|

7789.5 |

1606.1 |

The assessed value of the referenced property was steadfast utilizing an exchange rate of $10.27 per norwegian Krone, current as of August 4, 2025.

|

7789.5 |

1606.1 |

The assessed value of the referenced property was steadfast utilizing an exchange rate of $10.27 per norwegian Krone, current as of August 4, 2025.

Saudi Arabian healthcare provider, reportedly experiencing robust growth across multiple departments, anticipates positive results for the third quarter of 2025.

During a recent meeting with analysts and investors, company executive Al-Mousa detailed broad-based growth encompassing surgery, primary care, rehabilitation, hematology, oncology, neuroscience, and orthopedics. This diversification is credited with bolstering overall company performance. Specifically, July – the initial month of the third quarter – saw particularly strong gains in the rehabilitation sector, alongside increased utilization of surgical services and a rise in patient volume, defying typical seasonal dips associated with summer vacations.

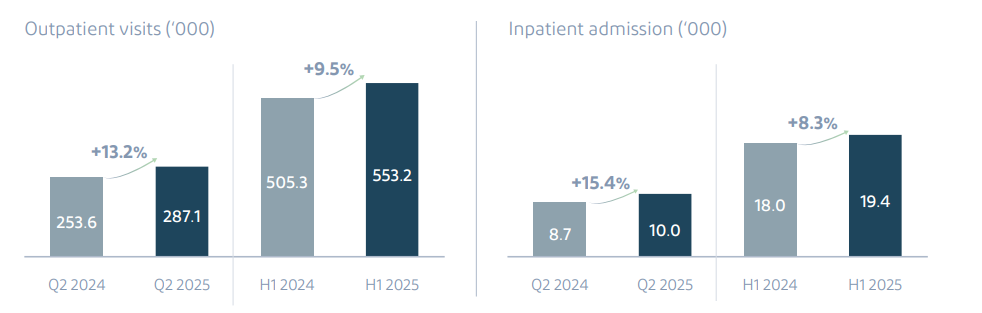

Financial data presented indicated a 15.4% increase in inpatient numbers, reaching 10,000 patients, during the second quarter of 2025. Outpatient clinic visits rose by 13.2% to 287,100 during the same period.

The company is actively pursuing expansion initiatives. The 6,100 square meter “Palm Medical Center” opened in Al-ahsa in July 2025, housing 37 clinics. Construction is nearing completion on additional facilities: the “Aziziyah Medical Center” in Al-Khobar and the “Salmaniya Medical Center,” also located in Al-Ahsa. These expansions represent a significant investment in healthcare infrastructure within the Eastern Province of Saudi Arabia.

“`html

Washington D.C. – New data released today indicates a notable shift in consumer confidence regarding future economic conditions. A recent survey reveals that 26.74% of respondents anticipate improved financial prospects by January 2025,a decrease of 24% from previous projections.

The findings, compiled from a national sample of over 1,200 adults between November 15th and November 22nd, 2024, by the Institute for Economic Forecasting in collaboration with the National Bureau of Economic Research, highlight growing anxieties surrounding inflation, interest rates, and potential employment fluctuations. The survey specifically focused on household expectations for income, business conditions, and buying conditions over the next 12 months.

Prior forecasts, conducted in July 2024, showed a more optimistic outlook, with 35.18% of consumers predicting a positive economic trajectory.This represents a considerable correction in sentiment, attributed by analysts to recent reports of slowing GDP growth and persistent inflationary pressures in key sectors like housing and energy. Dr. Eleanor Vance,lead economist at the Institute for Economic Forecasting,noted that the decline is notably pronounced among households earning less than $50,000 annually.

The survey also examined regional variations. States in the Southeast and Midwest exhibited the most significant drops in optimism, while the Northeast and Pacific Coast regions showed comparatively more resilience. specifically,Mississippi experienced a 31% decrease in positive projections,while california saw a decline of only 18%.

Looking ahead, economists are closely monitoring key indicators such as the Consumer Price Index (CPI) and the Personal consumption Expenditures (PCE) price index to assess the validity of these shifting expectations. The Federal Reserve is scheduled to meet on December 12-13, 2024, where these survey results will likely be a key consideration in determining future monetary policy decisions. Further analysis of the data is expected to be published in the January 2025 edition of the Journal of Economic Perspectives.

|

35.18 |

(31 %) |

< Determine the price range for the launch of the marketing house group in Tassi between 80 and 85 riyals per share

written by Priya Shah – Business Editor

Marketing House Group Sets Share Price Range for IPOCompany targets between 80 and 85 riyals per share for TASI listingThe Financial Development Company has announced the price range for the upcoming initial public offering of Trade Marketing House Group. This move initiates the crucial book-building phase for institutional investors. IPO Details EmergeThe offering aims to price shares between 80 and 85 Saudi riyals each. The book-building period for participating entities commences on Sunday and will conclude on Thursday, August 7, 2025. This establishes the valuation for the company’s debut on the Saudi stock exchange, Tadawul. Trade Marketing House Group is offering 4.8 million ordinary shares, representing 30% of its total issued capital. These shares are being sold by existing shareholders as part of the company’s transition to public ownership. Market ContextThe Saudi IPO market has seen significant activity, with several companies successfully listing in recent years. For instance, oil giant Saudi Aramco’s 2019 IPO raised approximately $29.4 billion, becoming the world’s largest ever. This indicates strong investor appetite for Saudi companies. More details and subscription information are available for interested parties. The start of the participation in the August version of a right product .. and the return of the return by 4.97%

written by Chief editor of world-today-news.com

Zakat on Savings: Understanding the Nuances for SaversBy [Author Name] | [Date] For individuals who diligently save their earnings, understanding the implications of Zakat on their accumulated wealth is crucial. The application of Zakat, a pillar of Islam requiring the charitable giving of a portion of oneS wealth, can be a complex topic, especially concerning savings that generate returns. A key consideration for savers is how Zakat interacts with the growth of their savings.While the principal amount of savings is generally subject too Zakat if it meets the nisab (minimum threshold) and hawl (one lunar year) requirements, the treatment of the returns generated by these savings can vary. Some interpretations suggest that the product of Zakat, meaning the returns or interest earned on savings, may not be directly payable as Zakat. This distinction is critically important for savers aiming to fulfill their Zakat obligations accurately. The market conditions from month to month can also influence the overall value of savings and, consequently, the calculation of Zakat. Fluctuations in economic environments can impact the growth or decline of invested savings, necessitating a careful review of wealth at the time Zakat is due. Furthermore, the question of whether the product of Zakat is “tolerated” by savers often arises. This can be interpreted in various ways, but from a jurisprudential standpoint, the focus is on the correct distribution and calculation of Zakat.If savings generate returns, the permissibility and method of including these returns in the Zakat calculation are subjects of scholarly discussion. Some scholars hold the view that the product of savings, particularly if derived from interest-based instruments, may not be considered pure wealth eligible for Zakat distribution in the same manner as the principal savings.Rather, such returns might be directed towards charitable causes separate from the obligatory Zakat distribution, or handled according to specific scholarly opinions. For savers, staying informed about these details and consulting with educated Islamic scholars or financial advisors specializing in Zakat is recommended to ensure compliance and a clear understanding of their religious obligations.

|