“`html

The United states and the European Union have reached an agreement to avoid the imposition of new tariffs, according to a report from the Central News Agency. This growth comes as the U.S. had previously threatened to implement tariffs on imported goods from the EU, though the average U.S. tariffs on such goods last year stood at a mere 1.2%.

Subscribe to the “International News” e-newspaper to master the latest world’s latest pulse

The EU, a bloc of 27 nations, represents the united States’ largest trading partner. In the preceding year, total imports from the EU amounted to $605 billion, exceeding those from Mexico, Canada, and China. Key import categories include pharmaceuticals and pharmaceutical products originating from Ireland, followed by automobiles, aircraft, and other heavy machinery from France and Germany.

This agreement also comes amidst previous threats from the U.S. to impose a 200% tariff on all imported drugs, a measure slated for implementation no earlier than 18 months from its announcement. The extent to which this EU agreement might shield against such a future tariff remains uncertain.

Trump

Taiwan-US tariff negotiation officials stationed in the United States: Zheng Lijun is difficult to deal with by her opponent’s fingers

Trump: Hamas has no intention of releasing hostages Israel has to decide what to do next

Van der Ryan

EU executive Committee President goes to Scotland to hold trade negotiations with Trump

trump will meet with British and European leaders in Scotland

Vogue Editor Anna Wintour Steps Down, Yet Remains Influential

Fashion Icon’s Departure and Transition

After a remarkable 37 years at the helm, Anna Wintour has stepped down as editor-in-chief of American *Vogue*. Her influence on fashion has been undeniable, with her leadership shaping the magazine into a major trendsetter. She’s renowned as the industry’s most influential figure.

The Transition and Future Plans

The 75-year-old Wintour made the cover of “Fashion Magazine” an authority in contemporary fashion. Though relinquishing her daily editorial duties, her departure was swiftly denied by Condé Nast, the magazine’s parent company.

“I will focus all on global leadership and work with our outstanding editorial teams around the world.”

—Anna Wintour

Wintour will remain as a senior executive and continue as global editorial director. In 2023, the global fashion market was valued at $2.25 trillion, and is projected to reach $3 trillion by 2030 (Statista).

Her Legacy

Born in the UK, Wintour has often been credited with inspiring both the 2003 novel, “The Devil Wears Prada”, and the 2006 film adaptation of the same name. Actress Meryl Streep played the role of the commanding magazine editor, Miranda Priestly, and was nominated for an Academy Award.

The American Fashion Magazine’s staff was informed of the search for a new editorial content director. Wintour called this a “critical decision,” but emphasized that she will continue working from her office.

UK-US Trade Agreement Signed amidst Steel tariff Questions

Table of Contents

- UK-US Trade Agreement Signed amidst Steel tariff Questions

- Key Highlights of the UK-US Trade Agreement

- Implications and Strategic Considerations

- The Broader Context of UK-US Trade Relations

- Frequently Asked Questions About the UK-US Trade Agreement

- What specific industries will benefit most from the UK-US trade agreement?

- How will this trade agreement affect consumers in the UK and the US?

- What are the potential risks associated with the UK-US trade agreement?

- How does this agreement compare to previous trade deals between the UK and the US?

- What role does the Economic Prosperity Deal (EPD) play in this agreement?

Kananaskis, Canada – U.S. President Trump and British Prime Minister Keir Starmer officially signed the UK-US trade agreement on Monday, June 16th, aiming to reduce tariffs between the two nations. While the agreement promises to boost economic activity, questions linger regarding the reduction of steel and aluminum tariffs, initially slated to drop to 0% as per the preliminary agreement in May. The final details concerning steel tariffs remain under negotiation,casting a shadow over the comprehensive trade deal.

Key Highlights of the UK-US Trade Agreement

The signing took place during the G7 summit in Kananaskis, Canada, where President Trump, holding the signed document, expressed optimism about the strengthened relationship with the UK, anticipating job creation and increased income. The agreement, initially outlined in May, includes provisions for the United States to reduce tariffs on the first 100,000 vehicles imported annually from the UK from 27.5% to 10%.In return,the UK has committed to increasing tax-free quotas for US beef and ethanol.

Did You Know? The UK-US Economic Prosperity Deal (EPD) was agreed upon in principle on May 8, 2025, laying the groundwork for this recent trade agreement [[2]].

