“`html

Digital Payments Dominate Italian Food & Beverage Purchases in 2024

Table of Contents

Rome, Italy – A recent study by adyen Financial Technological Platform reveals a significant shift in Italian payment preferences within the food and beverage sector. As of 2024,approximately 67% of Italians favor digital payment methods over traditional cash transactions when purchasing food and drinks at restaurants,bars,or through delivery and takeaway services.

The Rise of Digital Transactions in Italy’s Food Scene

The research highlights the increasing consolidation of digital payments as a preferred method for Italians. Credit and debit cards remain the most popular choice, but innovative solutions like QR codes and mobile payment apps are gaining traction.The study emphasizes that speed and a positive human interaction during checkout are crucial for customer satisfaction.

Did You Know? Italy’s e-commerce sector is projected to reach $42.7 billion in 2024, demonstrating a broader trend toward digital transactions across various industries (Statista).

Speed and Convenience Drive Payment Choices

Payment speed is a critical factor for Italians in the food and beverage sector. Approximately 77% of those surveyed consider quick transaction times essential. When choosing a payment method, 26% cite speed as a key element, second only to ease of use, which is favored by 29% of respondents.

Innovative Payment Methods Gain Popularity

There’s a growing interest in adopting innovative payment methods. A ample 69% of Italians are willing to use QR codes or mobile apps for payments at the table, provided the service is fast. Though, 40% would only use these methods if speed is guaranteed.

While preferences are evolving, traditional payment methods still hold their ground. Paying at the table (42%) and at the cashier (48%) remain popular. Generational differences are also evident, with younger demographics showing greater openness to app-based payments for services like Click & Collect and delivery.Such as, 24% of individuals aged 25-34 prefer app payments, exceeding the general average by 10 percentage points. Similarly, kiosk payments are favored by 14% of those aged 18-24, compared to the overall average of 6%.

Pro Tip: Restaurants can leverage these generational preferences by offering a variety of payment options to cater to different customer segments.

The Enduring Importance of Human Contact

Despite the increasing popularity of digital solutions, human interaction remains a vital part of the payment experience. A significant 61% of Italians still prefer paying at the cashier with an operator, particularly among those over 45.However, the 25-34 age group favors self-checkout options, with 46% preferring this method. Interestingly, among the youngest respondents (18-24 years old), the presence of an operator regains importance, with 51% expressing a preference for this mode, underscoring the continued significance of human contact in the payment process.

Loyalty Programs and Digital Tipping

The study also explored the potential of loyalty programs linked to digital payments. When asked if discounts, cashback offers, or points collections would encourage them to use digital payment methods more, discounts emerged as the most effective incentive, chosen by 39% of respondents, with a peak of 52% among 25-34 year olds. Cashback appeals primarily to the 35-44 age range (36%), while points collections resonate particularly well with younger individuals, with 37% of 18-24 year olds citing it as an incentive, compared to the general average of 25%.

Even in the realm of tipping,an evolution is apparent. While cash remains the dominant choice (52%),among 25-34 year olds,the proportion opting for digital tipping rises to 37%,indicating a growing acceptance of new methods even for small,everyday gestures.

| Payment Method | Preference | Demographic Insights | |||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Digital Payments (Overall) | 67% | Growing preference across all age groups | |||||||||||||||||||||||||||||||

| Credit/Debit Cards | Most Popular | Established as the leading digital method | |||||||||||||||||||||||||||||||

| QR codes/Apps | 69% Willing to Use | Dependent on speed of service | |||||||||||||||||||||||||||||||

| Cashier with Operator | 61% | Favored by those over 45 and 18-24 age group | |||||||||||||||||||||||||||||||

| Self-Checkout |

| substance | Product | Level Found | Safety Limit | Exceedance Factor |

|---|---|---|---|---|

| Phthalates | Umbrellas | 443.5x | 1x | 443.5 |

| Lead | Various Items | 27.7x | 1x | 27.7 |

E-commerce Growth and Safety Concerns

The rapid expansion of e-commerce has brought unparalleled convenience and access to goods for consumers worldwide. However, this growth has also introduced challenges in ensuring product safety and regulatory compliance. The case in Seoul highlights the need for continuous monitoring and proactive measures to protect consumers, especially children, from potentially harmful products sold through online platforms.

