Breast Prosthetic Market Summary

Table of Contents

- Breast Prosthetic Market Summary

- Market Concentration & Characteristics

- Material Type Insights

- Product Type Insights

- Application Insights

- Distribution Channel Insights

- Regional Insights

- Key Breast Prosthetic Company Insights

- Recent Developments

- Breast Prosthetic Market Report Scope

- Global Breast Prosthetic Market Report Segmentation

The global breast prosthetic market size was estimated at USD 360.0 million in 2024 and is projected to reach USD 692.7 million by 2033, growing at a CAGR of 7.60% from 2025 to 2033. The industry is experiencing significant growth driven by various factors. The rising prevalence of breast cancer worldwide is a primary catalyst, as increased incidences lead to a higher demand for reconstructive solutions.

Key Market Trends & Insights

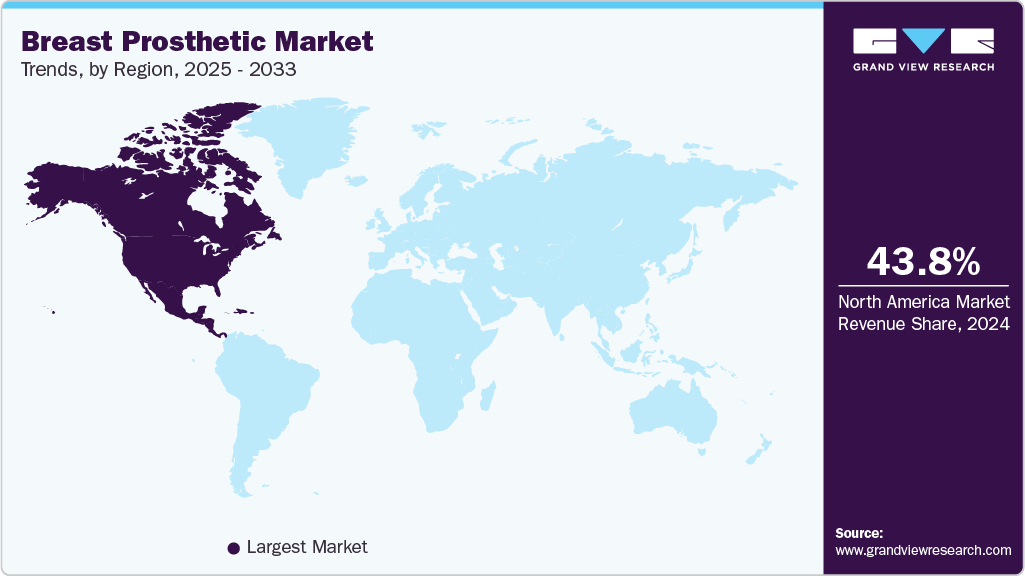

- North America dominated the breast prosthetic market with the largest revenue share of 43.83% in 2024.

- The breast prosthetic market in the U.S. accounted for the largest market revenue share of 77.16% in North America in 2024.

- The silicone breast forms segment led the market with the largest revenue share in 2024 based on material type.

- Based on application, the post-mastectomy care segment is expected to grow at the fastest rate over the forecast period.

- By distribution channel, the retail pharmacies & medical supply stores segment led the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 360.0 Million

- 2033 Projected Market Size: USD 692.7 Million

- CAGR (2025-2033): 7.60%

- North America: Largest market in 2024

The market has been experiencing notable growth driven by medical, technological, and social factors. One of the primary drivers is the increasing global incidence of breast cancer and patients undergoing mastectomy procedures. For instance, according to the American Society of Plastic Surgeons report published in November 2024, the proportion of patients choosing breast reconstruction following mastectomy has stabilized in recent years. Further, according to the same source, most patients receiving breast reconstruction had private insurance; however, this percentage declined from 85.0% to 75.1%. Conversely, the share of breast reconstruction patients covered by public health insurance has grown, with Medicaid patients increasing from 3.3% to 6.6% and Medicare patients rising from 9.9% to 15.6%. This suggests that increasing public health insurance for breast reconstruction is fueling the market growth.

According to the Breast Cancer Research Foundation, breast cancer is the most prevalent cancer among women globally, affecting both developed and developing countries. In 2022, approximately 2.3 million women were diagnosed with breast cancer worldwide, resulting in around 670,000 deaths. Alarmingly, every 14 seconds, a woman somewhere in the world receives a breast cancer diagnosis. Hence, a growing number of breast cancer cases is expected to boost the market demand.

