Transition to Digital Payments Raises Concerns for Vulnerable Americans

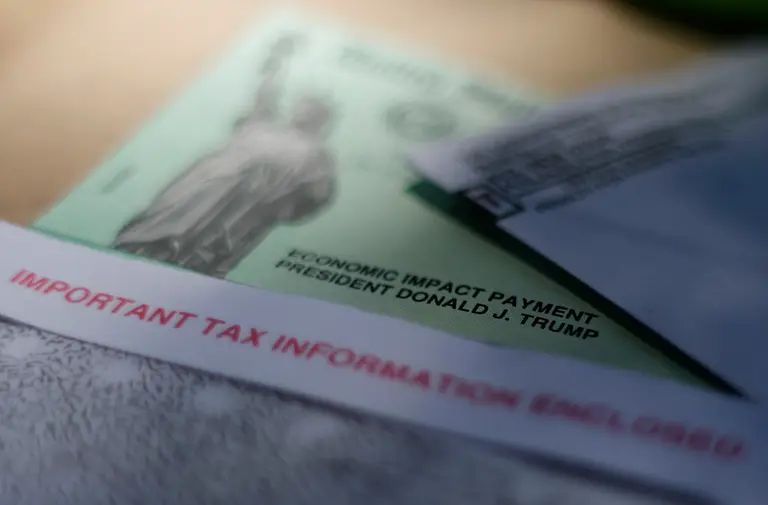

The U.S. government, under a directive from President Trump issued in March, is phasing out paper checks for most federal payments, including Social Security benefits, Supplemental Security Income (SSI), and tax refunds. While the move aims for efficiency, advocates worry it will disproportionately harm vulnerable Americans who lack access to, or familiarity with, digital payment methods.

Currently, around 400,000 Social Security and SSI beneficiaries - less than 1% of the 70.6 million recipients – receive benefits via paper check. The government intends to transition these individuals to direct deposit or the Direct Express debit card, designed for those without bank accounts. The Social Security Administration (SSA) states it will continue issuing paper checks as a last resort for those with no other options.

However, concerns remain about the transition process. Jennifer Burdick, a lawyer with the SSI Community Services unit in Philadelphia, notes that many clients learn about the change only through her, and often after moving and missing important notifications. She fears new beneficiaries needing a paper check to open a bank account will face significant hurdles.

Experts highlight that those most affected are often the most vulnerable: individuals without bank accounts, stable housing, or the digital literacy needed to navigate online systems. Kathleen Romig, Director of Social security and Disability Policy at the Centre on Budget and Policy Priorities, explains that some distrust financial institutions due to mental health challenges, while others simply lack the funds to open an account.

“This is a population that cannot afford to lose payment, so it is very important that the administration manages the transition without interrupting benefits,” Romig stated.

Nancy Altman, president of Social Security Works, argues the elimination of paper checks is unneeded and could be devastating for those unaware of the change or with limited income. She believes everyone should have the option to receive a paper check, even though the number of recipients is small. A poorly managed transition, she warns, “will be devastating.”