Frequently Asked Questions About Product Safety on E-commerce Platforms

Why is product safety a growing concern on e-commerce platforms?

The rapid growth of e-commerce has led to a vast increase in the variety and volume of products available, making it challenging to monitor and regulate product safety effectively.

What measures can consumers take to ensure product safety when shopping online?

Consumers should carefully review product descriptions, check for safety certifications, read customer reviews, and be wary of products with unusually low prices.

What are e-commerce platforms doing to address product safety concerns?

Many platforms are implementing stricter seller verification processes, enhancing product monitoring systems, and working with regulatory agencies to enforce safety standards.

How do international safety standards impact products sold on global e-commerce platforms?

<

Pro Tip: Always check for product certifications from reputable organizations to ensure the item meets established safety standards.

What role do government agencies play in ensuring product safety on e-commerce platforms?

Government agencies are responsible for setting safety standards, conducting inspections, and enforcing regulations to protect consumers from unsafe products sold online.

Do you think current regulations are sufficient to protect consumers from unsafe products sold online? What steps should consumers take before making a purchase?

Real Estate Investment Fund Eyes Expansion into Germany and Austria

Table of Contents

Investment, a prominent investment firm, is setting its sights on expanding its real estate fund’s reach into Germany and Austria. This strategic move aims to diversify teh fund’s portfolio, which currently includes assets in the Czech Republic, Poland, Spain, and Croatia, according to Chairman Petr Čížek during a recent board presentation.

The decision to target Germany and Austria comes as the real estate market experiences a shift. Rising interest rates have led to a decline in commercial real estate prices since 2022,creating new investment opportunities,according to Kysela. This market correction, coupled with an increased availability of properties, makes the timing ideal for expansion.

Strategic Advantages in Germany and austria

The Austrian market, in particular, shares similarities with the Czech Republic, making it an attractive and stable investment destination, Kysela notes. Germany, on the other hand, presents a vast and highly liquid market, facilitating easier resale of properties.

Zdenka Klapalová, Managing Director of Knight Frank, highlights that investors are showing interest in all major segments within the German and austrian markets, including logistics, office, and residential real estate. The logistics sector, driven by e-commerce growth and supply chain efficiency demands, remains particularly appealing. Demand is also strong for high-quality, eco-pleasant office spaces that meet ESG (Environmental, Social, and Governance) standards.

Did You know? ESG-focused investments grew to over $35 trillion globally in 2020 and are projected to exceed $50 trillion by 2025, according to Bloomberg.

Investment is already considering a specific property for investment in Austria, located near Vienna, with a long-term lease and a strong global tenant, Kysela revealed. The building is described as advanced and operating cleanly.

Slovakia Not Currently a Target

While Austria and Germany are on the radar, Investment is not currently considering investments in Slovakia. Kysela explains that no opportunities have yet met the fund’s investment criteria. despite similar prices to the Czech Republic, the Slovak market is smaller.

Poland Remains a Key Market

Poland remains the most crucial market for the real estate fund,followed by the Czech Republic. Investments in Poland account for 68% of the fund’s assets, while the Czech Republic accounts for every fourth crown invested. The expansion into Poland was driven by a limited supply of suitable investment opportunities in the Czech Republic. Poland offers a greater selection of offices and logistics properties and benefits from a rapidly growing economy. Klapalová notes that many foreign investors view Poland as a key market in Central and Eastern Europe.

Pro Tip: Diversifying your real estate portfolio across different geographic regions can help mitigate risk and enhance returns.

As of April, the Real Estate Investment Fund managed nearly 24 billion crowns, with regular monthly investments of CZK 120 million. The fund’s portfolio includes a total of sixty properties, and the average annual return for investors over the past three years has been 6.27%.

Investment manages assets of over thirty billion crowns across all its funds, with more than one hundred thousand investors participating.

Real Estate Investment Fund Performance

| Metric | Value |

|---|---|

| Assets Under Management (April) | CZK 24 Billion |

| Monthly Investments | CZK 120 Million |

| Number of Properties | 60 |

| Average Annual Return (3 Years) | 6.27% |

What factors do you believe are most critical when evaluating real estate investment opportunities in emerging markets? How can individual investors best navigate the complexities of international real estate investments?