As more women undergo mastectomy procedures, either as part of cancer treatment or prophylactically, the demand for breast prostheses rises. Additionally, growing awareness surrounding post-mastectomy reconstruction options-both surgical and non-surgical-has increased patient interest in breast prosthetics as a viable alternative or complement to reconstructive surgery. One of the leading breast reconstruction awareness campaigns is sponsored by the American Society of Plastic Surgeons (ASPS) and The Plastic Surgery Foundation (The PSF), with funding provided by corporations, institutions, private practices, and individuals. Many women, particularly older individuals or those with co-morbidities, opt for external prostheses due to the less invasive nature and quicker recovery time compared to reconstructive procedures.

Another significant driver is the psychological benefit associated with breast prosthetics. These devices help restore body image, self-esteem, and a sense of normalcy, which are often deeply impacted after a mastectomy. Moreover, the role of healthcare policies and reimbursement schemes cannot be overstated. In countries like the U.S., the Women’s Health and Cancer Rights Act (WHCRA), Centers for Medicare & Medicaid Services (CMS) mandates insurance coverage for post-mastectomy prosthetic devices. In contrast, national health systems in Canada and several European countries offer subsidies or full coverage, removing financial barriers and broadening access.

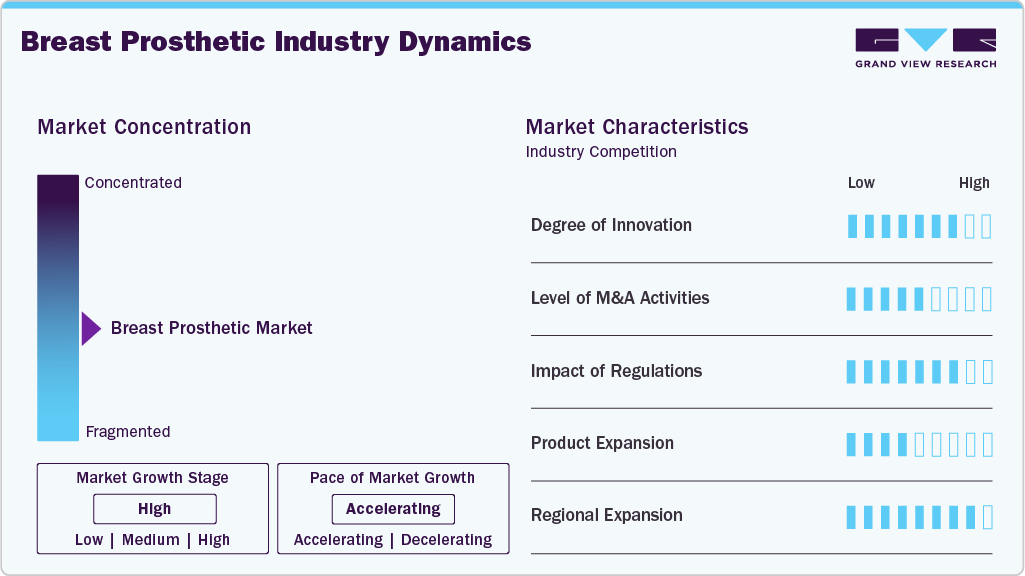

Market Concentration & Characteristics

The breast prosthetic market has seen significant innovation in recent years, driven by materials, design, and technology advances. Traditional prostheses primarily focused on mimicking the look and feel of natural breast tissue using silicone-based materials. However, emerging innovations aim to improve comfort, realism, and functionality. For example, lightweight and breathable materials have been developed to enhance comfort for long-term wear.

Advances in 3D printing technology now allow for customized prostheses tailored to individual body contours, improving fit and aesthetic outcomes. For instance, MyFit is a company that offers a mobile B2B solution specializing in precise 3D human body measurements through advanced mobile scanning technology. This innovative approach is transforming the healthcare industry, especially in the design of breast prostheses. Utilizing mobile 3D scanning, MyFit enables healthcare providers and prosthetic specialists to quickly and accurately capture detailed body measurements in a clinical or patient setting. This technology facilitates the creation of highly customized prostheses for patients who have undergone mastectomies, suffer from congenital malformations, or seek breast augmentation. The ability to generate precise, personalized measurements on-demand enhances fit, comfort, and aesthetic outcomes. As a result, MyFit’s mobile 3D scanning solution represents a significant leap forward in personalized healthcare, offering a more efficient, accurate, and patient-centric approach to breast prosthesis design and manufacturing .