Uncertainty Surrounding Steel Tariffs

Despite the initial agreement to eliminate steel tariffs, the specific tariffs applicable remain unclear. The UK currently benefits from an exemption from a 50% steel tariff imposed by the U.S. The ultimate outcome of the UK-US trade agreement may hinge on the UK’s ability to assure the U.S. regarding British Steel’s holdings in China.

Prior to the meeting,both U.S. and British officials indicated their readiness to implement the trade agreement reached the previous month. Though, Trump’s repeated assertions about this being the first agreement with a major trading partner, coupled with a lack of concrete details and implementation, have left british companies uncertain.

Implications and Strategic Considerations

With President Trump’s tariff negotiation deadline approaching, this agreement with the UK represents a critically important achievement, alongside a “framework agreement” with China. For the UK, securing favorable terms ensures the protection of key industries from high tariffs. For the U.S., concessions from the UK in agricultural trade signify a accomplished outcome of the tariff war.

Pro Tip: Keep an eye on official publications from the USTR and the UK Department for Business and Trade for the most up-to-date facts on the implementation of the trade agreement [[1]].

| Aspect | Details |

|---|---|

| Auto Tariffs | 10% on first 100,000 UK vehicle imports, 25% + Most Favored Nation tariff on additional vehicles. |

| Steel Tariffs | Reduction to 0% initially planned,current status uncertain and under negotiation. |

| UK Concessions | Increased tax-free quotas for US beef and ethanol. |

| Implementation Date | Seven days following official publication [[3]]. |

The Broader Context of UK-US Trade Relations

Trade relations between the United Kingdom and the United States have long been a cornerstone of both economies. this new agreement builds upon decades of economic cooperation, aiming to further reduce barriers and stimulate growth. The agreement is notably significant in the wake of Brexit, as the UK seeks to forge new trade partnerships globally. The US remains one of the UK’s most important trading partners, and this deal is expected to strengthen those ties.

Frequently Asked Questions About the UK-US Trade Agreement

What specific industries will benefit most from the UK-US trade agreement?

The automotive and agricultural sectors are expected to see significant benefits, with reduced tariffs on vehicles and increased quotas for beef and ethanol.

How will this trade agreement affect consumers in the UK and the US?

Consumers may see lower prices on certain goods as tariffs are reduced, potentially increasing purchasing power.

What are the potential risks associated with the UK-US trade agreement?

Uncertainty surrounding steel tariffs and potential shifts in trade balances could pose challenges.

How does this agreement compare to previous trade deals between the UK and the US?

This agreement represents a new chapter in UK-US trade relations, particularly in the post-Brexit landscape, with a focus on reducing specific tariffs and increasing quotas.

What role does the Economic Prosperity Deal (EPD) play in this agreement?

The EPD provides the framework and general terms for the new trade relationship between the US and UK [[2]].

What are your thoughts on the potential impact of this trade agreement? How do you think it will affect specific industries in your region?

Disclaimer: This article provides general information about the UK-US trade agreement and should not be considered financial or legal advice. Consult with a qualified professional for specific guidance.

Share your insights and join the conversation! Subscribe to World Today News for the latest updates on global trade and economic developments.

