“`html

Romanian Investors Increase Gold Investments Amid Economic Fears

As economic uncertainties loom and the U.S. dollar faces depreciation, Romanian investors are increasingly seeking the stability of gold, viewing it as a strategic asset to protect their capital. According to a recent Plader International Survey by eToro, this shift reflects growing pessimism about the economic outlook among Romanian investors [[1, 2]].

Rising Demand for Gold Investments

The survey,encompassing 10,000 individual investors across 12 countries,reveals that 58% of Romanian respondents have already adjusted or plan to modify their investment portfolios in anticipation of a weakening dollar. This figure surpasses the global average of 48%, highlighting a heightened sense of caution among Romanian investors.

Did You Know? Gold prices typically have an inverse relationship with the U.S. dollar. As the dollar weakens, gold frequently enough becomes more attractive as a safe haven asset.

Dalio Warns of Economic Turmoil Amidst Trade Disputes

Billionaire investor foresees potential for instability beyond a recession.

Prominent investor Ray Dalio is cautioning about economic uncertainty. He believes that the current financial climate, influenced by trade policies and global debt, could lead to more than just a recession. Dalio suggests the world may face significant, destabilizing changes.

Expert’s Dire Forecast

The founder of Bridgewater Associates, a major hedge fund, expressed worries about the implications of Donald Trump’s economic strategy. He indicated that we are at a “decision-making point” and are very close to a recession, as he told NBC’s Meet the Press. His concern extends to potentially experiencing something more severe if things are not handled effectively.

A recession, usually indicated by negative GDP growth across two consecutive quarters, is a key concern. Dalio has correctly predicted major financial events previously, including the 2008 financial crisis. He now fears a breakdown of the present monetary system.

Bridgewater’s Ray Dalio on the economy and the impact of politics: “Right now, we are at a decision-making point and very close to a recession. And I’m worried about something worse than a recession if this isn’t handled well.” #MeetThePress pic.twitter.com/1N0L7WvS43

— Meet the Press (@MeetThePress) June 9, 2024

“Right now we’re at a juncture,”

—Ray Dalio, Founder of Bridgewater Associates

Economic policies, such as steel and aluminum tariffs, have led to a global economic shakeup. These issues, paired with high debt levels and competition between superpowers, are cause for the investor’s grave assessment. In 2024, global trade decreased by 1.2%, according to the World Trade Organization (WTO).

The Looming Concerns

Dalio explained that the United States currently needs to reduce its budget deficit to 3% of GDP and properly manage trade deficits. If these actions aren’t taken, there may be a significant supply-demand problem involving debt.

The investor compared the current environment to the 1930s. He emphasized that tariffs implemented in a “chaotic and disruptive way” could make a substantial difference. This, he suggests, is akin to “throwing rocks into the production system.”

Dalio indicates that such times are very similar to the 1930s and how they ended after WWII. He feels that if Congress does not get the budget deficit down, then the results of that will be worse than a normal recession.

US Retail Sales Dip Amid economic Concerns

washington, DC – A new report reveals that U.S. retail spending experienced a decline in March, signaling a potential pullback by consumers amid growing fears of a recession. The Commerce department’s data, released Friday, indicates a notable shift in consumer behavior.

Key Findings: March Retail Sales

- Retail sales fell by 1% in March, adjusted for seasonality but not inflation.

- This decline surpassed expectations of a 0.4% decrease, according to Refinitiv.

- The previous month’s decline was revised to 0.2%.

- Though, retail spending saw a 2.9% increase year-over-year.

Factors Contributing to the Decline

Several factors appear to have influenced the decrease in retail spending. Analysts point to smaller tax refunds and concerns about a potentially weakening labor market as primary drivers.

- The IRS issued $84 billion in tax refunds this March, approximately $25 billion less than in March 2022, according to BofA analysts.

- Expiration of enhanced food assistance benefits also played a role, economists suggest.

Spending Patterns: Where Consumers Pulled Back

The decline in retail sales was evident across various sectors, with consumers reducing spending on specific categories.

- Spending at general merchandise stores decreased by 3%.

- Gas station spending fell by 5.5%.

- Excluding gas station sales, retail spending decreased by 0.6%.

- Durable goods, such as appliances and furniture, also saw reduced spending.