According to CMS, external breast prostheses are covered under the Prosthetic Devices benefit (Social Security Act §1861(s). To qualify for reimbursement, beneficiaries’ supplies must meet the reasonable and necessary (R&N) criteria outlined in the relevant Local Coverage Determination. Certain statutory payment policies, discussed below, must also be satisfied. The expected useful lifetime for silicone breast prostheses is two years. For nipple prostheses, the lifetime is three months. Prostheses made of fabric, foam, or fiber-filled materials have a useful lifespan of six months. Replacements requested earlier than these timeframes due to normal wear and tear will be considered noncovered and denied.

The breast prosthetic market has experienced a low but strategic level of mergers and acquisitions (M&A), reflecting the industry’s drive for innovation, expanded capabilities, and market consolidation.

In the breast prosthetic market, product substitutes play a significant role in meeting diverse needs and preferences of users. Traditional silicone-based prostheses remain the most common choice due to their realistic feel and appearance. However, alternative options are increasingly available for different lifestyles and sensitivities. Gel-filled prostheses offer a lightweight alternative, providing comfort and natural movement. Foam-based prostheses are also popular for their breathability and reduced weight. Additionally, custom-made prosthetics using advanced materials like memory foam or medical-grade silicone blends are gaining traction for personalized fit and comfort. Some users opt for lightweight, silicone-free options made from eco-friendly or hypoallergenic materials, especially those with sensitivities or allergies.

The global breast prosthetic market is characterized by a moderate level of market concentration, with a few key players dominating a significant share of the industry.

Material Type Insights

Based on material type, silicone breast forms held the largest share in 2024. These forms closely mimic the natural feel and movement of real breasts, making them the preferred choice for many women. Silicone’s flexibility and softness provide a more natural appearance and feel, significantly enhancing user confidence and comfort. Additionally, silicone breast forms are highly customizable, available in various shapes, sizes, and thicknesses to suit individual preferences and body types. Their resistance to wear and tear also ensures long-term usability, making them a cost-effective option over time.

Several factors drive the dominance of silicone breast forms segment in this market. Advances in silicone technology have improved the realism and comfort of these products, attracting more users. Increasing awareness about breast reconstruction options and the rising prevalence of breast cancer patients seeking post-mastectomy solutions further propel demand. Moreover, the growing availability of aesthetically pleasing and lightweight silicone options enhances user satisfaction. The rising adoption of these forms in cosmetic and reconstructive surgeries and advancements in manufacturing processes that reduce costs continue to support their market leadership. Overall, silicone breast forms are set to maintain their dominance due to their superior attributes and expanding consumer acceptance.

The foam and fabric breast forms/non-silicone segment is anticipated to experience significant growth with CAGR of 6.42% in the global breast prosthetic market. This trend is driven by increasing demand for lightweight, breathable, and hypoallergenic options that offer comfort and ease of wear. Foam-based breast forms are appreciated for their soft, natural feel and reduced weight compared to traditional silicone prostheses, making them suitable for everyday use, especially for women with sensitive skin or allergies to silicone. Fabric breast forms, often incorporating foam or other lightweight materials, enhance breathability and flexibility, further boosting their popularity among users seeking comfort and discreetness.

Product Type Insights

On the basis of product type, full breast prosthesis segment held the largest share in 2024. This prominence is driven by the increasing preference for complete breast reconstruction solutions following mastectomy or lumpectomy procedures. Full breast prostheses offer a symmetrical appearance, restoring the natural silhouette and boosting the confidence and self-esteem of women post-surgery. Their ease of use and ability to provide a realistic, natural look make them a preferred choice among users.

The specialty/functional prosthesis segment is anticipated to experience significant growth within the breast prosthetic market, driven by the increasing need for customized solutions that cater to specific medical or functional requirements. These prostheses are designed to address unique challenges, such as asymmetry, reconstruction after complex surgeries, or certain physical activities, providing enhanced comfort and functionality for the user. The growing awareness of personalized healthcare options and the demand for prostheses that restore both appearance and function are key factors fueling this growth.

