Bitcoin Price Prediction: Could BTC Hit $5.2 Trillion by 2030?

Table of Contents

- Bitcoin Price Prediction: Could BTC Hit $5.2 Trillion by 2030?

Coatue Management, a hedge fund known for its focus on technology, healthcare, and cryptocurrency trends, projects a bullish future for Bitcoin. The firm forecasts that the cryptocurrency could reach a market capitalization of $5.2 trillion by 2030, potentially becoming one of the world’s most valuable assets. This projection, revealed at coatue’s annual east Meets West conference, suggests a notable upside from Bitcoin’s current market value.

Coatue’s bullish Bitcoin Forecast

Coatue Management’s prediction implies a ample increase in Bitcoin’s value over the next five years. If accurate, Bitcoin would rank among the top three most valuable assets globally, rivaling tech giants like microsoft and Nvidia, and surpassing companies such as Amazon, meta Platforms, and Tesla. This forecast hinges on several factors that could propel Bitcoin to new heights.

Did You No? As of June 2024, Bitcoin’s energy consumption is estimated to be around 91 terawatt-hours per year, comparable to the energy usage of countries like Finland. Source: Statista

Factors driving Bitcoin’s Potential Growth

Several elements contribute to the potential for Bitcoin’s growth and mainstream adoption:

- fixed Supply: Bitcoin’s limited supply of 21 million coins creates a perception of scarcity, potentially driving up its value as demand increases.

- Growing Acceptance: More companies and institutions are begining to accept Bitcoin as a form of payment or investment, increasing its legitimacy and usability.

- Hedge Against Economic uncertainty: Some investors view Bitcoin as a safe haven asset during times of economic instability, similar to gold.

Investing in Bitcoin: Direct and Indirect Methods

Investors have multiple avenues for investing in Bitcoin, depending on their risk tolerance and investment preferences.

- Spot bitcoin ETFs: Exchange-Traded Funds (ETFs) that directly hold Bitcoin, such as iShares Bitcoin Trust, provide exposure to Bitcoin’s price movements without requiring direct ownership of the cryptocurrency.

- Cryptocurrency Exchanges: Platforms like Coinbase allow users to buy, sell, and store Bitcoin and other cryptocurrencies.

- Trading Applications: Apps like Robinhood offer access to bitcoin trading alongside traditional stocks and options.

Pro Tip: Diversifying your cryptocurrency investments can definitely help mitigate risk. Consider allocating a portion of your portfolio to other promising digital assets.

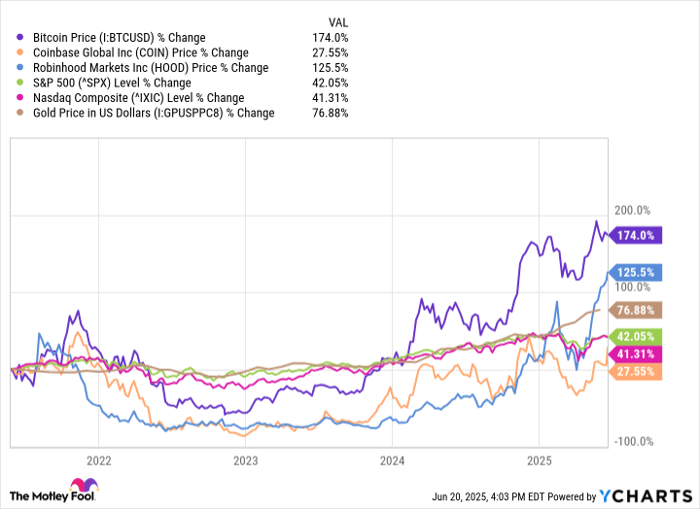

Bitcoin’s performance Compared to Traditional Assets

Over the past year, Bitcoin has demonstrated strong performance compared to traditional assets. However, it is essential to consider the volatility associated with cryptocurrency investments.

| Asset | 1-Year Return (as of June 2024) |

|---|---|

| Bitcoin | ~130% |

| S&P 500 | ~25% |

| Nasdaq Composite | ~35% |

| gold | ~15% |

Data from Yahoo Finance indicates that Bitcoin has significantly outperformed major market indexes and gold over the last year.Source: Yahoo Finance

Given these dynamics, incorporating Bitcoin into a diversified portfolio could be beneficial. However, it’s crucial to recognise that Bitcoin and the broader cryptocurrency market are still evolving and may not yet be superior to traditional investment options.

Bitcoin: A Brief History and Context

Bitcoin, created in 2009 by an anonymous entity known as Satoshi Nakamoto, was the first decentralized cryptocurrency. It operates on a blockchain, a public ledger that records all transactions. Bitcoin’s value has fluctuated significantly as its inception, experiencing periods of rapid growth and sharp declines. Its increasing adoption by institutional investors and corporations has contributed to its growing legitimacy as an asset class.

Frequently Asked Questions About Bitcoin

What is Bitcoin mining?

Bitcoin mining is the process of verifying and adding new transactions to the blockchain. Miners use powerful computers to solve complex mathematical problems, and in return, thay receive newly minted Bitcoins.

how secure is Bitcoin?

Bitcoin’s blockchain technology is highly secure due to its decentralized nature and cryptographic protocols. However, individual Bitcoin wallets and exchanges can be vulnerable to hacking and theft.

What are the risks of investing in Bitcoin?

The risks of investing in Bitcoin include price volatility, regulatory uncertainty, and the potential for loss due to hacking or fraud. It’s essential to conduct thorough research and understand the risks before investing.

What are your thoughts on coatue’s Bitcoin price prediction? how do you see Bitcoin evolving over the next decade?

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Share this article and join the discussion! Subscribe to our newsletter for more insights on cryptocurrency and financial trends.