“`html

Loro Piana‘s Comfort-First Approach Drives Billion-Dollar Luxury Empire – Italian luxury brand Loro Piana, renowned for its exquisite cashmere and elegant ready-to-wear, traces its success back to a simple desire for comfortable footwear, according to recent reporting. The company, now valued at over $2.7 billion following its acquisition by LVMH in 2013,initially gained traction by addressing a personal need within the founding family.

The story began in the 1920s in Viguzzolo, Italy, when Pietro Loro Piana started trading wool and other fabrics. By the 1970s, his grandson, Pier Luigi Loro piana, noticed a gap in the market for high-quality, comfortable shoes. Specifically, he and his brother Sergio sought footwear suitable for sailing, a passion of theirs. Existing options proved inadequate, lacking the necessary comfort and practicality. “We were looking for something comfortable to wear on the boat,” explains Pier Luigi Loro Piana.

Rather than accept the limitations of available products, the Loro Piana brothers decided to create their own. They began by sourcing the finest materials, initially focusing on suede uppers. This led to the advancement of two key styles: a classic loafer and the Open Walk,a slightly higher-cut model. The shoes quickly gained popularity not only among sailors but also among a broader clientele who appreciated their exceptional comfort. “We discovered people were using them also for formal wear as they were so comfortable,” says Pier Luigi. The success of the footwear line demonstrated the power of addressing a specific need with superior quality and design.

Today, Loro Piana operates over 130 boutiques globally, including locations in New York City (Madison avenue), London (new Bond Street), and Milan (Via Montenapoleone). The brand’s product range has expanded considerably beyond footwear to encompass a full spectrum of luxury apparel, accessories, and home goods, all underpinned by a commitment to exceptional materials and craftsmanship. The company remains a significant employer in the piedmont region of Italy, supporting local artisans and preserving conventional techniques.

The Loro Piana story exemplifies how a focus on problem-solving and personal needs can translate into a thriving global business.The initial investment in comfortable footwear, born from a desire for practicality on the water, laid the foundation for a luxury empire built on quality, innovation, and a dedication to the finer things in life.

Top: A model relaxes on Pier Luigi Loro Piana’s 81-foot sailing yacht, My Song, in a linen shirt whose collar is designed to stay standing, even in humid conditions.

Model: Loic Antina; Grooming: eduardo Bravo

Authors

-

The wealth of Bernard Arnault, the richest man in the world just 6 months ago, has decreased significantly – HotNews.ro

written by Chief editor of world-today-news.comFrench billionaire Bernard Arnault in 2024, at an event organized a few days before the opening of the Olympic Games in Paris, PHOTO: Fabrice Coffrini / AFP / Profimedia

French billionaire Bernard Arnault, the founder and CEO of luxury goods giant LVMH, was the world’s richest man just half a year ago, but has now fallen to fifth place in ranking of the planet’s super-rich after a major decline in its fortunes, he reports Business Insider.

At the end of March, the Bloomberg group estimated Arnault’s fortune at 231 billion dollars, a large amount that put him in front of famous billionaires such as Elon Musk and Jeff Bezos.

But the French billionaire’s fortune has since fallen by $54 billion to $177 billion before the US stock market closed last week.

The head of LVMH Moët Hennessy Louis Vuitton has now surpassed the ranking of the richest billionaires not only with Musk ($ 265 billion) and Bezos ($ 215 billion), but also with Mark Zuckerberg ($ 200 billion) and Larry Ellison ($178 billion), the co-founder and head of Oracle, who recently did conflicting opinions on mass research with the help of artificial intelligence.

By early 2024, Arnault’s fortune has fallen by $30 billion, making him the biggest loser from stock market fluctuations among the 500 billionaires included in the Bloomberg ranking.

The Forbes ranking, which uses a slightly different approach, tells a similar story: on March 8, Arnault was the richest man in the world with a fortune of $233 billion, and he -now dropped to 5th, with 167 billion.

The situation is the result of the depreciation of LVMH shares by 20% in the last half year, their price reaching the lowest level in the last two years.

Like most billionaires on the planet, most of Arnault’s wealth is due to the shares he has in the company he founded. Arnault controls about 48% of the luxury goods conglomerate, which includes 75 famous brands such as Tiffany, Louis Vuitton, Dom Perignon and Sephora.

LVMH’s share price fell amid declining sales of luxury goods, which have reached the highest levels in the pandemic.

LVMH, however, remains the second most valuable company in Europe, with a market capitalization of $344.18 billion, behind only the Danish pharmaceutical giant Novo Nordisk (554.35 billion).

