“`html

Capital One Card-Linked Offers Debut: Maximize Rewards in 2025

Table of Contents

Capital One cardholders are seeing a new way to earn rewards: card-linked offers.These offers,located within the Capital One Offers section of your credit card login,provide opportunities to earn bonus miles or cash back when shopping at participating merchants. While the initial selection of offers is limited, this expansion into card-linked offers represents a perhaps valuable enhancement for Capital One cardholders.

Unlocking Capital One Card-Linked Offers

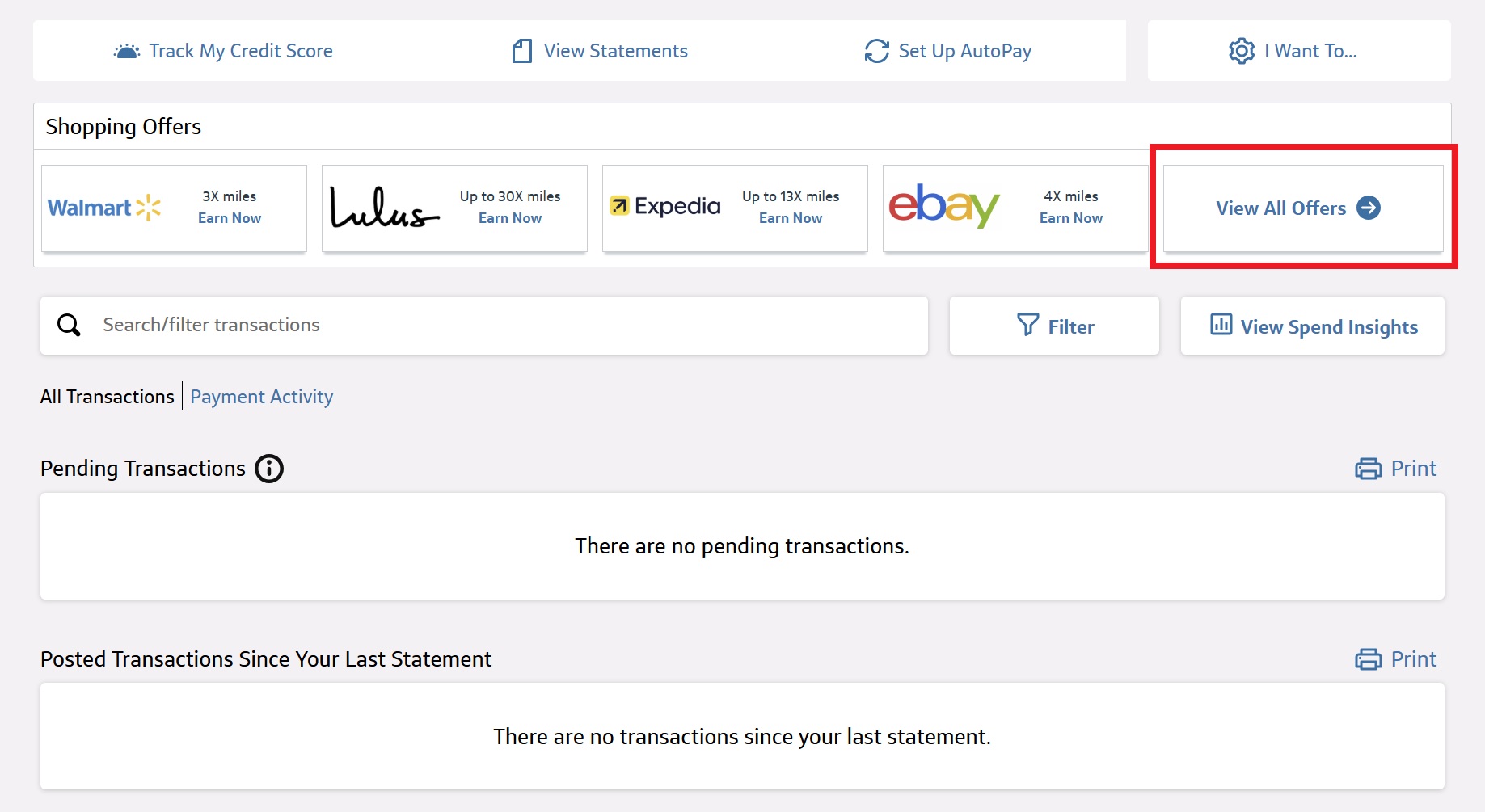

To access these offers, cardholders should log in to their Capital One credit card account and locate the “View All Offers” button, typically found just below the card balance. Once in the offers section, an “In-store” filter will display the available card-linked offers.

