreds of billions of pounds to promote growth, the Chinese economic system narrowly escaped contraction in the 2nd quarter.

Formal figures unveiled on Monday showed even worse-than-anticipated consumer and production action as the pace of the country’s financial restoration slows right after large freezes.

Retail product sales, an critical consumption indicator, rose 2.7% yr-on-calendar year in July, when industrial creation, which was the engine of development at the start out of the pandemic, grew 3.8%. Analysts experienced forecast advancement of 5% and 4.6% respectively.

Youth unemployment rose to a file 19.9%, increasing stress on the Xi Jinping administration to revive the economic system.

Experts be expecting China’s economic slowdown to direct to extra accommodative monetary procedures and fiscal stimulus, but some are pessimistic about Beijing’s scale and pace of reaction.

“China’s growth in the 2nd 50 % of the year will be seriously hampered by its zero-Covid system, a downward spiral in actual estate marketplaces and a most likely slowdown in export growth,” claimed Ting Lu, Nomura’s Chinese chief economist. . Political help from Beijing may perhaps be as well tiny, too late and way too ineffective. “

Analysts also pointed out that Beijing’s central banking institutions have been reluctant to slash prices because of to fears of growing financial debt and inflation.

“But the PBoC appears to be to have determined it now has a extra urgent dilemma. The most current info shows weak economic momentum in July and a slowdown in financial loan progress that has been much less responsive to policy easing than in former financial downturns, ”said Julian Evans-Pritchard, senior Chinese economist at Funds Economics.

Société Générale described the July details as “only unfavorable”, with production, investment decision and intake slowing “below the overpowering weight of zero Covid procedures” and with “the serious estate sector in free of charge slide”.

“Politicians have begun to talk their concerns about more than-stimulating the economy with too a great deal liquidity, whilst the actual possibility, in our view, is just the opposite: much too little easing and much too very little recovery,” banking analysts stated. .

Xi’s coronavirus coverage of imposing rigorous limits where ever virus outbreaks are discovered further more complicates the outlook.

Numerous Chinese towns, including Haikou on the southern island of Hainan and Urumqi in the western region of Xinjiang, have imposed or extended lockdown limits in some places, with conditions escalating across the country around the weekend.

The blockade of Hainan sparked little protests among tens of countless numbers of tourists stranded on tourist trips.

Shanghai authorities are testing the use of drones to allow for citizens to scan their health codes as they enter structures. The health and fitness code is created in a required smartphone app that determines no matter whether folks can transfer dependent on their exposure to Covid-19.

In accordance to the Fiscal Occasions

Snapshot of the industry – ProFinance.Ru information and market place gatherings in Telegram

About this subject matter:

US senators are contacting for sanctions in opposition to Russian oil sales to China

The Chinese economic climate slows sharply in the 2nd quarter, world-wide pitfalls cloud the outlook

–