In the overall ranking, LVMH is the 26th most valuable company in the world, and Novo Nordisk is 16th in controlled status of companies in the United States.

2024-09-24 08:44:18

#wealth #Bernard #Arnault #richest #man #world #months #decreased #significantly #HotNews.roFrench consortium LVMH acquires stake in rival Richemont

written by Chief editor of world-today-news.comZurich. French billionaire Bernard Arnault, Europe’s richest man and president of the world’s largest luxurious group LVMH, purchased a stake in its smaller rival Richemont, Bloomberg reported on Tuesday.

In keeping with the report, each the precise involvement of the proprietor of the Cartier jewellery in addition to Arnault’s intentions had been unclear. Representatives for Arnault didn’t instantly reply to a request for remark.

The report stated the funding was small and was a part of a broader portfolio of investments by the Arnault household in publicly traded firms.

Richemont, whose shares rose 2.8 % on the information, declined to remark. The corporate’s shares have gained 21 % this yr.

Paris-based LVMH, whose manufacturers embody trend homes Louis Vuitton and Christian Dior, watchmakers Hublot and Tag Heuer and champagne maker Dom Perignon, has beforehand purchased stakes in rivals.

The world’s largest luxurious firm revealed in 2010 that it had acquired a stake in purse maker Hermès.

The Hermès household house owners reacted by tying up their stakes, and LVMH finally gave up its stake in 2014. Richemont might additionally show a tough goal to tackle, if that’s Arnault’s intention.

The corporate, which additionally owns Swiss watchmakers IWC, Piaget and Jaeger-LeCoulture, is managed by Chairman Johan Rupert by means of a mix of two classes of shares that offers him 51 % of the voting rights.

#French #consortium #LVMH #acquires #stake #rival #Richemont

– 2024-06-26 10:05:14Louis Vuitton – Kiko Milano: The mega deal and the Greek success story – 2024-05-03 23:52:34

written by Chief editor of world-today-news.comAkathektos continues its development and expansion plan Kiko Milan in Greece and abroad the Faiss group, remaining unaffected by international developments and the mega deal of the Italian low cost beauty brand with the Louis Vuitton group.

LVMH-backed investment firm L Catterton has agreed to buy a majority stake in Kiko Milano from the Percassi family in a deal worth around €1.4 billion that also includes the Italian brand’s debt.

From Benetton to Kiko Milano

It all started with Antonio Percassi, when in 1976 he met Luciano Benetton and a year later he opened the first Benetton store in Bergamo. Thus marking the beginning of the activities of the now Percassi company in the retail sector and a thirty-year partnership with the Benetton family, which over the years will lead to the management of the most important stores of the Benetton Group in Italy and around the world for brands United Colors, Zerododici, Sisley and Playlife.

If the collaboration with Benetton was the first important collaboration responsible for the development of the Percassi company, another milestone that confirms the company’s affirmation at an international level includes the joint venture with Inditex. The group led by Amancio Ortega, who in 2001 looked to Antonio Percassi to help the famous Zara brand enter the Italian market. Opening of the first megastore in Milan, in Corso Vittorio Emanuele, followed by the opening of additional Zara and Zara Home stores, as well as other brands of the Inditex Group (Massimo Dutti, Oysho, Pull and Bear, Bershka and Stradivarius).

Other major retail development partnerships led by founder Antonio Percassi in retail development include those with Swatch, Nike, Levi’s, Calvin Klein Guess and Tommy Hilfiger, in addition to luxury brands such as Gucci, Ferrari and Ralph Lauren.

In 1997 he decided to create his own original brands, starting with Kiko Milano which was developed by his son Stefano, as one of the most successful projects in the business landscape in recent years, as it combines professional quality and affordable prices with more than 1,200 makeup, beauty and skin care products, as well as limited edition thematic collections.

In the cosmetics industry, Percassi is also present with Bullfrog barber products and Womo men’s cosmetics.

In 2007 Antonio Percassi started another project in the men’s world when he started a partnership with Flavio Briatore, creating the clothing brand Billionaire Italian Couture, in which he remains a 50% shareholder.

Today, the Percassis own the Serie A football team Atalanta, while they are active in the real estate retail sector, they carry out commercial activities in Italy for companies such as Starbucks, Nike, Gucci and Victoria’s Secret. With offices around the world, the company has 9,000 employees.

The Percassi family

The Greek success story

Faces Group was the first to bring the low cost beauty brand to Greece, as an exclusive distributor, in 2020, through the subsidiary SLF East Europe. The first store was opened in The Mall Athens, followed by the eshop in early 2021, while the continuation was very fast: physical stores in Athens, Thessaloniki, Patras, Nicosia, Larnaca, Paphos and Sofia, pop-up and shop-in-shop stores in large shopping centers – today it has reached 25 points.

