Bitcoin Braced as Geopolitical Turmoil Rattles Markets

Bitcoin faced a significant drop following the US attack on Iranian nuclear facilities on June 21, 2025. Despite the market’s initial shock, many experts predict the cryptocurrency’s resilience. They are analyzing the impact of rising oil prices and inflationary pressures and the potential for Bitcoin to rebound and even surge to new heights.

Geopolitical Tensions and Market Reaction

On June 21, 2025, the United States launched a major airstrike targeting three Iranian nuclear sites. This military action, labeled “Operation Midnight Hammer,” triggered a swift reaction in the cryptocurrency market, causing Bitcoin to plummet below $100,000. The conflict escalated from the earlier Israeli operation “Rising Lion,” culminating in direct US intervention within a week.

Bitcoin’s Price Dip and the Factors at Play

Bitcoin’s value dipped to $99,975 on June 22, falling beneath the $100,000 threshold for the first time since early May. This decline was caused by a confluence of factors. These included a risk-off sentiment, the selling of Bitcoin by large investors, and the liquidation of leveraged positions.

Interestingly, the fall was not a sign of panic selling but rather an orderly adjustment. The 200-day moving average, around $95,567, acted as a stable support level, preventing any mass exodus by institutional investors.

Oil Prices, Inflation, and Cryptocurrency

The attack caused a surge in crude oil prices. WTI crude jumped 10.1%, and Brent crude reached $77 per barrel. Some analysts predict a potential rise to $110 per barrel if Iran blocks the Strait of Hormuz. Increased oil prices elevate inflation, which could influence the Federal Reserve’s monetary policy.

The Strait of Hormuz is vital, with roughly 20% of global oil consumption passing through it. A blockade could significantly impact the global economy. Rising oil prices also create inflationary pressures, which could strengthen Bitcoin’s appeal as an inflation hedge, similar to digital gold.

Expert Predictions and the $200,000 Bitcoin Forecast

Despite the turmoil, many experts remain optimistic about Bitcoin. They forecast a surge to over $200,000 by the end of 2025. These predictions are based on historical cycle return analysis, an examination of the magnification from previous highs, and the power law model.

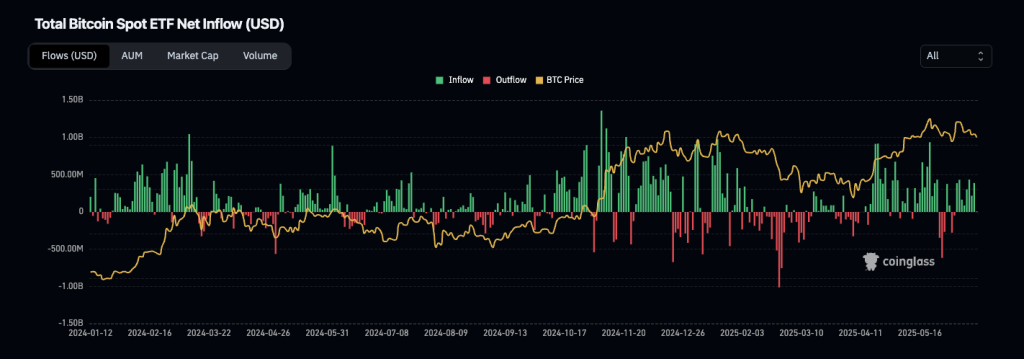

Institutional investors have continued investing despite the geopolitical issues. There have been ten straight weeks of inflows totaling $1.24 billion into cryptocurrency funds. Since the start of the year, Bitcoin ETFs have seen over $15 billion in investments. For instance, the CoinShares ETF inflow data shows a strong interest in the cryptocurrency.

Conclusion: Navigating the Crypto Market Amidst Crisis

The attack on Iran’s nuclear facilities certainly caused short-term disruption. However, historical data suggests that Bitcoin often thrives during geopolitical crises. The demand for ETFs stays strong and the potential for Bitcoin to serve as an inflation hedge. According to CoinDesk, Bitcoin’s market capitalization has increased over the last decade, suggesting that it is gaining popularity.

Investors need to analyze the market cautiously and maintain a disciplined investment strategy. Viewing this chaos as an opportunity, with appropriate risk management, is essential to profit. The path towards Bitcoin reaching $200,000 is clear amid geopolitical risks and rising oil prices, but it will not be a straightforward journey.