Expert Insights and Analysis

Experts weigh in on the implications of the latest retail sales data and the broader economic outlook.

Did you know? The Employment Cost Index (ECI), a complete measure of wages, has shown a moderation in worker pay gains over the past year. The ECI data for the first quarter will be released later this month.

Aditya Bhave, senior U.S. economist at BofA Global Research, noted the importance of tax refunds in March, stating, Some folks might have been expecting something similar to last year.

Bank of America researchers observed that credit and debit card spending per household moderated in March to its slowest pace in over two years, likely due to smaller tax returns, expired benefits, and slowing wage growth.

Michelle Meyer, North America chief economist at Mastercard Economics Institute, believes the labor market’s strength could support consumer spending in the coming months. The big picture is still favorable for the consumer when you think about their income growth, their balance sheet and the health of the labor market,

Meyer said.

Labor Market Dynamics

While the labor market remains relatively strong, there are signs of a potential slowdown.

- Employers added 236,000 jobs in March, a solid gain but less than the average monthly pace in the prior six months.

- The Job Openings and Labor Turnover Survey (JOLTS) report indicated that available jobs remained elevated in February but were down more than 17% from their peak in March 2022.

- Revised data showed higher weekly claims for U.S. unemployment benefits than previously reported.

Recession Concerns and Consumer Sentiment

The Federal Reserve’s economists anticipate a potential recession later in the year due to the lagged effects of higher interest rates. This outlook has implications for consumer sentiment and spending behavior.

Pro Tip: Keep an eye on the University of Michigan’s consumer sentiment surveys for insights into how consumers are feeling about the economy. These surveys can provide valuable clues about future spending patterns.

Consumer sentiment, as tracked by the University of Michigan, worsened slightly in March during the bank failures but had already shown signs of deterioration beforehand.

The latest consumer sentiment reading in April showed that sentiment held steady despite the banking crisis. Though, higher gas prices contributed to a full percentage point increase in year-ahead inflation expectations, rising from 3.6% in March to 4.6% in April.

Joanne Hsu, director of the surveys of consumers at the University of Michigan, stated in a news release, On net, consumers did not perceive material changes in the economic habitat in April.

In an interview with Bloomberg TV, Hsu added, Consumers are expecting a downturn, they’re not feeling as dismal as they were last summer, but they’re waiting for the other shoe to drop.

Frequently Asked Questions (FAQ)

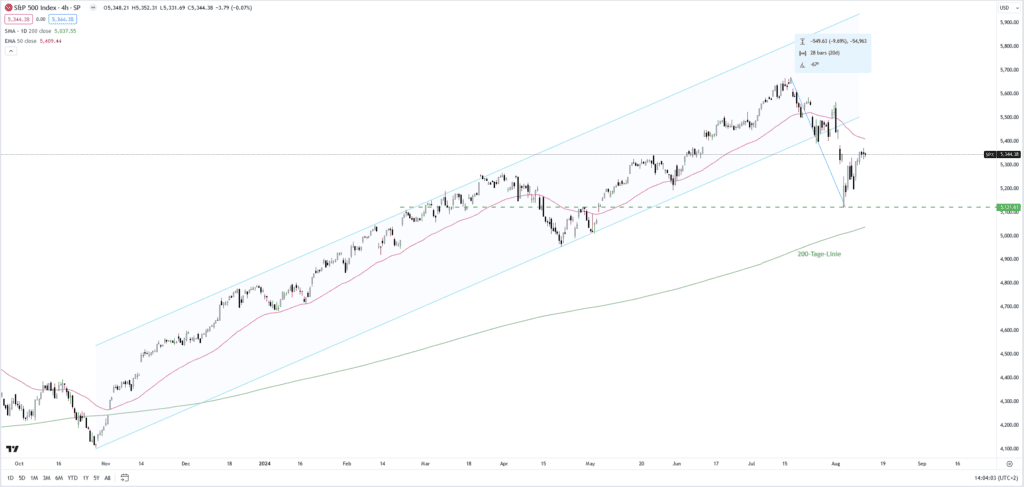

Correction on the stock market. Graphic: Greatkim – Freepik.com

Last week, the US benchmark index S&P 500 fell out of its uptrend channel that has been in place since the end of October 2023. Starting from its record high on July 16 at 5,669.67 points, the index fell by almost 10%. A correction of around 10% is absolutely appropriate for such dynamic rallies as we have seen since the end of October 2023. But the recent correction in the stock markets does not seem to be a normal correction, because at the same time we are seeing a steepening of the yield curve, which is generally considered a signal of an impending recession.