Application Insights

On the basis of application, post-mastectomy care segment held the largest share in 2024 primarily driven by the increasing number of women undergoing mastectomy procedures due to breast cancer, which creates a substantial demand for effective post-surgical solutions. Post-mastectomy care products, including breast prostheses, are essential for restoring aesthetic appearance and improving psychological well-being, making them a vital component of comprehensive cancer recovery.Several factors propel the growth of this segment. Rising awareness about breast cancer and the importance of reconstruction and rehabilitation contribute significantly to market expansion. Advances in prosthetic technology, such as lightweight, comfortable, and more realistic options, enhance user acceptance and satisfaction.

The non-surgical breast augmentation segment is anticipated to experience significant growth within the breast prosthetic market, driven primarily by the increasing preference for minimally invasive procedures. This segment includes non-invasive options such as external breast enhancers, silicone or gel-based inserts, and innovative wearable devices that offer a temporary or semi-permanent enhancement of breast size and shape without surgery. The rising demand for quick, painless, and low-risk solutions contributes to the expanding popularity of non-surgical augmentation methods.

Distribution Channel Insights

On the basis of end use, retail pharmacies & medical supply stores segment dominated the breast prosthetic market in 2024. Primarily driven by the widespread accessibility, convenience, and trust associated with retail pharmacy outlets. Consumers prefer purchasing breast prostheses from these stores due to their easy availability, professional guidance, and the opportunity to receive immediate assistance and consultation regarding product options. Retail pharmacies also facilitate discreet shopping, which is important for sensitive health-related products, thereby increasing customer comfort and confidence.

The direct sales segment is projected to experience significant growth in the global breast prosthetic market due to several compelling factors. Direct sales involve manufacturers selling products directly to healthcare providers, hospitals, clinics, or end-users without intermediaries. This channel offers numerous advantages, including customized solutions tailored to individual patient needs, improved communication, and better after-sales support. As the demand for personalized and advanced breast prostheses increases, healthcare providers prefer direct procurement to ensure product quality and compatibility.

Regional Insights

North America dominated the breast prosthetic market with the largest revenue share of 43.83% in 2024propelled by the rising incidence of breast cancer and the strong supportive reimbursement environment-such as the U.S. Women’s Health and Cancer Rights Act (WHCRA, CMS)-which ensures insurance coverage for prostheses post-mastectomy. In addition, Centers for Medicare & Medicaid Services (CMS), provide coverage for external breast prostheses and related supplies when they are deemed reasonable and medically necessary. A Standard Written Order (SWO) from the prescribing practitioner is required for both initial items and replacements. Below are the eligible HCPCS codes as per CMS:

|

HCPCS Codes

|

Description

|

|

L8000

|

Breast prosthesis, mastectomy bra, without integrated breast prosthesis form, any size, any type

|

|

L8001

|

Breast prosthesis, mastectomy bra, with integrated breast prosthesis form, unilateral, any size, any type

|

|

L8002

|

Breast prosthesis, mastectomy bra, with integrated breast prosthesis form, bilateral, any size, any type

|

|

L8015

|

External breast prosthesis garment, with mastectomy form, post mastectomy, covered

for use in the postoperative period before a permanent breast prosthesis or as an alternative to a mastectomy bra and breast prosthesis

|

|

L8020

|

Breast prosthesis, mastectomy form

|

|

L8030

|

Breast prosthesis, silicone or equal, without integral adhesive

|

|

L8032

|

Nipple prosthesis, prefabricated, reusable, any type, each

|

|

L8033

|

Nipple prosthesis, custom fabricated, reusable, any material, any type, each

|

Additionally, growing patient awareness, body positivity movements, and telehealth have expanded access and uptake across urban and rural areas. Innovations focus on customization and comfort. 3D scanning and printing developments now enable bespoke external prostheses that mimic individual anatomy while remaining affordable. Silicone gel-filled models with realistic texture and weight are increasingly preferred, enhancing aesthetics and wearer satisfaction.

U.S. Breast Prosthetic Market Trends

The U.S. held the largest share of 77.16% in 2024 in the North America breast prosthetic market, driven by the rising incidence of breast cancer-projected at over 316,950 new invasive cases in 2025-which fuels demand for post‑mastectomy prostheses as part of physical and emotional recovery.

Insurance support, including Medicare Part B and mandates like the Women’s Health and Cancer Rights Act, ensures coverage for external prostheses, reducing financial barriers. Moreover, growing awareness via patient advocacy campaigns and social media has also heightened patient engagement and helped destigmatize prosthetic use.

