It won’t be as bad as in 2008, but “it all seems to be getting a bit too problematic,” said Charlie Munger, Warren Buffett’s right-hand man. The risks are particularly high at the smaller banks.

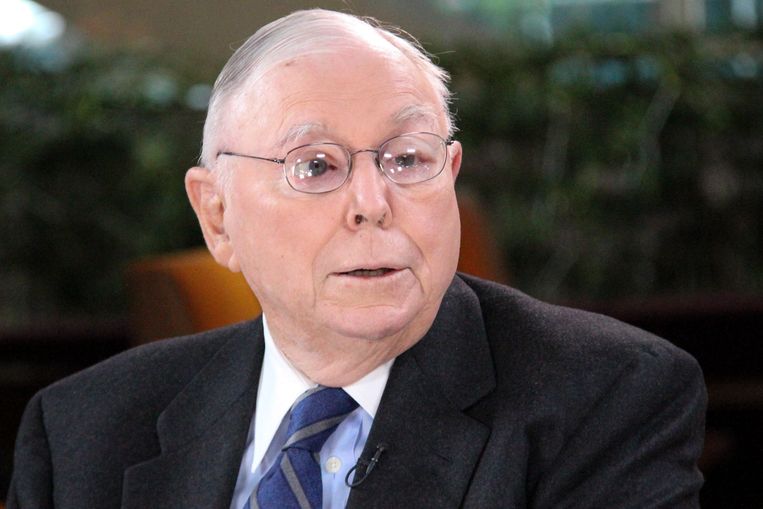

A storm is brewing in the US real estate market. That warning gives Charlie Munger, the 99-year-old right-hand man of CEO Warren Buffett at the Berkshire Hathaway conglomerate. In an interview with the Financial Times he says that when real estate prices fall, US banks are “full of bad loans”. The value of the real estate that the banks have as collateral is then lower than the value of the credit granted, which means that they risk losses.

Munger has extensive experience in the real estate industry and is an investment veteran who has the ear of countless investors. “Every bank in the country lends less easily for real estate than it did six months ago,” said Munger, who notes that banks already have many office buildings and shopping centers in their loan portfolios that are struggling to repay their loans. “It all seems to be becoming a bit too problematic.”

According to him, the situation is not as bad as in 2008, when a crisis in a niche of the US mortgage market, that of the ‘junk mortgages’, led to a global financial crisis. Munger and Buffett were able to make good use of this at the time with a profitable investment in investment bank Goldman Sachs, something they repeated three years later with Bank of America. In both cases, Berkshire made a financial blow.

Munger is not alone in his fears of new problems in the real estate market. “Residential and commercial real estate loans account for nearly a quarter of all U.S. bank assets,” cautioned Neil Shearing of research firm Capital Economics recently. “When real estate prices collapse, loans that seemed safe thanks to their collateral suddenly look like bad loans, with significant implications for the health of bank balance sheets.”

In addition, there is an additional effect, Shearing notes. “Real estate accounts for about 30 percent of household wealth in the US. If house prices fall sharply, this will also have consequences there. Moreover, the situation of families and banks can interact and make everything worse.”

Small and medium banks

Commercial real estate prices in the United States have fallen about 5 percent since their peak in mid-2022, and Capital Economics expects them to fall another 20 percent. It is mainly small and medium-sized banks that finance such transactions. Together they account for 70 percent of all outstanding loans in the real estate sector.

To finance this, these banks rely on customers’ savings. There is a danger in this, because several medium-sized banks have gone bankrupt in the past two months when customers withdraw their money en masse. However, these institutions faced specific problems. Silicon Valley Bank, for example, had lent too much to the tech sector and was failing in its risk management.

Deposits at small and medium-sized banks are decreasing more gradually, largely due to the search for higher remuneration. “Money market funds offer higher interest rates,” explains Shearing. “That puts these banks in a difficult position. Either they raise interest rates on savings and try to keep profits intact by raising interest rates on new loans. Or they sell assets to meet lower deposits.”

2023-04-30 18:40:21

#Investment #veteran #Charlie #Munger #warns #storm #real #estate #market