Seniors to Get Major Tax Relief Under New Bill

A groundbreaking bill promises significant tax savings for numerous American seniors, potentially transforming their financial well-being. This initiative, championed by the current administration, aims to provide substantial relief to those who have diligently contributed to Social Security over their working lives.

Tax-Free Social Security Benefits

The “One Big Beautiful Bill” assures that a vast majority of Social Security recipients will no longer pay taxes on their benefits. An analysis from the Council of Economic Advisers indicates that 88% of all seniors currently receiving Social Security will experience this welcome tax exemption.

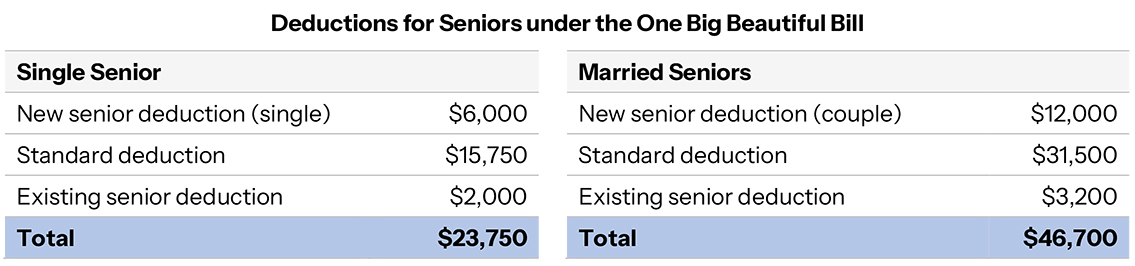

The initiative guarantees that single taxpayers receiving approximately $24,000 annually, the current average retirement benefit, will have deductions surpassing their taxable Social Security income. Married couples, each earning the average $24,000, totaling $48,000, will also see deductions exceeding their taxable income.

The Tax Policy Center indicates that in 2023, roughly 41% of senior households paid no federal income tax. This legislation is projected to further increase that percentage. The bill marks the largest tax reduction in history for older Americans, letting them retain more of their hard-earned funds.

The Promise Fulfilled

The administration framed this as delivering on prior promises. The bill’s provisions enable seniors to preserve more of their money, providing them with greater financial security during their retirement years. It represents a crucial step in supporting the financial stability of the nation’s aging population.