Mexico Metropolis. The depreciation of the change price is clearly defined by the overreaction of the markets earlier than the shocking victory of Morena within the configuration of Congress; Nevertheless, in a short while they are going to as soon as once more acknowledge the strengths of the peso, which have led it to understand in 2023 and at first of this yr, specialists agreed.

By collaborating within the “Evaluation and Views Spherical Desk: Elections 2024”, organized by the Institutional Inventory Change (BIVA), Alejandra Marcos, Director of Evaluation and Technique at Intercam, highlighted that the markets react in a short time and generally overly they react.

“As we speak what we’ve of uncertainty within the markets, particularly within the change price, has to do with initiatives that had been placed on the desk in February, not with the election of Claudia Sheinbaum as president. It could take weeks or months, however the market will have a tendency to acknowledge the worth of the peso. To the extent that the markets relax, we are going to return to see the basics of the Mexican foreign money,” she famous.

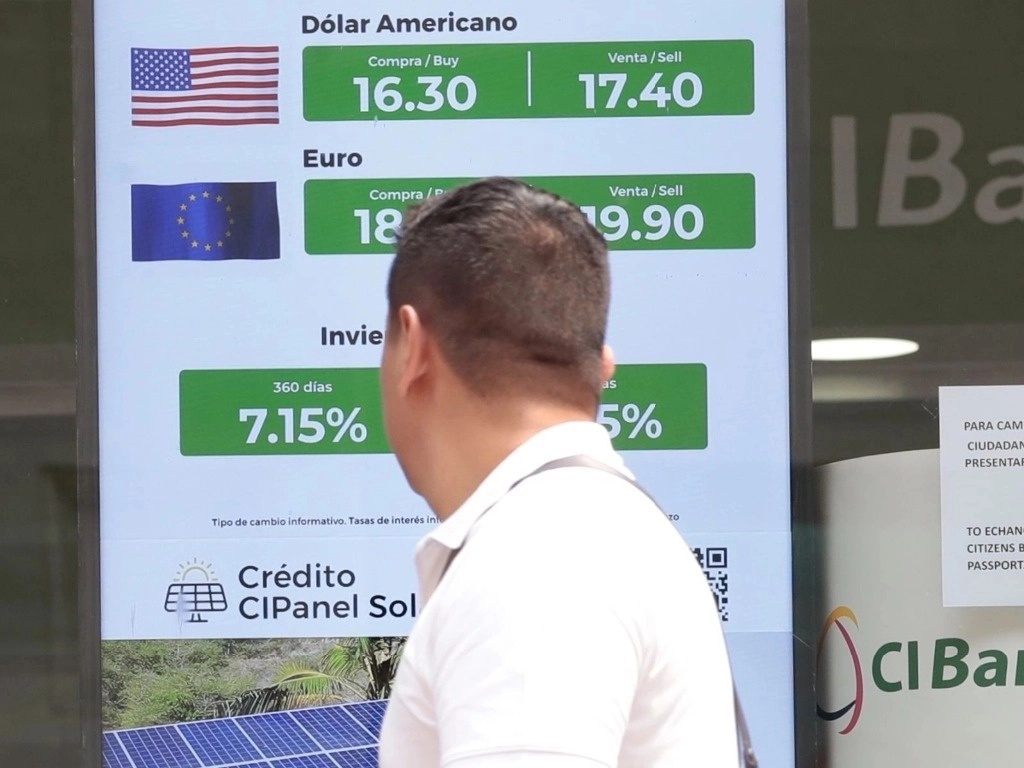

The feedback come after the Mexican foreign money depreciated greater than 4 % in opposition to the greenback on Monday on account of Morena’s victory in Congress, which was not foreseen by specialists.

For his half, Carlos Serrano, chief economist of BBVA Mexico, highlighted that the markets had absolutely discounted Sheimbaum’s broad victory within the presidential elections, which signifies that what’s producing nervousness within the markets is the victory in Congress. , particularly as a result of set of reforms proposed by President Andrés Manuel López Obrador final February.

“There are some that generate excessive nervousness, similar to the problem of the Court docket, the place it’s proposed that judges be elected by common election, which doesn’t occur in any nation on the planet besides in Bolivia. This generates concern as a result of buyers need an impartial Court docket to defend them if they’ve an issue with the State,” he famous.

María Ariza, normal director of BIVA, highlighted that the outcomes had been overwhelming, reflecting the belief she gave to Sheinbaum and Morena. She added that the corrections seen within the markets on Monday had been a product of the shocking configuration of Congress in favor of Morena; Nevertheless, this Tuesday some restoration started to be seen, with the inventory markets in optimistic territory and with the peso coming back from the extent above 18 pesos per greenback that it reached within the early morning.

#Market #acknowledge #strengths #peso #analysts

– 2024-06-13 10:37:02