Rockwell Automation Shares Climb, But Divergent Investor Views Signal Potential for Further Gains – or Risks

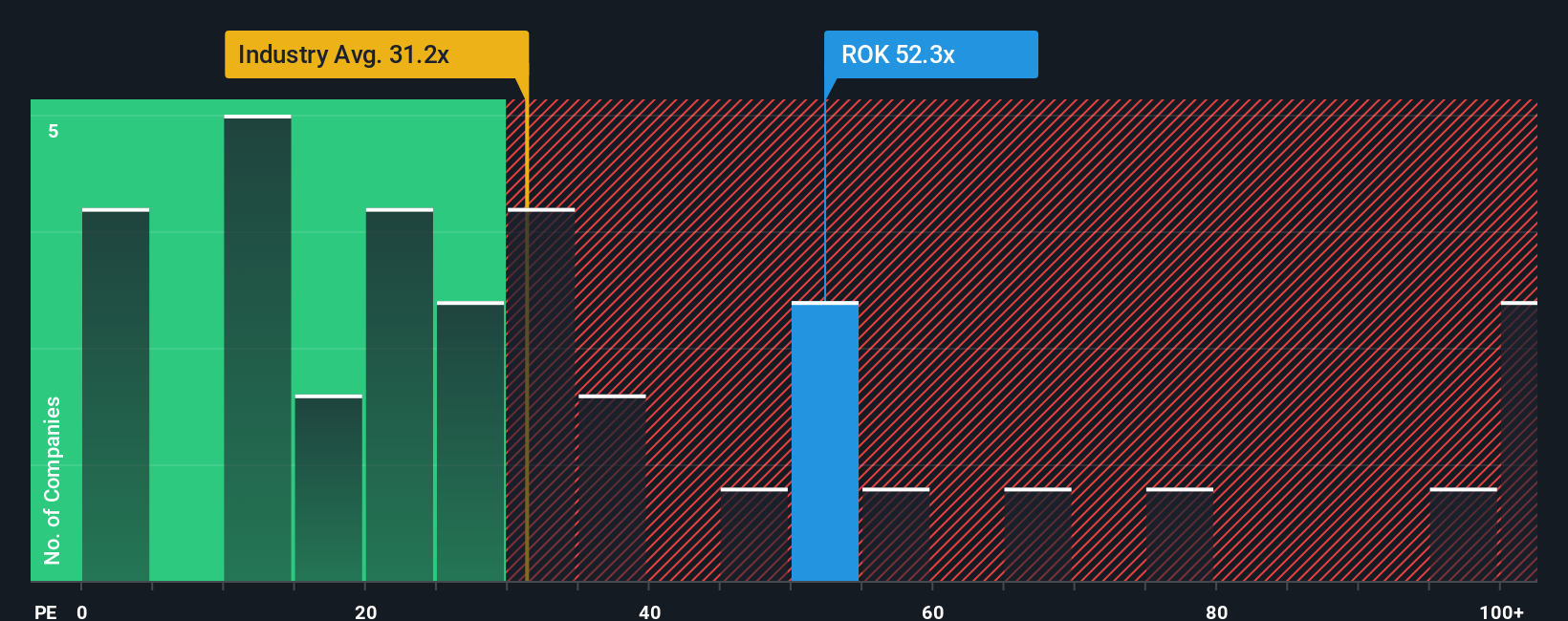

NEW YORK - rockwell Automation (NYSE: ROK) shares have surged 31% in 2025, yet a wide range of fair value estimates from investors suggest teh stock’s trajectory remains uncertain, with potential for continued upside or looming corrections. The disparity stems from differing perspectives on the industrial automation giant’s digital growth prospects versus potential headwinds from investment delays and global economic conditions.

Simply Wall St’s community-driven narrative platform reveals a significant divergence in valuation. Optimistic investors predict strong digital growth and margin expansion,supporting a fair value target of $410 per share. Conversely, more cautious analysts anticipate risks related to project investment timelines and broader global uncertainty, assigning a considerably lower fair value of $229.

This dynamic illustrates a key feature of simply Wall St’s approach: a continuously updated narrative reflecting new data, earnings reports, and news headlines to maintain valuation relevance.

The current debate centers on Rockwell automation’s ability to capitalize on the increasing demand for industrial digitalization. Proponents point to the company’s investments in software and analytics as key drivers of future growth. However, concerns linger regarding the pace of implementation and the potential for economic slowdowns to impact capital expenditure budgets.

As of October 2025, the community fair value estimates for rockwell Automation span a broad spectrum, highlighting the complexity of assessing the company’s future performance. Investors are encouraged to explore detailed analysis encompassing fair value estimates,potential risks,dividend information,insider trading activity,and financial condition via Simply Wall St’s research platform.