“`html

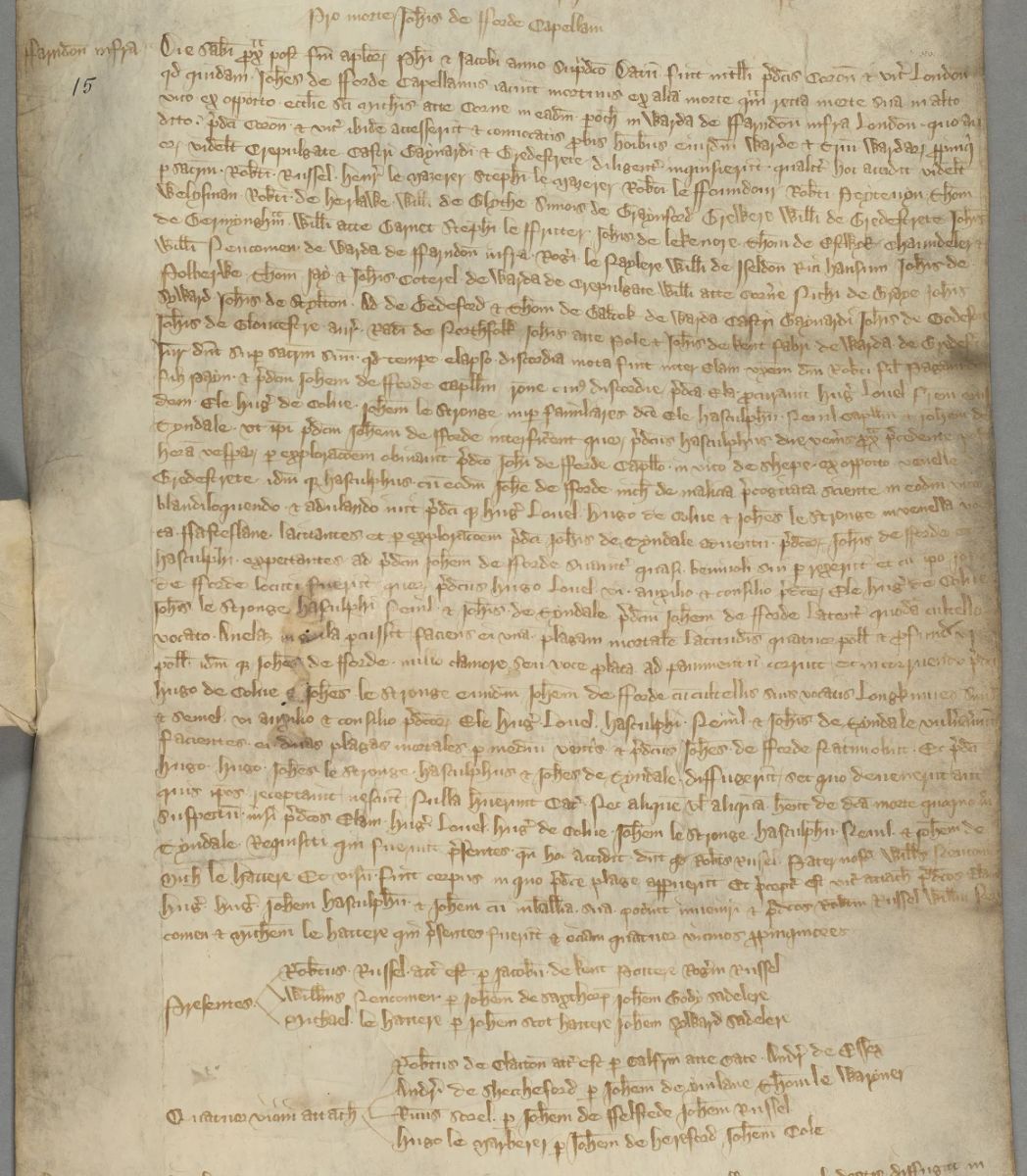

ella Fitzpain: noblewoman’s Role in 14th-Century Clergyman’s Murder Revealed

Table of Contents

In May 1337, on the dimly lit streets of London, a clergyman named John Ford was ambushed and fatally stabbed by a group of men near St. Paul’s Cathedral. While eyewitnesses identified the perpetrators, a powerful noblewoman, Ella Fitzpain, suspected of orchestrating the attack, evaded trial. Newly uncovered historical documents now reveal the extent of Fitzpain’s alleged involvement in the brutal crime and the motivations behind it.

The Crimes of Ella Fitzpain

Ella Fitzpain, a woman of considerable wealth and influence, was allegedly involved in various criminal activities, including theft, blackmail, and ultimately, the murder of John Ford, who was also her former lover.Recent research suggests that Ford was part of a criminal gang led by Fitzpain, which targeted a French-controlled priory, exploiting strained relations between England and France to extort money. The findings were published in the Criminal Law Forum on june 6th.

Did You Know? Public humiliation was a common form of punishment in the Medieval era. This could involve being paraded through town or forced to wear a sign detailing the crime.