Did You Know? Capital One’s introduction of card-linked offers aligns with a broader trend in the credit card industry to provide more personalized and convenient rewards experiences. According to a 2024 study by McKinsey, personalized offers can increase cardholder engagement by up to 20%.

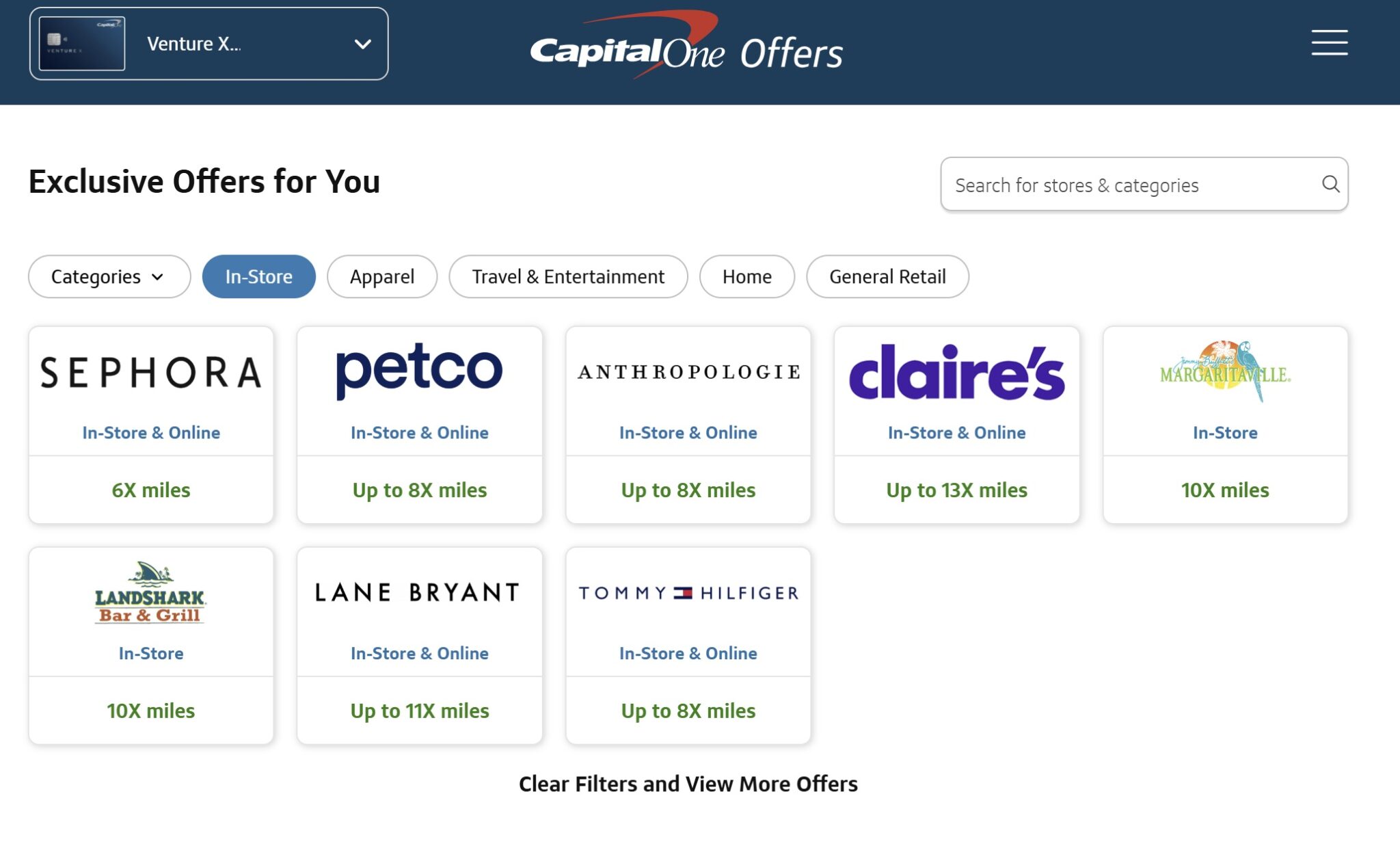

Limited Initial Offerings

Currently, the selection of card-linked offers is limited. Some cardholders report seeing similar offers across multiple cards in their household, with miles-earning cards offering between 6X and 13X miles, and cash back cards providing 6% to 13% back. As Capital One refines and expands this program, a wider variety of offers is expected.