In the immediate plans are the creation of new stores within the next quarter in Xanthi and Corinth (within the Mare West shopping center), in Serres and in Komotini later. Likewise, the signing of the agreement for the Bulgarian market is expected in the next period of time, with the eyes of the Faiss group also focused on Romania, where from 2021 the corresponding subsidiary has also been established.

During its first fiscal year (2021), Kiko Milano exceeded 3 million euros in sales, with a total of only 5 stores, while 2022 and 2023 marked the development of the chain at an intensive rate inside and outside the Greek borders, exceeding expectations beyond expectations. It is indicative that the performance of SLF Greece reached 8.4 million euros in turnover last year.

The takeover

The Percassis will retain a “significant” stake in Kiko Milano, according to Reuters, as the outlook for the beauty industry is excellent. Its revenue rose 20 percent last year to about 800 million euros, and it has more than 1,100 stores in 66 countries, while the global beauty market is expected to grow to $128 billion by 2032 from $78 billion last year, Fortune Business predicts Insight.

“The quality, accessibility, personalized advice and packaging design of the innovative products are the distinguishing elements of the brand,” said Kiko Milano CEO Simone Dominici, about the brand which, in addition to physical stores, also sells online and some of its products are best sellers apart from the dynamic Gen Z audience and across all age groups.

Dominici said Kiko Milano will expand in the United States with the support of L Catterton and her senior adviser John Demsey – a former Estee Lauder executive who developed the MAC Cosmetics brand before resigning over an Instagram scandal.

L Catterton’s investment giant

The American multinational private equity firm was founded in Greenwich, Connecticut in 1989 and has made over 250 brand investments across all sectors of the consumer industry. The company is currently headed by J. Michael Chu and Scott Dahnke.

Its original form until 2001 was Catterton Partners, the firm that between 1992 and 2002, invested in well-known consumer brands in the US, including PF Chang’s, Odwalla and Baja Fresh.

He has completed investments in numerous growth consumer businesses, including Peloton, Build-A-Bear Workshop, Ferrara Candy Company, Outback Steakhouse, Restoration Hardware, Wellness Pet Company and Kettle Foods. In fact, in 2008, it launched its first growth fund aimed at investing in early and late-stage growth companies, such as Vroom, Sweaty Betty, Il Makiage, Sweet Leaf Tea Company and Tula.

In January 2016, Catterton, LVMH and Financière Agache (the family office under the name Groupe Arnault), collaborated to create L Catterton.

This partnership was based on the combination of Catterton’s existing private equity activities in North and Latin America with the pre-existing European and Asian private equity and real estate activities of LVMH and Groupe Arnault.

In May 2021, Private Equity International listed L Catterton as the 32nd largest private equity firm in the world based on funds raised over the previous five years. Just consider that in 2020, it raised over $5 billion for its ninth buyout fund and over $950 million for its fourth growth fund. It has also backed several notable investments, including Birkenstock, Indian tech giant Jio Platform, Ainsworth Pet Nutrition, Peloton, Nature’s Variety, Pinarello, Freetrade, Miami Design District, Cover FX and Ginza Six.

It has also already invested in more than 30 beauty brands, including Intercos, an Italian make-up manufacturer that supplies top luxury brands, British skin care company Elemis, Japan’s ETVOS, hair care brand Maria Nila and consumer technology company Oddity.

Source OT

#Louis #Vuitton #Kiko #Milano #mega #deal #Greek #success #story

LVMH: Bernard Arnault prepares successor – The background – 2024-04-19 14:12:59

written by Chief editor of world-today-news.comFour decades passed the billionaire today Bernard Arnaultdeveloping the manufacturing company he inherited from his father into the LVMH group that holds a leading position in the luxury sector.

Methodical, exacting and sometimes ruthless, the 75-year-old remains deeply involved in the management of his empire and does not like to discuss the succession with outsiders. But behind the scenes the billionaire, who in 2022 raised the age limit for his role as chief executive to 80, is carefully laying the groundwork for his five children to one day lead the company worth almost 400 billion euros.