The 2-year/10-year Treasury yield curve has steepened in recent weeks after weaker U.S. economic data signaled a slowdown in the U.S. economy. This development is typical when the economy is heading for a downturn.

S&P 500: Signal for a recession

When the S&P 500 falls while the yield curve steepens, it is often a sign that financial markets are beginning to price in a recession. That is exactly what we have seen in recent weeks. The S&P 500 fell by around 10% while the yield curve steepened. The chart of TradingView shows the recent price collapse of the S&P 500 – the important 200-day line was defended.

S&P 500 correction: US leading index falls out of its uptrend

S&P 500 correction: US leading index falls out of its uptrend

Concerns about a recession in the US and the collapse of the carry trade were responsible for the collapse in the US stock markets. However, fears of a recession have since subsided. Slightly better economic data at the end of last week and the prospect of several interest rate cuts by the Fed give hope for a soft landing for the US economy.

According to the creators of Game of Trades, however, there are good reasons to be bearish on the stock markets. The US benchmark index S&P 500 could face a much larger correction than the collapse a week ago. One reason for this is the extremely high valuations, which continue to rise due to falling corporate profits and a potential economic downturn. Shiller PE Ratio Despite the slump, it is still trading above the 30 mark, which is significantly above the long-term average.

Stock markets on the verge of a new rally?

But there are also indicators that speak against a further sell-off of stocks: such as the VIX, the volatility on the S&P 500. The fear barometer VIX exploded last Monday, jumping to a value of 45. Such strong breakouts often mark the bottom of a correction and herald the beginning of a new rally that can lead to new all-time highs on the stock markets.

The Fed could also provide a boost if it begins the easing cycle in September at the latest. The key question as to whether the stock markets are facing a major correction or are about to begin the next rally is: is the recession coming or not? Historically, stock markets fall when the Fed has to cut interest rates due to an economic downturn. However, if it cuts interest rates while the economy remains robust, the stock market rally usually continues.

In the following video, the makers of Game of Trades show the most important indicators that speak for or against a major correction on the stock markets and then draw up a balance.

A sharp increase in bets on a rate cut in the United States could further fuel a rally in bonds, fueled by weakening economic data. The latest data showed that the Federal Reserve will need to move faster in easing its monetary policy in order to prevent the US economy from falling into recession.

The past week has been marked by sharp swings in investor sentiment: the Fed’s decision last Wednesday to leave interest rates unchanged but open the window for a cut in September sparked a market rally and investor euphoria, which however proved extremely short-lived: just a day later, the unemployment benefits data rattled markets, which were hit on Friday with disappointing US unemployment, prompting a massive sell-off that extended on both sides of the Atlantic.

This has resulted in markets now discounting more aggressive interest rate cuts, and the first criticisms that the Fed has again been slow to react have already begun to be heard.

“The rising unemployment rate says the Fed has lost its bearings,” said Tony Farren, managing director of Mischler Financial Group.

Bets on bonds

As Reuters points out, investors in futures contracts tied to the Fed’s overnight policy rate now see the Federal Reserve cutting rates by about 120 basis points this year, nearly double what they had predicted before Wednesday’s meeting . Bond yields, which move inversely to prices, fell sharply with two-year yields hitting their lowest since March last year and benchmark 10-year yields at their lowest since December.

The latter elements triggered the Sahm rule

The 2/10 yield curve, which has been inverting continuously for more than two years, was at minus 9 basis points, – the closest to a positive turn since the inversion began. In the last four recessions, this curve had turned positive a few months before the economy began to contract.

The Sahm rule

Data on Friday showed the jobless rate rose to 4.3%, signaling an unexpected deterioration in a labor market that has so far shown surprising resilience during the Fed’s aggressive rate hike campaign. And analysts say the two-tenths of a percentage point increase in the unemployment rate triggered the so-called Sahm Rule, a historically accurate early indicator of recession.