Evergreen Insights: Real Estate Investment Trends

Real estate investment funds play a crucial role in the global economy, providing capital for advancement and offering investors access to a diverse range of properties. The trend towards diversification is driven by the desire to reduce risk and capitalize on growth opportunities in different markets. Factors such as interest rates, economic growth, and regulatory changes substantially impact the performance of real estate investments. According to a recent report by Deloitte, enduring and ESG-compliant properties are increasingly in demand, reflecting a broader shift towards responsible investing.

Frequently Asked Questions About Real Estate Investment Funds

- What are the primary benefits of investing in a real estate investment fund?

- investing in a real estate investment fund offers diversification, professional management, and access to properties that might be otherwise inaccessible to individual investors. It can also provide a steady stream of income through rental payments and capital appreciation.

- How do rising interest rates affect real estate investment funds?

- Rising interest rates can lead to a decrease in property values, making investments more affordable.However, they can also increase borrowing costs, potentially impacting the profitability of new developments and acquisitions.

- Why is diversification important in real estate investing?

- Diversification helps to mitigate risk by spreading investments across different property types, geographic regions, and tenant profiles. This reduces the impact of any single property or market downturn on the overall portfolio.

- What role do ESG factors play in real estate investment decisions?

- ESG factors are increasingly important as investors seek to align their investments with environmental and social values. Properties that meet high ESG standards are frequently enough more attractive to tenants and investors, leading to higher occupancy rates and better long-term performance.

- How does the liquidity of a real estate market impact investment decisions?

- A highly liquid market allows investors to easily buy and sell properties, providing flexibility and reducing the risk of being locked into an investment. This is particularly critically important for funds that need to manage cash flow and respond to changing market conditions.

- What are the key considerations when investing in international real estate markets?

- Key considerations include understanding local regulations, economic conditions, currency risks, and cultural differences. It’s also critically important to work with experienced professionals who have a deep understanding of the target market.

- How can investors evaluate the performance of a real estate investment fund?

- Investors can evaluate performance by looking at factors such as the fund’s historical returns,asset allocation,expense ratio,and management team.It’s also important to compare the fund’s performance to relevant benchmarks and peer groups.

Share your thoughts in the comments below and subscribe for more updates on real estate investment trends!

Czech Billionaires Increase stake in E-Commerce Firm Maluna.cz

Table of Contents

- Czech Billionaires Increase stake in E-Commerce Firm Maluna.cz

- Billionaire Duo’s Growing Influence in Fashion Retail

- Strategic Synergies and Future Plans

- SPM Group’s Diversified Portfolio

- Ownership Structure: A Closer Look

- The future of E-Commerce and Fashion Retail

- Evergreen Insights: The Evolution of E-Commerce

- Frequently Asked Questions About E-Commerce Investments

Prague, Czech republic – Slavomír Pavlíček and Marek Španěl, the Czech entrepreneurs behind the globally recognized game studio Bohemia Interactive, have substantially increased their presence in the e-commerce sector. This week, their company SPM Finance finalized the acquisition of the remaining 30% stake in maluna.cz, an online retail platform, from its founder, Ilona Bittnerová.

Billionaire Duo’s Growing Influence in Fashion Retail

The transaction, visible in the Commercial Register, brings Pavlíček and Španěl’s total control of Maluna.cz to 75.5%. This controlling share is held through Danidarx, where Pavlíček owns 65% and Španěl holds the remaining 35%, alongside the founders of the e-shop.

This move underscores the billionaires’ strategic expansion into fashion retail, adding to their existing portfolio of e-commerce ventures. According to a recent report by Statista, e-commerce sales in the Czech Republic are projected to reach $9.8 billion in 2024, demonstrating the sector’s robust growth potential Statista.

Did You Know? Bohemia Interactive, co-owned by Pavlíček and Španěl, is renowned for creating the Arma series and Operation Flashpoint, globally prosperous military simulation games.

Strategic Synergies and Future Plans

The acquisition aligns with the SPM Group’s broader strategy of consolidating smaller fashion companies to establish a stronger presence in the retail market. In February, the group acquired Feratt Fashion, an Ostrava-based retail network specializing in formal men’s fashion, which operates fifteen brick-and-mortar stores across several cities.