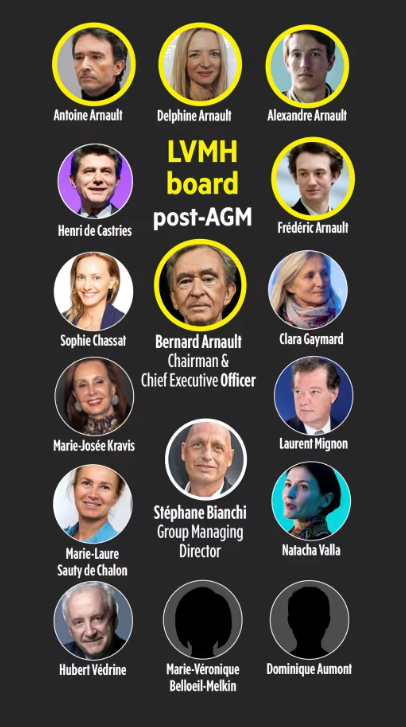

Two of his sons are set to join LVMH’s board at its annual meeting on Thursday, leaving only the youngest without a seat, as Arnaud prepares for the… generational handover both within his family and among the executives who work together their.

“Five years ago, you could argue that if something happened to Arnault, you would have an interim, non-family CEO while you wait for the children to grow up and gain more experience,” Erwan Rambourg, global head of consumer research at HSBC. “Now there is no need for this middleman as all the preparation has been done,” he added.

At stake is the future leadership of the world’s largest luxury group, which includes fashion houses such as Dior and Louis Vuitton to hotels and jeweler Tiffany & Coat a time when the broader sector is struggling with a slowdown after an unprecedented pandemic-era boom.

It is too early to say who will take the top job: although his eldest child, Delphine, holds the most senior position in his empire as chief executive of Dior and a member of the executive committee, analysts point to possible scenarios according to which two or more of the heirs could manage the company jointly.

LVMH’s size and market share also mean its next generation of leaders will have to be more inventive to sustain growth and will no longer be able to rely on China, which drove the industry’s expansion for much of the past decade, to give impetus.

The case of Lagardère

Arnaud, whose family owns 48% of LVMH’s share capital and 64% of voting rights, is seeking to avoid the fate of other French business dynasties, where mismanaged successions can sink fortunes.

In the rarefied world of France’s business elite, the fall of the Lagardères acts as a “red flag”. Created in 1992 as Matra, Hachette & Lagardère, the group had two arms, Lagardère Publishing and Lagardère Travel Retail. While the book and e-publishing sector (Lagardère Publishing) includes the major printer Hachette Livre, the Travel Retail unit includes retail outlets, mainly in airports and train stations.

The group’s business scope also includes other activities, which mainly include Lagardère News (Paris Match, Le Journal du Dimanche, Europe 1, Europe 2, RFM and the license to use the Elle brand), Lagardère Live Entertainment (concert production and performances and venue management) and Lagardère Paris Racing (sports club). On November 21, 2023, Vivendi completed the purchase of a majority stake (60%) in Lagardère.

Avoiding a similar fate at LVMH is of the utmost importance. All of Arnault’s children work at the group, where they have been matched with mentors among its top executives, having been prepared for their roles from a young age, accompanying him as teenagers on weekend store visits or overseas business trips.

The new members who will join the group

Shareholders on Thursday will vote on the board appointments of Alexandre Arnault, a 31-year-old senior Tiffany executive, and his 29-year-old brother Frédéric, who was recently appointed head of LVMH Watches. Delphine, Christian Dior’s 48-year-old chief executive, and Antoine, the group’s 46-year-old head of image and communications, took their posts at around the same age. while Arnault’s youngest son, 25-year-old Jean, director of watches at Louis Vuitton, is expected to follow soon.

Three of the five children have been appointed to new roles within the group and its portfolio companies from early 2023, including Delphine’s appointment as head of Dior, the group’s second-biggest brand, last February.

Family above all else

Under a structure Arnault created at the family holding company in 2022 to strengthen long-term control and unity, family members each have an equal vote and must be unanimous on major decisions involving LVMH, such as changes to their share capital or the strategic direction of the group. Arnault sees business experience as the ideal training ground for this, and regularly organizes lunches with the five children to discuss the business.

The Lagardère affair is not the only one Arnault has reflected on as he works to ensure the longevity of his empire. The decline and breakup of US conglomerate General Electric is another, while many of the assets he bought to build his empire – including Christian Dior – were acquired from family dynasties that had fallen on hard times.

Retirement of executives

As the next generation steps up, today’s… deputy leaders step aside to facilitate it.

In addition to the changes in family roles, group chief executive Antonio Belloni is expected to step down after 23 years as Arnault’s right-hand man, to be replaced by Stéphane Bianchi, LVMH’s head of watches and jewellery, who is a veteran of the family succession at the Yves Rocher cosmetics group.

