featured

Russian Aerospace Forces Lieutenant Alexander Grushanin Freed Along with Tu-22M3 Aircraft: Crew Member Identified and Funeral Held

Commander of the Russian Aerospace Forces Alexander Grushanin was freed along with the Tu-22M3 aircraft. The identity of one of the crew members of the Tu-22M3 long-range bomber, which was shot down last week by …

Russian Aerospace Forces Lieutenant Alexander Grushanin Freed Along with Tu-22M3 Aircraft: Crew Member Identified and Funeral Held

Commander of the Russian Aerospace Forces Alexander Grushanin was freed along with the Tu-22M3 aircraft. The identity of … Read more

UK Parliament Approves Controversial Law Allowing Asylum Seekers to be Deported to Rwanda

AFPMigrants arrive at the port of Dover NOS news•today, 6:07 p.m After years of political and legal wrangling, … Read more

Measles Epidemic Surges in Covasna County Despite Vaccination Efforts – Over 400 Cases Recorded in Children

The measles epidemic gained momentum this year in the county of Covasna, despite the vaccination recovery activities that … Read more

Thiago Silva to Join Fluminense from Chelsea: Latest Updates and Details

Thiago Silva knows exactly which club he will switch to Chelsea Tuesday, 23 April 2024 at 19:28 Thiago … Read more

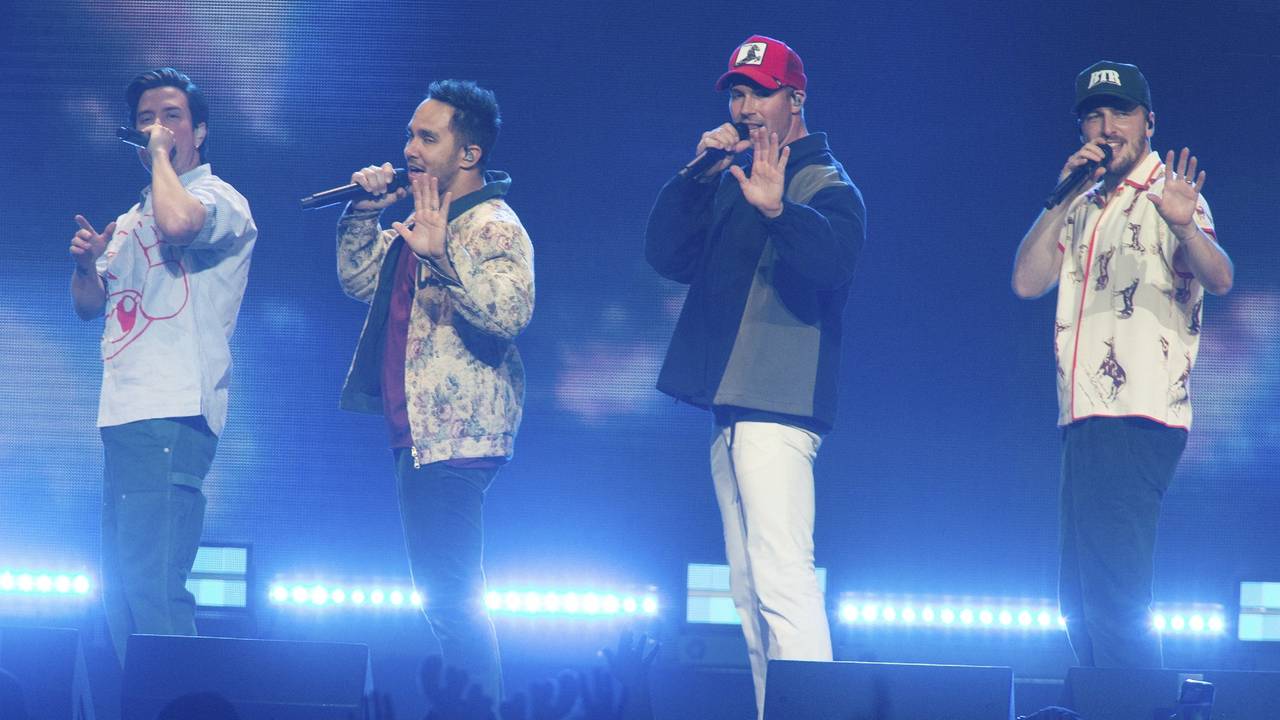

Big Time Rush concert in Tilburg moved to Ziggo Dome in Amsterdam due to overwhelming demand

The performance of the band Big Time Rush in the pop center 013 in Tilburg has raised so … Read more

:max_bytes(150000):strip_icc()/Rebel-Wilson-042324-576cd738f9f649b7bfbcacde62460711.jpg?fit=%2C&ssl=1)