featured

Thibau Nys takes phenomenal stage victory in Romandie after a flight of 150 kilometers and is the leader: “I will remember this all my life”

READ ALSO. Thibau Nys starts his road season in Romandie: “Normally not many bad guys drive around here” Thibau Nys lost the wheel of his lead-out a day earlier, in the first stage in line, …

Thibau Nys takes phenomenal stage victory in Romandie after a flight of 150 kilometers and is the leader: “I will remember this all my life”

READ ALSO. Thibau Nys starts his road season in Romandie: “Normally not many bad guys drive around here” … Read more

Antwerp city poets hold benefit auction: “Good start, but not enough for two more years of city poetry”

reportage city poets The benefit auction took place at the Bernaerts auction house. — © Sebastian Steveniers A … Read more

From dead chickens to diapers and wood waste in organic waste containers: “We are going to check incorrect sorters more strictly” (Sint-Niklaas)

People have already put vacuum cleaner bags, plastic bags and even a dead chicken in the organic waste … Read more

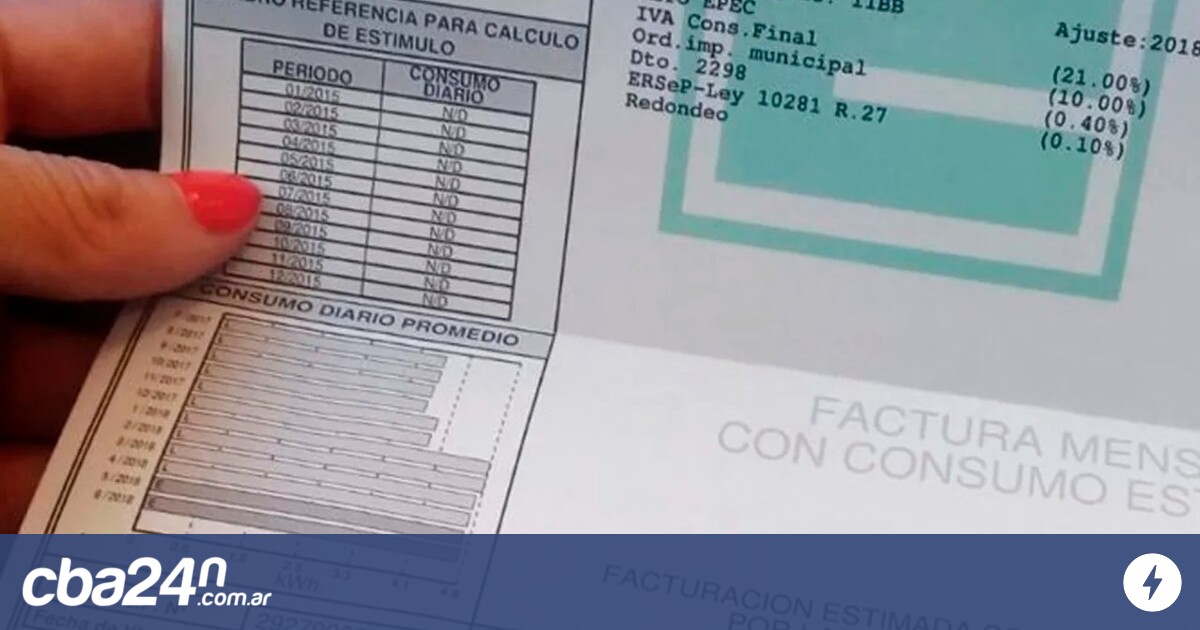

Step by step: how to change category and pay less on EPEC tickets

The Provincial Energy Company (EPEC) launched a campaign so that its clients, as well as those of the … Read more

Premiere today for the Netflix series “In Dina Händer” – starring Ardalan Esmaili

In February, it was clear that the Swedish Netflix series “In Dina Händer” (English title “Deliver Me”) would … Read more