According to Ruslan Skopal,synergies between their various holdings are expected to enhance their offerings. For instance, Maluna.cz coudl potentially supply products like menstrual underwear,swimwear,boxers,and socks under the Feratt or Pietro filipi brands.

Pro Tip: When evaluating e-commerce platforms, consider factors like user experience, mobile optimization, and secure payment gateways to ensure customer satisfaction and drive sales.

SPM Group’s Diversified Portfolio

Beyond fashion, the SPM investment group has a diversified portfolio spanning technology, real estate, media, and agriculture.Their technology investments include Bohemia Interactive, as well as smaller projects focused on artificial intelligence and virtual reality. In real estate, they own the Křižík Palace in Prague and other assets. Their media holdings include Echo Media, publisher of the weekly Echo and the online daily Echo24, as well as Parliamentary Letters and the weekly Tip of the Media.

The group also owns five farms involved in cattle breeding, poultry, egg production, vegetables, and pastry production.

Ownership Structure: A Closer Look

The ownership changes reflect a clear strategy to consolidate control and leverage synergies across various business units. The table below summarizes the key ownership percentages:

| Entity | Ownership |

|---|---|

| SPM Finance | 30% of maluna.cz (newly acquired) |

| Danidarx (Pavlíček 65%, Španěl 35%) | 70% of maluna.cz (previously held) |

| Total Control (Pavlíček & Španěl) | 75.5% of Maluna.cz |

The future of E-Commerce and Fashion Retail

The increased investment in Maluna.cz highlights the growing importance of e-commerce in the fashion retail sector. As consumer preferences shift towards online shopping, companies are seeking to strengthen their digital presence and create seamless omnichannel experiences. According to a recent report by McKinsey, companies that successfully integrate their online and offline channels can achieve up to 30% higher customer lifetime value McKinsey.

What impact do you think this acquisition will have on the Czech e-commerce market? How will Maluna.cz evolve under its new ownership?

Evergreen Insights: The Evolution of E-Commerce

E-commerce has transformed the retail landscape, offering consumers unprecedented convenience and choice. The rise of mobile commerce and social media marketing has further accelerated this trend,creating new opportunities for businesses to reach customers and drive sales. As technology continues to evolve, e-commerce platforms are incorporating artificial intelligence, augmented reality, and personalized recommendations to enhance the shopping experience and build customer loyalty.

Frequently Asked Questions About E-Commerce Investments

- What are the key factors driving e-commerce growth?

- Key drivers include increasing internet penetration, rising smartphone adoption, and changing consumer preferences towards online shopping.

- How can businesses succeed in the competitive e-commerce market?

- Success factors include offering a seamless user experience, providing personalized recommendations, and building a strong brand reputation.

- what are the emerging trends in e-commerce?

- Emerging trends include the use of artificial intelligence, augmented reality, and voice commerce to enhance the shopping experience.

- How does e-commerce impact conventional retail businesses?

- E-commerce has forced traditional retailers to adapt by integrating online and offline channels and offering omnichannel experiences.

- What are the challenges of operating an e-commerce business?

- Challenges include managing logistics, ensuring data security, and competing with established players in the market.

what other e-commerce companies do you think Pavlíček and Španěl might target next?

Share your thoughts in the comments below and subscribe to our newsletter for more updates on business and finance!

Foto: chormail – Freepik.com

China is currently experiencing a boom in cross-border e-commerce (CBEC). More than 80,000 companies are active in this sector, and the export of inexpensive products via online platforms has become a driver of the Chinese economy. Even if the CBEC occurs in both directions, the balance is clear: for every dollar imported, ten dollars are exported. This rapid growth has prompted governments from Southeast Asia to the US and EU to take measures to curb this flow of trade.

75 new e-commerce companies in China every day: rapid expansion

The numbers speak for themselves: 75 new CBEC companies are registered in China every day – that’s one new company every twenty minutes. This rapid expansion is supported by various government initiatives, including optimizing comprehensive pilot zones and promoting Silk Road e-commerce under the Belt and Road Initiative.