Analyzing coroner’s records revealed Fitzpain persuaded four men, including her brother, to kill Ford. (The London Archives/City of London Corporation)

Betrayal and Revenge

Ford’s betrayal of Fitzpain by informing the superior clergy triggered a series of events that culminated in his assassination. A 1332 letter from the Archbishop of Canterbury accused Fitzpain of infidelity, alleging relationships with both single and married individuals, including knights and clergymen. Ford, identified as one of fitzpain’s mistresses and the chief priest of a parish church in Dorset, was also implicated.

The church ordered Fitzpain to undergo public humiliation as atonement, which included making ample donations to the poor, abstaining from wearing gold and jewelry, and walking barefoot through Salisbury Cathedral to the altar, carrying a heavy candle for seven consecutive autumns. Though, Fitzpain seemingly ignored the Archbishop’s demands, and this humiliation “may have ignited a heart that craved revenge,” according to the researchers.

The Medieval Murder Map Project

Manuel Eisner,lead author of the paper,a professor at Cambridge University,and director of the university’s Criminology Institute,suggests that Fitzpain orchestrated Ford’s assassination as an act of revenge. Dr. Hannah Skoda,an associate professor of medieval history at St. John’s College, Oxford University, who was not involved in the research, noted that the 688-year-old murder provides new evidence of clergy involvement in secular matters and highlights the active roles women played in their own affairs and relationships.

A map

With the U.S. implementing new reciprocal tariff measures, the global economic landscape is undergoing a meaningful shift.This article provides an insightful look at the ongoing negotiations and identifies key nations poised for new U.S. trade deals, helping you understand the evolving implications of these policies. Learn which countries and specific stocks, based on expert analysis, could be most affected by the latest U.S. tariff measures.

Trade Winds Shifting: U.S. Tariff Measures and Potential Agreements

2025-04-09

President Trump’s reciprocal tariff measures, now in effect, spur global negotiations. Aniket Shah of Jefferies identifies nations poised for trade deals and highlights potentially impacted stocks.

The Global Scramble for Trade agreements

The international community is closely watching the unfolding trade landscape as reciprocal tariff measures enacted by the U.S. take hold. With the measures officially in effect since noon today, nations worldwide are eager to engage in negotiations with the U.S. to mitigate potential economic fallout.

The White House reports notable interest, stating that 70 countries have all their intentions

to discuss trade agreements. This widespread interest underscores the broad impact of the U.S. policy shift.

Jefferies’ Prediction: Five Nations to Watch

Aniket Shah, head of sustainable and change strategy at investment bank Jefferies, offers insights into which countries are most likely to secure agreements with the U.S.in the near future. Shah predicts that in the next few days, the united States will reach an agreement with some trading partners.

he identifies five nations as particularly promising candidates:

- United Kingdom

- Japan

- Vietnam

- India

- Cambodia

Notably,Taiwan is not among the countries Shah believes are likely to reach an agreement soon.

Pre-Tariff Diplomacy: A Flurry of Meetings and Calls

Prior to the implementation of the reciprocal tariff measures, a flurry of diplomatic activity took place. Israeli Prime Minister Benjamin Netanyahu met with President Trump at the White House. additionally, japanese Prime Minister Shiro Ishiba and South Korean Acting President Han Yusoo engaged in telephone conversations with the U.S. president.

President Trump acknowledged the call with South Korea, stating he had a great call with South Korea.

Stocks to Watch: Supply Chains and Tariff Negotiations

According to Baron’s Weekly, Shah has also identified potential stocks worth monitoring in the five countries he highlighted. His analysis considers factors such as supply chain dynamics and customer location.

Key considerations include:

- Corporate Supply Chains: Companies with extensive international supply chains stand to benefit from multi-party tariff negotiations.

- Clothing Brands: Brands like Nike, VF, and Tapestry could see direct benefits if Vietnam and Cambodia avoid high tariffs.

- Boeing: With production and sales bases in the UK, India, and Japan, Boeing is considerably invested in these markets. 6% of it’s revenue comes from the UK, and 4.3% from Japan.

- First Solar: This solar company has 30% of its production capacity in vietnam and India.

Othre Companies Potentially Impacted

Shah also notes the potential impact on medical device manufacturers Cooper and Waters, both of which have ties to the UK. Cooper has a distribution center in Japan, while approximately 8% of Waters’ revenue comes from India.

Other companies with significant revenue reliance on the aforementioned countries include:

- ON Semiconductor (semiconductor supplier)

- Alcon (pharmaceutical factory)

- Carnival

- Callaway

These companies are also likely to experience impacts from the evolving trade landscape.