Capital One provides several shopping-related platforms, each with its own features and benefits. Understanding the differences between these platforms can help cardholders maximize their rewards:

- Capital One Shopping: A public shopping portal open to everyone, regardless of Capital One card ownership. Rewards are redeemable for gift cards.

- Capital One Travel offers: Exclusive offers found when logging in to Capital One Travel with an eligible Capital One credit card.

- Capital One offers: Located within the Capital One credit card login, this section includes both traditional shopping portal offers (requiring click-throughs) and the newly introduced card-linked offers.

Pro Tip: Regularly check the Capital One Offers section for new card-linked deals. Since the program is new, offers may change frequently as Capital One tests and refines its offerings.

the Future of Capital One Card-Linked Offers

While the initial rollout of Capital One card-linked offers is modest, it signals a commitment to providing more value and convenience to cardholders. As the program matures,expect to see a greater variety of offers,potentially tailored to individual spending habits and preferences.

| Platform | Eligibility | Rewards | Access |

|---|---|---|---|

| Capital One Shopping | Open to all | Gift Cards | Public Portal |

| Capital One Travel Offers | Capital One Cardholders | Varies (Travel-Related) | Capital One Travel Login |

| Capital One Offers | Capital One Cardholders | Miles or Cash Back | Capital One Credit Card Login |

| Feature | Savor Student Cash Rewards | Quicksilver Student cash Rewards |

|---|---|---|

| Sign-Up Bonus | $100 after spending $300 in the first 3 months | $100 after spending $300 in the first 3 months |

| Dining & Entertainment | 3% Cash Back | 1.5% Cash Back |

| All Other Purchases | 1% Cash Back | 1.5% Cash Back |

| Annual Fee | $0 | $0 |

| Foreign Transaction Fee | None | None |

To qualify for a student credit card,applicants must be at least 18 years old and enrolled in an accredited university,community college,or other higher education institution. Individuals admitted and planning to enroll within the next three months may also be eligible.

Understanding Student Credit Cards

Student credit cards are designed as an entry point into the world of credit for young adults. They typically have lower credit limits and more lenient approval criteria compared to conventional credit cards. This allows students to build a credit history while managing their spending. According to the Consumer Financial Protection Bureau (CFPB), responsible credit card use can significantly impact a student’s future financial opportunities, including loan approvals and interest rates.

The history of student credit cards dates back to the 1990s when financial institutions began targeting college campuses as a prime market.Over the years, regulations have been put in place to protect students from predatory lending practices, such as the Credit Card Accountability Responsibility and Disclosure (CARD) Act of 2009, which requires applicants under 21 to demonstrate an independent ability to repay or have a co-signer.

Frequently Asked Questions

What credit score is needed for a Capital One student card?

Capital One student cards are designed for students with limited or no credit history, so a high credit score is not typically required.Though, having a fair credit score can improve your chances of approval.

Can I upgrade my Capital one student card after graduation?

yes, Capital One allows students to continue using their student credit cards after graduation. You may also be eligible to upgrade to a different Capital One card with better rewards or benefits based on your creditworthiness.

How does Capital One protect against fraud?

Capital One offers $0 fraud liability, meaning you won’t be responsible for unauthorized charges.They also provide account alerts and a card lock feature to help you monitor and secure your account.

What happens if I miss a payment on my Capital One student card?

Missing a payment can result in late fees and perhaps damage your credit score. It’s meaningful to make at least the minimum payment by the due date each month to avoid these consequences.

Are there any spending limits on the Capital One student credit cards?

Yes, Capital One student credit cards typically have lower credit limits compared to traditional credit cards. These limits are designed to help students manage their spending and avoid accumulating excessive debt.

Disclaimer: This article provides general information about credit cards and is not financial advice.Consult with a financial advisor for personalized recommendations.

Ready to start building your credit and earning rewards? Which Capital One student credit card aligns best with your spending habits? Share your thoughts in the comments below!