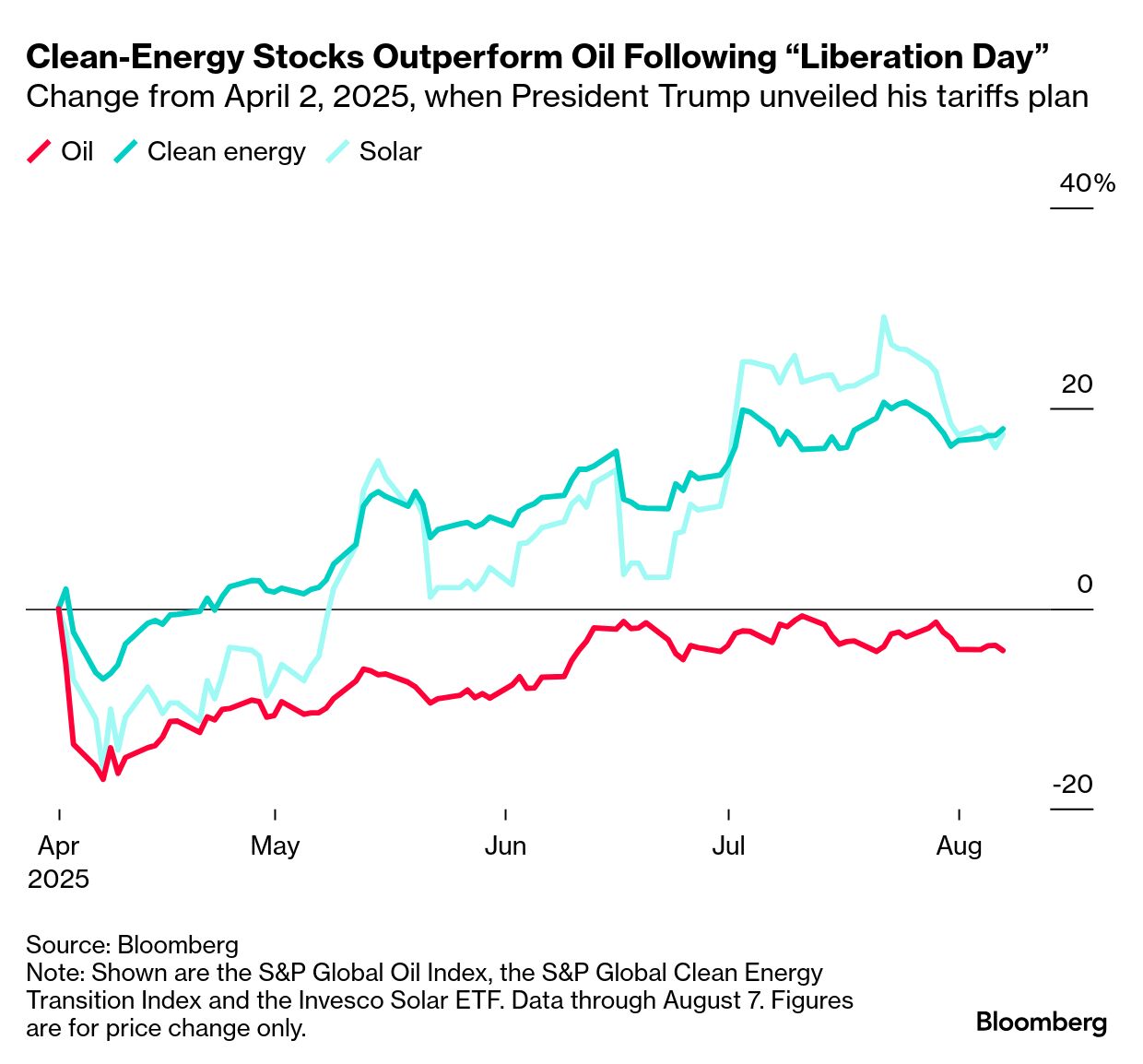

Breaking news: Hedge fund sentiment towards solar and wind energy stocks is experiencing a notable shift, reversing a trend of skepticism that began in 2021, as investors anticipate increased energy demand driven by the rapid expansion of artificial intelligence (AI). This comes as oil-related investments face increased scrutiny.

The proportion of hedge funds shorting stocks within the Invesco Solar Traded Investment Trust (TAN ETF) decreased to 3% in June, marking the lowest level since April 2021, a period when environmental stocks were approaching record valuations. Concurrently, the First Trust Global Wind Energy ETF (FAN ETF) witnessed the highest level of fund buying activity in two and a half years in February. While buying momentum eased in June, purchases continued to significantly outweigh sales.

This change in investor behavior is fueled by the belief that AI’s escalating energy requirements will create a significant tailwind for renewable energy sources. Analysts at BloombergNEF (BNEF) project that renewable energy will likely account for over half of the increase in global power generation capacity needed by 2035, as detailed in their July report.

karim Musalem, equity officer at London-based Selwood Asset Management, articulated this perspective, stating, “The market has told us that AI will be the biggest event we’ll see in our lives.” He emphasized the critical role renewable energy will play in satisfying AI’s power demands, citing its potential for rapid deployment. Selwood Asset management, managing approximately $7.5 billion in assets as of December 31, 2023, has been increasing its exposure to renewable energy companies in anticipation of this trend.

Context: The Rise of Energy Demand and Renewable Integration The global demand for electricity is projected to increase significantly in the coming decades, driven not only by AI but also by electrification of transportation, industrial processes, and population growth. The International Energy Agency (IEA) estimates that global electricity demand will grow by 60% between 2022 and 2030. integrating renewable energy sources, such as solar and wind, is crucial for meeting this demand sustainably and reducing carbon emissions.However, challenges remain in ensuring grid stability and reliability wiht intermittent renewable sources, necessitating investments in energy storage solutions and grid modernization.

news-rsf-original-reference paywall">Original title:Hedge Funds Unwind Energy Bets That Dominated Since 2021 (excerpt)