The rule, which aims to signal the onset of a recession more quickly than the current process that officially dates business cycles, identifies signals associated with the onset of a recession when the three-month moving average of the national unemployment rate rises by 0.50 percentage point or more from its low in the previous 12 months. On Friday, this index increased to 0.53 percentage points.

“This rule of thumb is empirical and has literally never failed,” Alfonso Peccatiello, managing director of global macro investment strategy firm The Macro Compass, said in a note. “Of course ‘this time may be different, but markets are now forced to take the possibility of recession more seriously.’

“People rush into bearish trades,” he said. “We went from ‘Goldilocks’ to recession in a week,” referring to the Goldilocks scenario of lower inflation and steady growth that has supported asset prices this year.

SOURCE: ot.gr

#Bonds #inversion #yield #curve #reveals

In light of the slight and sudden increase in the inflation rate in the United States during the month of February, new challenges emerge before the US economy and President Joe Biden, at a time when increasing inflation is considered a possible indicator of a delay in lowering interest rates, which may negatively affect growth expectations. The economic situation puts the president facing thorny scenarios ahead of the presidential elections expected in November.

Already, inflation in the United States rose unexpectedly to 3.2 percent in February, driven by higher prices for services such as car insurance and health, and with the recent increase in inflation and better-than-expected jobs data, the Federal Reserve is facing increasing pressure to take action to bring inflation back to normal. Its target levels of two percent.

US Treasury Secretary Janet Yellen said on Wednesday that it was “unlikely” that interest rates would return to pre-Covid-19 levels.

The Consumer Price Index rose 0.4 percent last month after increasing 0.3 percent in January, the Labor Department said, and gasoline and housing prices, which include rents, contributed more than 60 percent to the monthly CPI increase.

Despite the markets’ expectations of a reduction in interest rates in the period between March and June, Joe Yark, head of the global markets department at Sidra Markets, indicated in an interview with “CNN Economics” that the Fed may wait until July before it begins reducing interest rates. In light of inflation and jobs data.

Yarak adds that the Fed will need more data, especially inflation numbers in March and April, before making decisive decisions.

Yarak believes that the continuing rise in inflation, or what is called “sticky inflation,” during the months of February and January, and the subsequent high interest rates for a longer period, may greatly affect economies, specifically the global and American economies.

For his part, Wael Makarem, chief market strategist at Exness Trading Company, in an interview with CNN Economic, agrees with this assessment, as he believes that inflation has become sticky, and adds that recent inflation data showed that from mid-2022 until today, there has been There is a noticeable decline in all components of the index, especially energy prices, but with the exception of housing and transportation. The housing price index is considered later and does not give a clear picture of the decline in rental rates by about 20%. Fed members are counting on a decline in this index, which may push general inflation towards the target. If Rental prices are back on the rise with oil prices recovering, and the Fed may face a dilemma that forces it to even consider raising interest rates again, according to Makarem.

Although the Federal Reserve’s decisions are made independently of the Biden administration, rising inflation and the possibility of delaying a rate cut may increase the challenges Biden faces in light of the upcoming elections. Although inflation in the United States has declined from its peak of 9.1%, it has not It was not enough to stop voters’ complaints about high prices, as some of them blame Biden, and in this context, former President Donald Trump, a candidate for the upcoming presidential elections, targeted his rival because of inflation, saying, “People are going through hell, because of high prices, with energy and food costs rising to the highest levels.” Levels.

Economic policies and inflation represent a source of concern for Biden, who seeks to demonstrate his successes in managing the economy and achieving a balance between inflation and economic growth. Biden uses this period to attack the opposition and highlight his promise to confront high prices.

Despite his attempt to portray himself as committed to defending ordinary Americans against the interests of the powerful and the wealthy, polls consistently show that far more Americans, including large numbers of black and Hispanic voters, believe they have personally benefited from Trump’s policies. Trump compared to Biden’s policies.

In light of the current economic challenges and sticky inflation, the US Federal Reserve and President Biden’s administration stand at a critical crossroads.

With the announcement of expectations of a decline in some components of inflation and not others, questions are increasing about the future of monetary policies. Will the Federal Reserve succeed in balancing between lowering prices and supporting economic growth? How will this scenario affect the American and global economy in light of the upcoming presidential elections?

2024-03-14 18:26:48

#Inflation #pressures #Feds #crossroads…postponing #interest #rate #cut #scenario #CNN #Economics