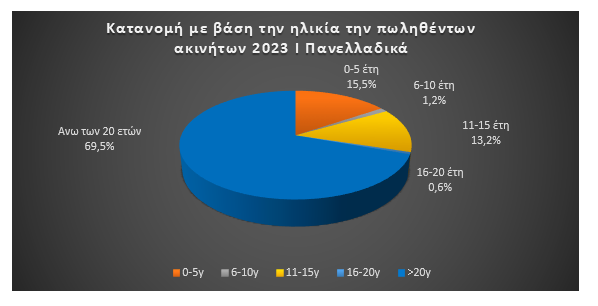

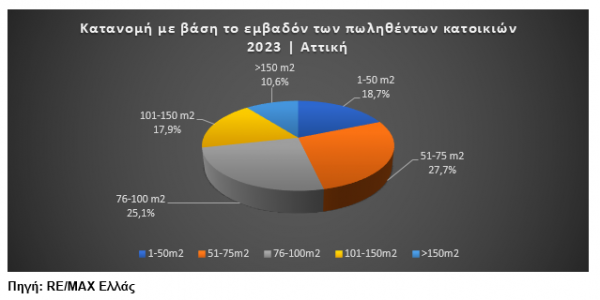

Greek patrons are turning to smaller properties, aiming primarily for funding alternatives that may safe future capital good points, whereas bigger properties are primarily chosen for owner-occupancy. Consumers additionally favor smaller properties as a result of they’re extra inexpensive and have much less upkeep prices in comparison with bigger ones, whereas in the event that they select to hire them out the returns are important.

In comparison with final 12 months, a rise within the share of property gross sales of as much as 50 sq.m., but additionally these between 51 and 75 sq.m., is recorded within the nationwide survey by RE/MAX Greece, the most important actual property community within the nation, whereas the proportion of properties with an space of greater than 76 sq.m. seems barely decreased.

Property particulars

In accordance with latest information from RE/MAX Greece, which has 85 places of work and greater than 1,100 actual property consultants all through the nation, 50% of patrons throughout the nation favor properties as much as 75 sq. meters. This share refers to finish property gross sales made by the RE/MAX actual property community and never only a buy curiosity.

Specifically, in line with the nationwide gross sales by RE/MAX, 1 in 4 patrons (24.9% of the entire) selected properties with an space of 51-75 sq.m., whereas 24.7% selected smaller areas as much as 50 sq. meters. The purchases of bigger properties stay at comparatively excessive ranges, as properties from 76 to 100 sq.m. 23 out of 100 events purchased and about 1 in 5 purchased even bigger properties from 101 to 150 sq. meters. Properties with an space of 151 sq. meters and above have been chosen by 8.8% of all patrons, even supposing these properties provide extra consolation and spaciousness.

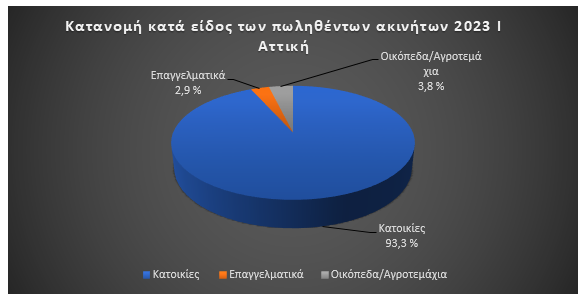

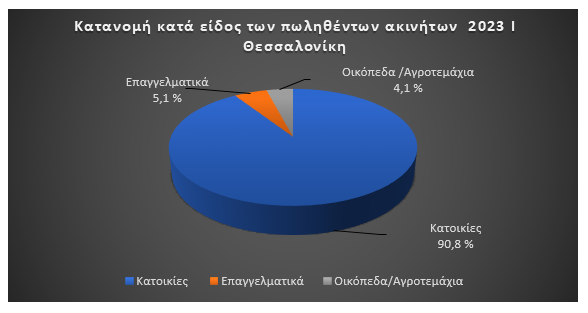

The icon in Attica and Thessaloniki

Within the prefecture of Attica, the image confirms the above development. Specifically, 27.7% of patrons most well-liked properties with an space of 51 to 75 sq. meters, which makes them the preferred in your entire county. Additionally, 1 in 4 patrons most well-liked properties between 76 and 100 sq. meters, that are nonetheless in excessive demand. Subsequent in buying recognition, with a share of 18.7%, are the smaller properties as much as 50 sq. meters and really shut are the properties with an space of 101 to 150 sq. meters. As for the very massive residences (over 151 sq.m.), solely 10 out of 100 patrons selected them.

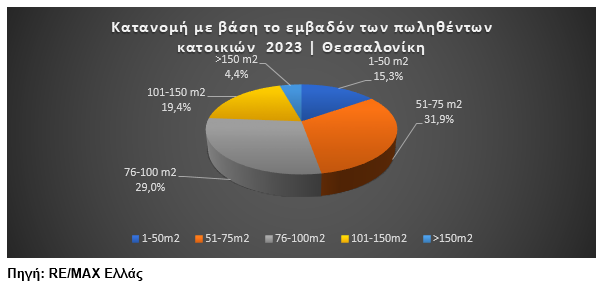

In Thessaloniki, an analogous image to that of Attica was noticed, with most patrons selecting properties from 51 to 75 sq. meters. Properties from 76 to 100 sq.m. have been chosen in a better share than these as much as 50 sq.m. and particularly by 29% and 15.3% respectively. Lastly, it’s value noting that bigger houses, over 151 sq. meters, have been most well-liked by nearly 50% lower than final 12 months.

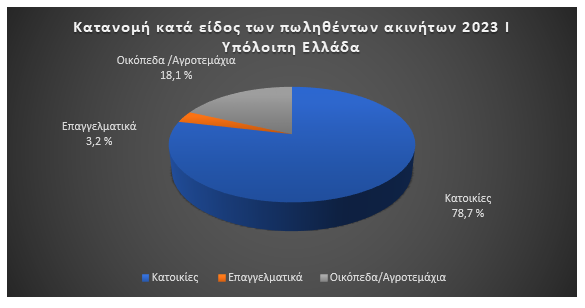

The remainder of Greece

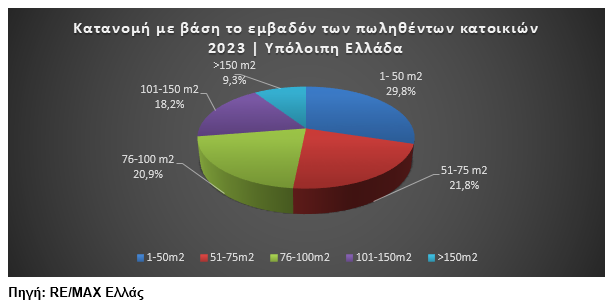

In the remainder of Greece, a distinct image is noticed in comparison with that of Attica and Thessaloniki, with 29.8% of patrons selecting smaller properties as much as 50 sq.m. and to see a rise of about 35% in comparison with final 12 months, making this class the preferred in these areas.

Listed below are the properties from 51 to 75 sq.m. at a charge of 21.8%, whereas 20.9% of patrons favor properties from 76 to 100 sq. meters. Lastly, properties between 101 and 150 sq. meters have been chosen by 18.2% of patrons.

This selection in choices displays the completely different wants and preferences of patrons in several areas of Greece. Properties bigger than 151 sq. meters take up 9.3% of the market, reflecting decrease demand for bigger properties in these areas.

Sources: ot.gr

#Turning #actual #property #Greeks #select #Athens #Thessaloniki #analysis #reveals