Investment Disclaimer

the content is for reference only. Investors shoudl carefully evaluate risks when making decisions and be responsible for their own investment results. Investment must be risky, fund investments can make profits and loses, and you should read the public instruction manual in detail before applying.

Sanli News Network

US Nuclear Buildup won’t Deter China in Taiwan strait, War Game Suggests

A recent war game conducted by the Center for Strategic and International Studies (CSIS) and the Massachusetts Institute of technology (MIT) indicates that even a significant expansion of the United States’ nuclear arsenal might not prevent China from resorting to nuclear weapons in a hypothetical conflict over Taiwan.

The Financial Times reported a growing chorus of US experts advocating for increased nuclear capabilities, including new tactical weapons, suggesting a potential nuclear arms race between the US and China is looming. This concern fueled the CSIS/MIT simulation, which explored the impact of enhanced US nuclear capabilities on a potential 2028 taiwan Strait conflict.

The war game, which didn’t focus on the likelihood of nuclear use, instead examined scenarios that might trigger battlefield commanders from either side to employ nuclear weapons. The study aimed to understand how such a decision would alter the course of the conflict.

For decades, China’s nuclear strategy has centered on retaliation, not parity with the US and Russia. Though, some US experts argue that bolstering nuclear capabilities could compensate for potential conventional arms deficiencies. This includes proposals to reintroduce tactical nuclear weapons, such as submarine-launched cruise missiles (SLCM-N), previously withdrawn at the end of the Cold war.

“The United States has more than 600 tactical nuclear weapons and is modernizing its delivery tools,” noted Eric Heginbotham, a leading expert on Chinese nuclear weapons at MIT and one of the war game’s authors.

Despite this, the war game’s findings suggest that further nuclear expansion beyond existing modernization plans is unneeded. The report concludes that US policymakers should not “develop more nuclear weapons in preparation for a possible conflict with China,” nor should they “pursue numerical nuclear superiority in the belief that this will Deter China from using nuclear weapons.”

While the simulations largely favored a decisive US victory, only 5 out of 15 scenarios resulted in a PLA withdrawal, and in 4 of those, neither side used nuclear weapons. The authors urge the US to collaborate with allies to explore potential concessions that might dissuade China from resorting to nuclear options in a Taiwan Strait conflict.

Global Chip Shortage Continues to Squeeze US Consumers

The worldwide semiconductor shortage, a persistent challenge as 2020, continues to substantially impact american consumers. From higher prices for new cars to delayed shipments of electronics, the effects are widespread and deeply felt across the US economy.

The shortage isn’t simply a matter of inconvenience; it’s a key driver of inflation and a major obstacle to economic growth. Experts point to several contributing factors, including increased demand fueled by the pandemic, geopolitical tensions, and disruptions to the global supply chain.

the Ripple Effect: Feeling the pinch

The impact on the automotive industry has been particularly dramatic. “The chip shortage has severely constrained production,” explains automotive analyst,John Smith. “This has led to longer wait times for new vehicles and significantly inflated prices.” The ripple effect extends beyond cars, impacting the availability and cost of various consumer electronics, appliances, and even medical devices.

The situation is further complicated by geopolitical factors. Tensions between the US and China, particularly concerning Taiwan, a major producer of semiconductors, add another layer of uncertainty to the already complex supply chain.This uncertainty contributes to price volatility and makes long-term planning difficult for manufacturers.

Looking Ahead: potential Solutions

While there’s no quick fix, several strategies are being explored to mitigate the impact of the shortage. Increased domestic semiconductor production is a key focus,with significant government investment aimed at boosting manufacturing capabilities within the United States. ”We need to diversify our supply chains and reduce our reliance on single sources,” notes industry expert, Jane Doe. “This is crucial for long-term economic stability and national security.”

In addition to increased domestic production, efforts are underway to improve supply chain resilience and efficiency.This includes investing in advanced technologies, streamlining logistics, and fostering greater collaboration between government, industry, and academia. The long-term solution requires a multifaceted approach that addresses both immediate needs and long-term strategic goals.

The global chip shortage remains a significant challenge, but proactive measures and strategic investments offer a path towards greater resilience and stability for the US economy.