Bitcoin’s Critical Juncture: Analyst Signals Potential Bull Market Exhaustion

Bitcoin (BTC) is navigating a crucial phase, with one significant price movement potentially signaling the end of its bull market, according to a prominent on-chain analyst. The cryptocurrency currently trades around $94,816.

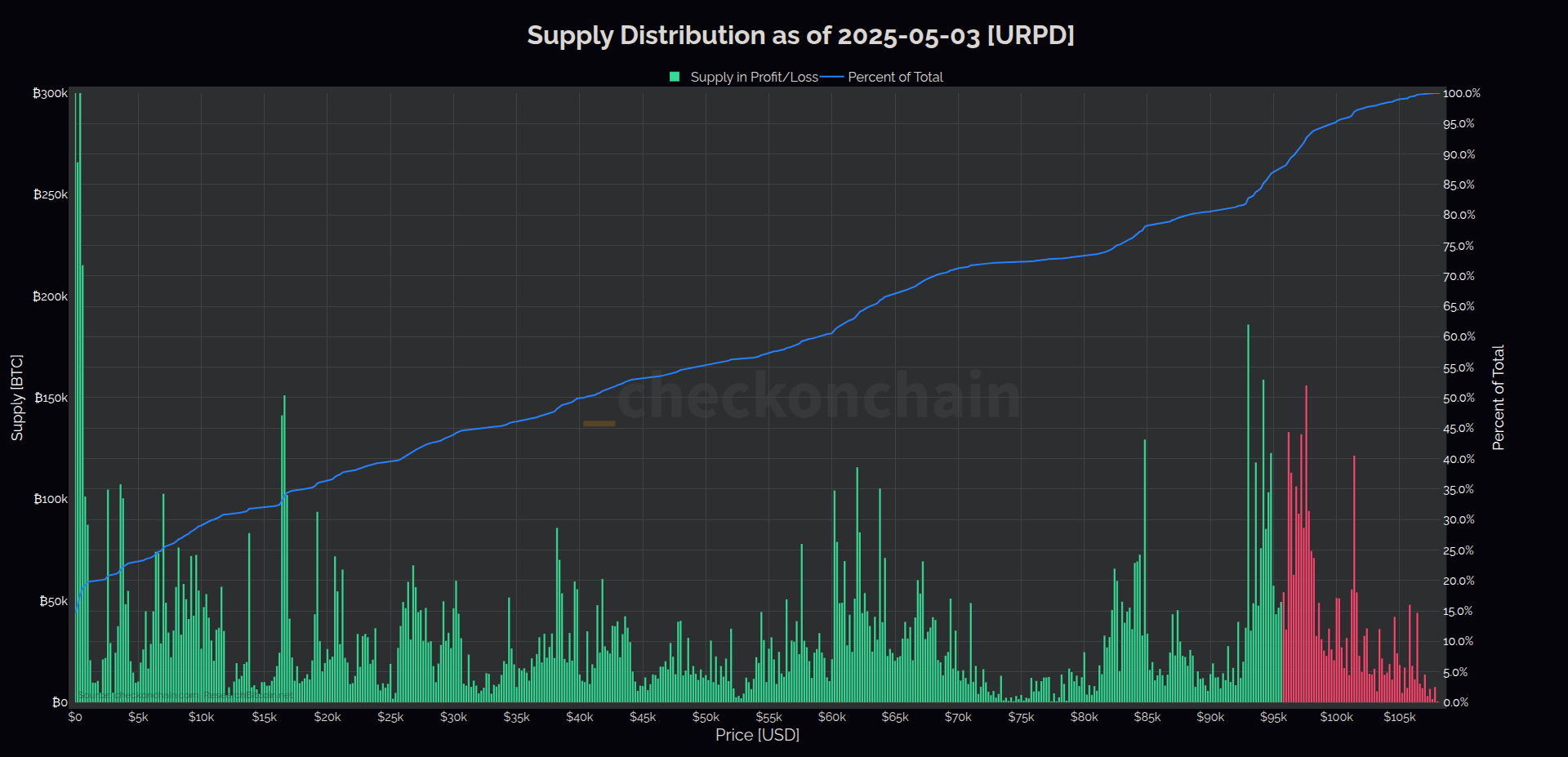

The $93,000 – $100,000 Bottleneck

The analyst, known as Checkmate, highlighted ample selling pressure facing Bitcoin between $93,000 and $100,000. This observation is based on a heatmap, a tool visualizing buy and sell orders within the order book.

Bitcoin is working its way through a very dense supply cluster between $93,000 and $100,000. Pretty much blue skies above $100,000.

Checkmate, On-chain Analyst

Did you know? Order book heatmaps provide a real-time visual representation of buy and sell orders, helping traders identify potential areas of support and resistance.

The Bull’s Challenge: Overcoming Selling Pressure

For the bull market to continue, Bitcoin bulls must absorb the selling pressure up to $100,000. Failure to do so could result in a bearish lower high structure, indicating the bull market’s conclusion.

In my view, it’s pretty crucial that Bitcoin clears this price zone in the near term. We’re sitting right in the middle of a decision point, and all it will take is one big red or green candle from here to convince people of a lower high, or bull continuation, respectively.

Checkmate, On-chain Analyst

Pro Tip: Monitor trading volume alongside price movements. High volume during a breakout above $100,000 would confirm bullish momentum.

Underwater Positions and Trend Exhaustion

Checkmate’s analysis reveals that numerous BTC positions are currently underwater as Bitcoin struggles to surpass $95,000.Hesitation at these levels could signal trend exhaustion.

We don’t want to keep chopping, to be honest, need to establish a clear trend.

Checkmate,On-chain Analyst

ETF Demand Remains Strong

Despite the selling pressure,demand for Bitcoin exchange-traded funds (ETFs) remains robust. cumulative inflows into Bitcoin ETFs have reached a new all-time high of $40.62 billion.