For investors, the handover was expected as top LVMH executives such as Sidney Toledano, 72, and Michael Burke, 67, are getting older. LVMH’s track record of selecting leaders is strong, and Arnault is known for ruthlessly ousting those who don’t live up to the task, but that dynamic is changing as the next generation of the family steps up.

“These are big positions to fill after the Burke, Belloni and Toledano generation who are great managers,” Flavio Cereda, luxury portfolio manager at fund manager GAM, told the FT. “The danger now is that he could be blindsided by the family. In other words, he may give too much responsibility to his children as opposed to an external administrator who could do a better job,” he added. “To be clear, we have no evidence of this, but this was not a risk before because, with the exception of the two older children from the first marriage, the rest were very young.”

The next CEO, Stéphane Bianchi

Bianchi’s role and the future

While much of the attention has focused on the family’s transition, the elevation of Stéphane Bianchi to group chief executive is at the heart of the new phase LVMH is entering.

The 59-year-old joined in 2018, which makes him relatively new by LVMH’s standards, while most top managers’ time at Arnault’s side is measured in decades.

He is credited with helping family business Yves Rocher overcome a difficult generational transition after the founder’s death, grooming scion Bris Rocher – just 19 when Bianchi became chief executive in 1998 – to take over the business.

Bianchi’s promotion is “the key indication of next generation preparation,” HSBC’s Rambourg said. “He has an unprecedented reputation in France for saving the Yves Rocher group and preparing the next generation there. That’s why you want someone like him.” “There are people who are more committed to being in the trenches. “Bianchi is one of the executive community and the most senior team who is able to be a top leader and a good ‘coach’ at the same time,” he added.

LVMH’s emerging leaders will also need to be even smarter to continue growing in a more mature global luxury market, where the group already dominates, and without the same push from China. Cereda estimates that LVMH has gone from a 14% share of the global luxury personal goods market in 2018 to 24% today – and could rise to 30% in the coming years.

Source: ot.gr

#LVMH #Bernard #Arnault #prepares #successor #background

Thailand Invites LVMH and Kering for Partnership in Fashion Industry Expansion

written by Chief editor of world-today-news.comToday (March 11, 2024) at 9:00 a.m. (Paris local time) at the Dior store, Avenue Montaigne branch, the location where the Christian Dior clothing house was founded in 2849 (1946), Mr. Bernard Arnault, Chairman and CEO of LVMH Group. who is an important person in the world in the fashion and luxury goods industry, met and discussed with Mr. Settha Thavisin, Prime Minister and Minister of Finance

The Prime Minister emphasized that Thailand is now open for investment. and moving forward to become a world-class industrial center Driving the economy towards higher growth and sustainability in key sectors. The government places importance on building global competitiveness, creating soft power and the creative economy. Thailand is proud of its long heritage of craftsmanship, such as Thai silk and jewelry that are famous all over the world for their uniqueness. and has complex techniques

The Prime Minister is confident that this unique craft and ancient local wisdom will be of mutual benefit to both sides. Therefore, I would like to invite the LVMH Group to join Thailand in using modern technology to strengthen techniques and develop Thai fabrics to better respond to the needs of the international market. Thailand is ready to welcome designers and creative teams from LVMH to discuss possible cooperation with relevant Thai agencies.

After that, at 10:00 a.m. (local Paris time) at the Chaillot room, 1st floor, PrincedeGalles Hotel, Mr. Jean-Marc Duplaix, Deputy CEO of Kering Company, a company operating in the business of fashion and luxury products. The 4th largest company in the world met with Mr. Settha Thavisin, Prime Minister and Minister of Finance. They discussed issues to expand cooperation.

The Prime Minister said The company is very popular in Thailand, such as Gucci and Bottega, which are considered to be the top sellers in Thailand. The Prime Minister said that next year there will be It’s a big year for Thai tourism. If the company considers opening additional branches It will be a huge opportunity for Thai customers and foreign tourists.

The company is pleased to acknowledge this. and said admiringly Thai customers are quality customers. And thank you for Thailand’s interest. The company is interested in collaborating with Thailand in increasing the quantity of products sold in Thailand and the Luxury Cruise business.

In addition, the Prime Minister said that the government aims to promote Thailand as a global industrial center. Driving the national economy towards higher growth and sustainability in various important sectors while strengthening competitiveness. Accelerating the creation of a creative economy. The Prime Minister invited Kering Company to cooperate with Thailand to open a Regional Office in Thailand. The Thai government will resolve trade barriers such as tax measures and pirated products. and facilitation of doing business (Ease of doing business)

2024-03-11 11:27:00

#Seththa #discusses #LVMH #group #Kering #attracting #Thai #investment #enhancing #soft #power