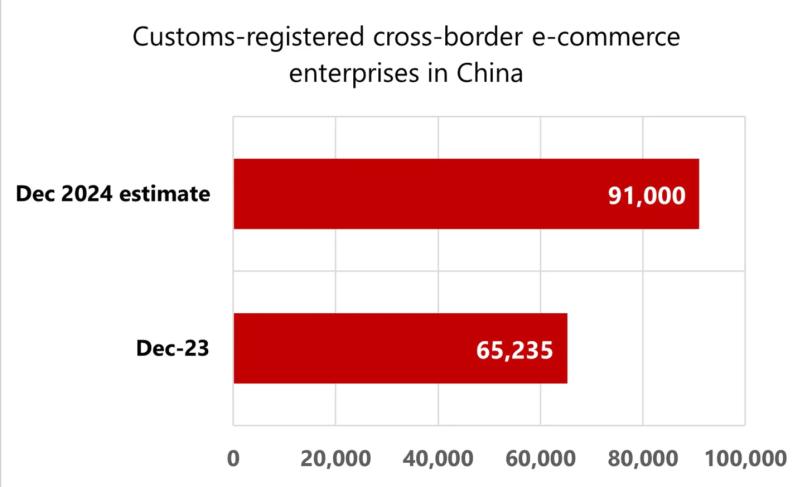

Figure 1: Chinese customs-registered company for cross-border e-commerce. Source: Soapbox

In 2023, China saw an increase in cross-border e-commerce volume a 15.6%which corresponds to a total value of 2.38 trillion renminbi (just over 300 billion euros). These figures highlight the growing importance of CBEC to the Chinese economy and the global trading landscape.

The effects of this boom are far-reaching. For Chinese companies, the CBEC offers an opportunity to enter new markets and expand their reach. At the same time, foreign markets face the challenge of dealing with the flood of Chinese products. This has led to discussions about possible regulatory measures to make competition fair.

USA defends itself: measures against China’s e-commerce giants

The US in particular has taken measures to curb the influence of Chinese e-commerce companies such as Shein and Temu. The Biden-Harris Administration has announced new measures to protect American consumers, workers and businesses by cracking down on abuses of the de minimis rule. This regulation allows goods worth up to $800 to be imported into the USA duty-free. The number of such shipments has increased exponentially in recent years, making it difficult to enforce U.S. trade laws. The new measures aim to block the import of unsafe and unfairly traded products and ensure compliance with health and safety regulations.

The future of cross-border e-commerce in China looks bright. With continued investment in technology and infrastructure, as well as support from government initiatives, this sector is expected to continue to grow and play an even greater role in global trade. But resistance abroad will probably also grow.

Just – European stocks rose, today, Friday, to an all-time high, led by a continued rise in stocks exposed to China, against a backdrop of significant economic stimulus from the financial authorities in Beijing, while the gains of “Moncler” and shares of the luxury goods sector also supported the index..

The European Stoxx 600 index rose 0.2% to an all-time high of 526.70 points at the start of the day, according to Reuters.

The index is heading for its best week in more than a month, if gains continue.

China-focused luxury goods stocks lifted the index’s performance, outperforming”LVMH“of billionaire Bernard Arnault, the fourth richest man in the world, and”Hermes“and”dry“and”Hugo Boss “and”Burberry “Profits are between 3-4%%.

Chinese stocks are heading for their best week since 2008.

Earlier today, China’s central bank lowered the borrowing cost for repurchase agreements for seven days, as part of the biggest stimulus package since Corona.

Moncler shares rose 11.8%, after CEO Reuvini ended a deal with… LVMH“, which will be evidence of partnership LVMH Le Rovini to invest more in Italian luxury goods group.

The region’s personal and household goods sector led sector gains, rising 1.6%.

French consumer prices rose less than expected in September, according to CPI figures. France’s CAC index rose 0.3%.

Spain’s main stock exchange, IBEX, was trading flat after data showed inflation in the country fell to 1.7%.

To trade and invest in the Egyptian Stock Exchange, click here

Follow the latest stock and economic news through our Telegram channel

Nominations

The Bank of England is cutting interest rates for the first time in four years

The decline in business activity casts a shadow over the global economic recovery

European stocks fell ahead of the Bank of England decision

English “Charred Capital” is considering pumping $7 billion to set up a petrochemical plant in Egypt

Dice Readymade Garments acquires the majority of the shares of United Dyers Company

2024-09-27 08:45:58

#European #stock #index #jumping #alltime #high