Innovation is centered on customization and comfort. Lightweight silicone gel models now closely mimic natural tissue, enhancing wearer satisfaction. Moreover, 3D scanning and printing technologies enable bespoke prosthetics tailored to individual anatomy-making fits more accurate and helping remote or underserved patients. Digital health tools-virtual fittings and telehealth-enabled consultations-have expanded access and streamlined ordering. Key surgical innovations also impact external prosthesis adoption: the rise of pre‑pectoral implant placement, acellular dermal matrices, and advanced tissue expanders not only improve reconstructive outcomes, but also influence the design and demand for prosthetics.

Europe Breast Prosthetic Market Trends

Europe’s breast prosthetic market is primarily driven by the high prevalence of breast cancer-accounting for roughly 29–30% of all female cancer cases in the EU-and an aging demographic that underscores the need for post-mastectomy reconstruction and prosthetic recovery. Robust healthcare systems and favorable reimbursement policies across countries like the UK, Germany, France, and Belgium further bolster adoption-public coverage of external prostheses makes them more accessible.

Patient awareness and active advocacy are shifting social attitudes: campaigns such as Breast Cancer Awareness Month and rising media visibility empower women to seek prosthetic solutions, reducing stigma and elevating confidence. Technological progress-like adopting silicone forms that mimic tissue softness and weight, alongside custom-fit designs enabled by 3D scanning and printing-has significantly improved comfort and satisfaction. Specialized innovations like resorbable 3D‑printed breast scaffolds are emerging from European research hubs.

The UK market for break prosthetic is anticipated to see a significant growth. Breast cancer is the most frequently diagnosed cancer in the UK-accounting for around 15% of all cancer cases-making post‑mastectomy prostheses essential to many women’s physical and emotional recovery. The National Health Service (NHS) provides reimbursement or direct provision for external breast prostheses, ensuring affordability and broad access, a core driver of market growth.

Social acceptance has evolved thanks to advocacy campaigns and body-positivity movements, which are helping to destigmatize external prosthetic use and encouraging women to explore their options. Consumer preferences also play a major role: modern models-especially lightweight silicone and foam prostheses-closely mimic natural breast tissue in feel and appearance, enhancing wearer confidence and comfort.

Asia Pacific Breast Prosthetic Market Trends

The Asia Pacific region is witnessing a significant growth in the breast prosthetic market owing to rising breast cancer incidence with nearly 985,817 new breast cancer cases in 2022 as reported by International Agency for Research on Cancer report. Medical tourism is a major catalyst, with Thailand, India, and Malaysia offering quality care at lower costs, drawing regional and global patients.

The China breast prosthetic market is experiencing strong demand, due to a rising breast cancer burden-more than 350,000 women in China are diagnosed with breast cancer annually .With mastectomy still the predominant surgical treatment, many survivors require external prostheses for symmetry, posture support, and psychological well-being. However, a study revealed limited patient awareness and clinician guidance on prosthetic options, highlighting a gap that is gradually being addressed. According to a research article published in Frontiers in Oncology journal in 2025, approximately 59% to 67% of patients in China use traditional cotton breast prostheses, largely avoiding heavier, silicone-based options due to their high cost. Additionally, studies indicate that 63.3% of patients wear external breast prostheses only during social occasions, while just 15.7% wear them continuously. This highlights both economic and cultural barriers to widespread prosthesis use. Affordability, comfort, and awareness remain key factors influencing patient choices. Addressing these gaps through lower-cost alternatives, insurance support, and improved education could significantly improve prosthesis adoption and quality of life for post-mastectomy patients in China.

Latin America Breast Prosthetic Market Trends

The Latin America Breast Prosthetic market is influenced by an increasing awareness and acceptance of breast cancer screening and treatment have led to higher demand for reconstructive procedures, including prosthetics. The rising incidence of breast cancer among women in countries like Brazil and Argentina significantly contributes to market growth. Additionally, advancements in prosthetic technology, such as lightweight and more natural-feeling implants, attract consumers seeking comfort and aesthetic appeal. Latin America’s growing beauty and wellness industry also influences demand, emphasizing personal appearance and self-confidence. Moreover, expanding healthcare infrastructure and improving access to reconstructive surgeries further propel the market. Government initiatives and increased funding for cancer awareness campaigns enhance early diagnosis and treatment, boosting prosthetic demand.

