Experts to Assess Credit Suisse Takeover Price

Zurich Court Appoints Specialists to Determine Fair Value

A recent court decision has initiated an assessment of the takeover of Credit Suisse by UBS. This aims to determine the accurate purchase price, after complaints that the original 76-centime-per-share valuation was far too low.

The Initial Deal and Subsequent Dispute

In March 2023, the initial offer from UBS to acquire Credit Suisse sparked debate. Ultimately, the price agreed upon was in the billions. The Zurich Commercial Court has now taken a decisive step in this ongoing dispute. The court appointed two independent experts to evaluate the appropriate takeover price, following complaints from approximately forty plaintiffs against UBS.

The plaintiffs have asserted claims potentially reaching CHF 13.70. Before the takeover, Credit Suisse shares traded at two and a half times this value. This difference could have increased the acquisition cost of Credit Suisse from three to almost eight billion. UBS‘s legal team from Bär & Karrer has maintained that Credit Suisse faced imminent bankruptcy.

“The CS could have done a liquidation itself. And I can assure you that this would have worked (…),”

—Sergio Ermotti, CEO of UBS

A report from Reuters indicated that UBS’s CEO, Sergio Ermotti, stated that Credit Suisse had adequate capital and could have been liquidated in an orderly manner. Recent reports indicate the global market for mergers and acquisitions decreased by 18% in the past year, highlighting the economic context of this deal (Reuters, 2024).

Expert Analysis and Key Documents

The court-appointed experts will determine an equitable purchase price for Credit Suisse. The judges have acknowledged significant reasons to believe that the 76 centimes per share paid by UBS was unduly low. The professors selected by the court are well-regarded academics. The experts include Peter Leibfried from HSG and Roger Neininger, who formerly led KPMG Switzerland.

Both the plaintiffs and UBS have the right to present objections. The court has set a deadline for these objections, requiring justifications by the Thursday of the following week. Further proceedings will occur, with UBS required to provide key documents before the commencement of the Zurich school holidays on July 14th.

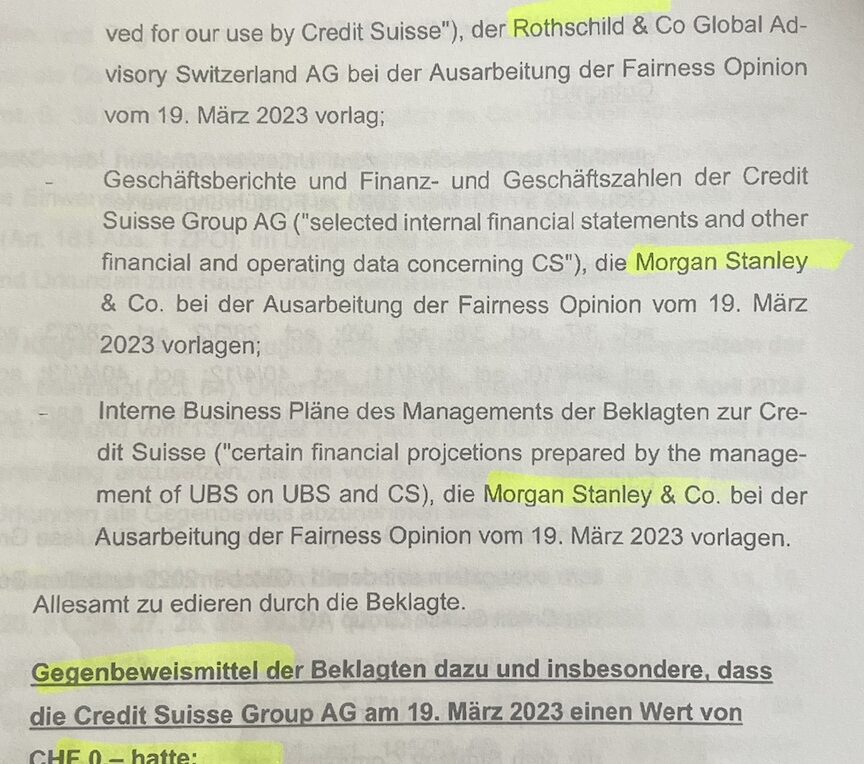

UBS must provide an assessment, “on the consequences of a transaction with Credit Suisse Group,” prepared by the former Credit Suisse top management. This was presented to the Strategy Committee on December 19, 2022. Also, UBS must provide the “Credit Suisse Business Plan” from February 2023. This document was prepared by Rothschild & Co, the advisor to Credit Suisse’s leadership at the time.

Additionally, UBS must present two documents from Morgan Stanley, which advised Colm Kelleher and his team during the critical phase of the acquisition. These include “selected internal financial statements and other financial and operating data concerning CS,” and “Internal Business Plans of the Defendant Management to Credit Suisse.”

The commercial judges have explicitly stated what UBS and its lawyers from Bär & Karrer must demonstrate to support their position, which is the provision of “counter-evidence of (UBS …) that Credit Suisse Group AG had a value of CHF 0.- on March 19, 2023.”