featured

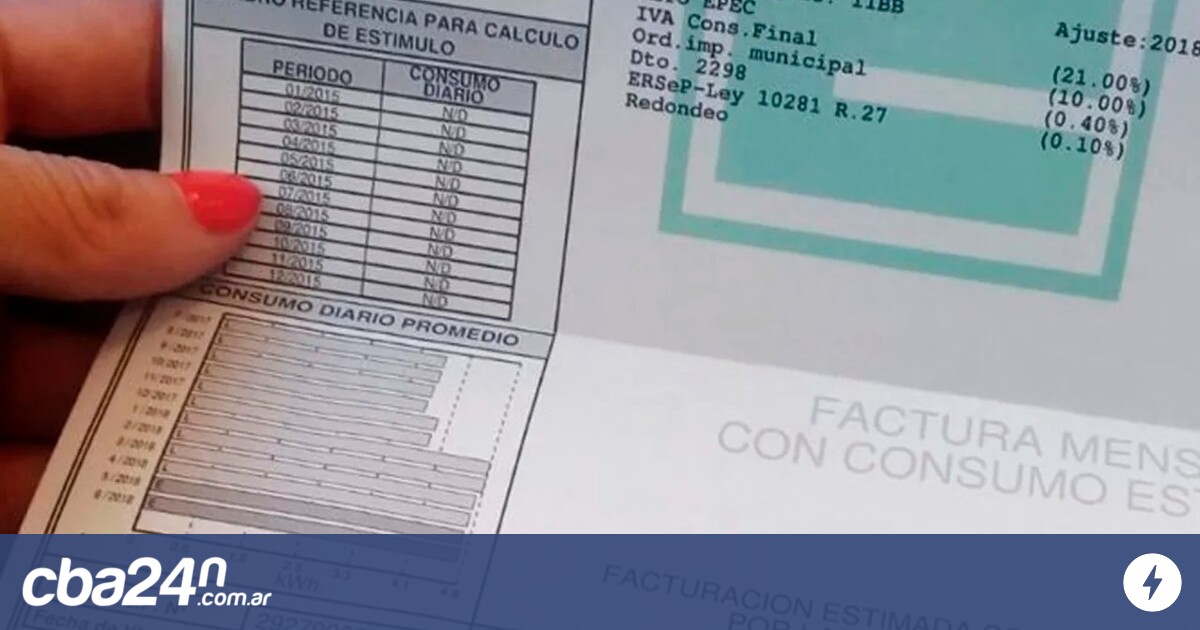

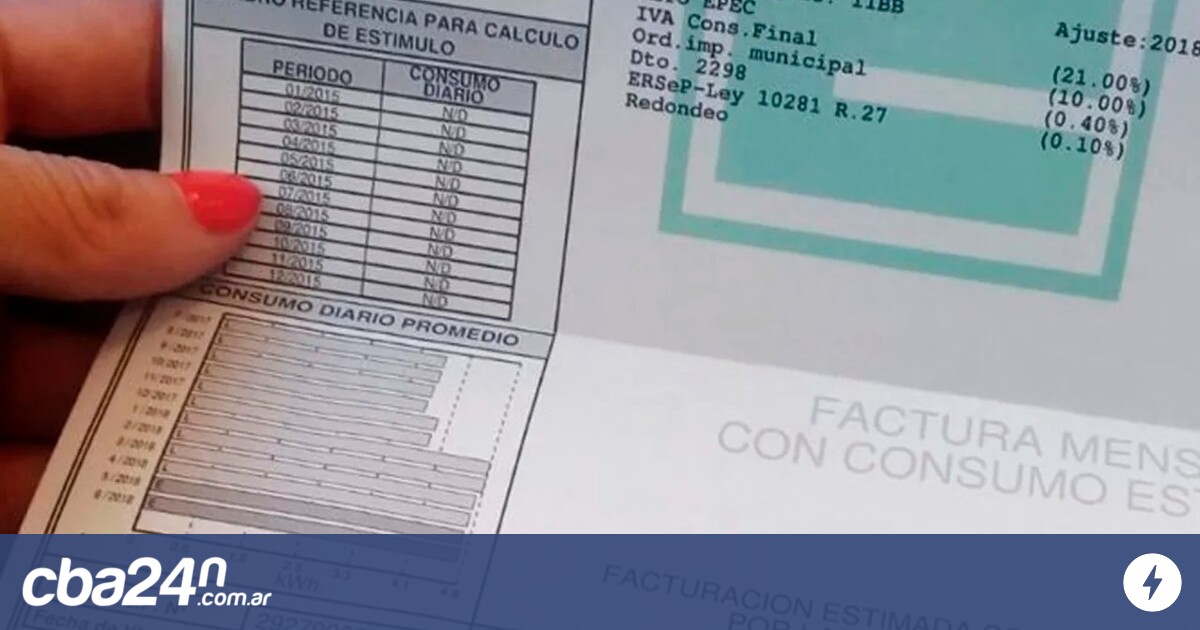

Step by step: how to change category and pay less on EPEC tickets

The Provincial Energy Company (EPEC) launched a campaign so that its clients, as well as those of the cooperatives that provide the service in the provincial interior, can recategorized to cushion the impact that service …

Step by step: how to change category and pay less on EPEC tickets

The Provincial Energy Company (EPEC) launched a campaign so that its clients, as well as those of the … Read more

Premiere today for the Netflix series “In Dina Händer” – starring Ardalan Esmaili

In February, it was clear that the Swedish Netflix series “In Dina Händer” (English title “Deliver Me”) would … Read more

The investigation against Zaldívar is totally political: AMLO

Mexico City. The investigation against retired minister Arturo Zaldívar Lelo de Larrea It is an eminently political issue … Read more

Biden seeks to triple US tariffs on Chinese steel and aluminum

Washington. President Joe Biden wants to triple tariffs on Chinese steel and aluminum imported by the United States, … Read more

New barrage of Israeli bombings in Gaza

Gaza Strip. Israel bombed the Gaza Strip again this Thursday, in its war against Hamas, in a context … Read more