AI Stocks Surge Beyond Giants: Oracle and CrowdStrike Shine

Market watchers focus on Nvidia and Palantir, but other AI players are quietly delivering significant gains.

While the spotlight often shines on AI titans like Nvidia and Palantir, a closer look reveals other artificial intelligence-driven companies posting impressive gains. Investors are finding opportunities in less-hyped names that have outperformed the broader market in the first half of the year.

Oracle’s Cloud Demand Fuels Growth

Oracle (NYSE: ORCL) stock has experienced a substantial 38% rise year-to-date, largely driven by robust demand from AI customers. The company, traditionally known for its database management software, has successfully expanded into cloud infrastructure and services.

Oracle anticipates its total cloud growth rate to climb from 24% in the last fiscal year to 40% in the current one. This expansion is attracting customers focused on building AI platforms and those needing general cloud capacity.

Larry Ellison, Oracle co-founder, commented on the unprecedented demand, stating, “I’ve never seen anything remotely like this.”

He noted that a recent client requested all available cloud capacity, irrespective of location.

The company’s multicloud strategy, allowing clients to utilize Oracle databases across various cloud providers without being confined to a single platform, is also a significant growth catalyst. Multicloud database revenue experienced a staggering 115% increase quarter-over-quarter, with the company expecting this trend to persist.

Given the projected trillion-dollar valuation of the AI market within the next decade, Oracle is well-positioned for continued earnings growth and stock appreciation, making it a compelling long-term investment. In 2024, the global cloud computing market size was valued at approximately $636.9 billion, with projections indicating significant future expansion (Source: Statista, 2024).

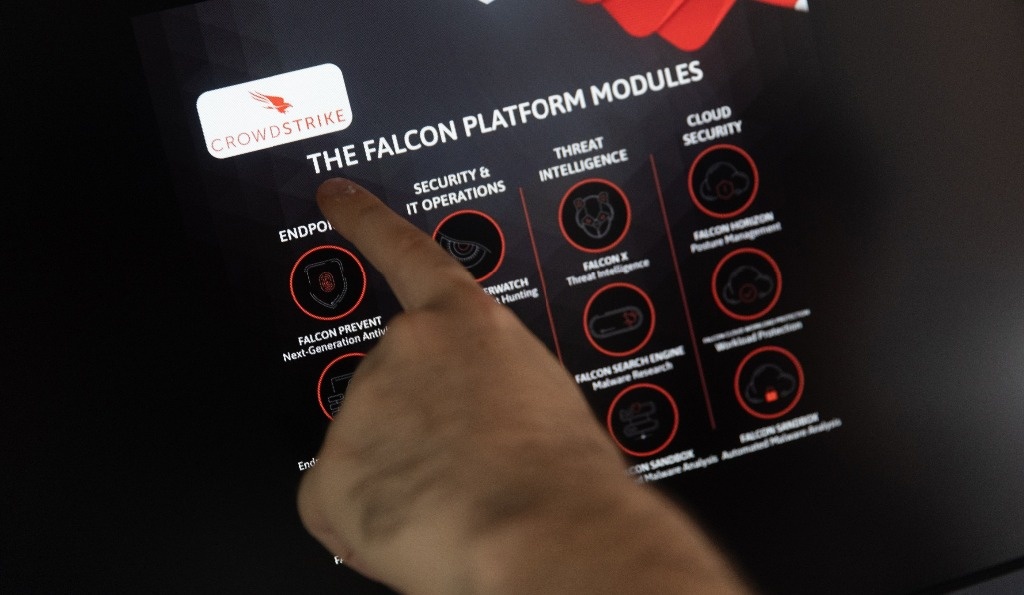

CrowdStrike Secures Growth Despite Past Hiccup

CrowdStrike Holdings (NASDAQ: CRWD) has seen its shares climb 39% this year. The cybersecurity firm has demonstrated resilience, recovering from a significant software bug incident in July that caused a widespread IT outage.

Despite offering compensation to affected customers, which presented a temporary financial headwind, CrowdStrike has maintained strong customer relationships and continued its growth trajectory. The company’s Falcon Flex system, which allows customers to customize service selections, has emerged as a key growth driver.

Deals exceeding $3.2 billion for Falcon Flex more than quadrupled year-over-year in the recent quarter. Both total revenue and annual recurring revenue (ARR) posted double-digit increases, while net cash from operations reached a record $384 million. CrowdStrike anticipates that the momentum of Falcon Flex deals will further boost ARR and margins in the latter half of the year.

Adding to investor confidence, CrowdStrike recently authorized a $1 billion share repurchase program, signaling strong belief in its future prospects. As earnings rebound from the previous year’s disruption and growth potentially accelerates, this AI-powered cybersecurity leader is poised for continued upward momentum.

These AI-focused companies, Oracle and CrowdStrike, represent compelling investment opportunities for those seeking to capitalize on the ongoing AI revolution beyond the most prominent names.