Middle East and Africa Breast Prosthetic Market Trends

Several key factors drive the Middle East and Africa breast prosthetic market. Increasing awareness about breast cancer and advancements in healthcare infrastructure have led to higher diagnosis rates, fuelling demand for reconstructive solutions. Rising urbanization and improved living standards also contribute to greater access to cosmetic and reconstructive procedures. The growing prevalence of breast cancer, particularly in countries like Saudi Arabia, South Africa, and the UAE, creates a substantial need for prosthetic products. Furthermore, the expanding medical tourism attracts patients seeking affordable and high-quality treatments, boosting market growth.

Key Breast Prosthetic Company Insights

The breast prosthetic market is moderately fragmented, with both major and local market competitors. Since the current market players are stepping up their efforts to grab the majority share in the breast prosthetic market, fierce competition is anticipated, with the degree of competitiveness perhaps rising even higher. Many market participants are engaging in various strategic activities, such as product launches, mergers and acquisitions, and geographic growth, to gain a competitive edge over rivals. Thus, with multiple strategies adopted by the market players, the breast prosthetic market is predicted to grow during the forecast period.

Key Breast Prosthetic Companies:

The following are the leading companies in the breast prosthetic market. These companies collectively hold the largest market share and dictate industry trends.

- Axel Orthotics

- Dynamic Techno Medicals

- Nicola Jane

- Amoena

- Aarna Biomedical Products

- American Breast Care

- Genesis Silicone House

- Anita Dr. Helbig GmbH

- Knitted Knockers

Recent Developments

-

In June 2025, Carle Illinois College of Medicine (CI MED) announced that one of its research teamsutilizes 3D scanning and printing technology to support breast cancer patients after mastectomy. CI MED innovators are developing a streamlined process to produce affordable, custom-fit breast prostheses directly in the physician’s office. This innovative approach eliminates the lengthy wait times and high costs associated with traditional prosthetic options, providing patients quicker access to personalized solutions. By integrating advanced 3D printing techniques into clinical settings, the team works to improve comfort, fit, and overall quality of life for women recovering from breast cancer [17] surgery.

-

In April 2025, the Massachusetts Institute of Technology announced that Xianglin Ji, a graduate student in Mechanical Engineering, designs and manufactures external breast prostheses for women who have undergone mastectomy. Drawing on his background in photonics research, he employs innovative methods to enhance the functionality and comfort of these prosthetic devices.

-

In July 2024, ARBURG announced that 3D printing company Hashtagtwo, in collaboration with ARBURG, received the TCT Healthcare Application Award in June at the annual TCT Awards. They were recognized for their innovative “Personal Fit Breast Prosthesis,” a groundbreaking solution designed for women who have undergone mastectomy due to cancer or other medical conditions. This collaborative effort represents a significant advancement in personalized medical devices, leveraging 3D printing technology to create customized, comfortable, and realistic prostheses. The award highlights the transformative impact of combining additive manufacturing with traditional medical solutions, offering improved quality of life and confidence for women affected by breast cancer.

Breast Prosthetic Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 385.6 million

|

|

Revenue forecast in 2033

|

USD 692.7 million

|

|

Growth rate

|

CAGR of 7.60% from 2025 to 2033

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2021 – 2023

|

|

Forecast period

|

2025 – 2033

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Material type, product type, application, distribution channel, and region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

|

|

Country scope

|

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Kuwait; UAE

|

|

Key companies profiled

|

Axel Orthotics; Dynamic Techno Medicals; Nicola Jane; Amoena; Aarna Biomedical Products; American Breast Care; Genesis Silicone House; Anita Dr. Helbig GmbH; Knitted Knockers

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Breast Prosthetic Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global breast prosthetic market report on the basis of product, application, distribution channel, and region:

-

Material Type Outlook (Revenue, USD Million, 2021 – 2033)

-

Product Type Outlook (Revenue, USD Million, 2021 – 2033)

-

Application Outlook (Revenue, USD Million, 2021 – 2033)

-

Distribution Channel Outlook (Revenue, USD Million, 2021 – 2033)

-

Direct Sales

-

Retail Pharmacies & Medical Supply Stores

-

Specialty Stores & Lingerie Boutiques

-

Online Retailers/E-commerce Platforms

-

Hospital & Clinic Sales

-

-

Regional Outlook (Revenue, USD Million, 2021 – 2033)

-

North America

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-