featured

«Нас ждет тяжелый период, но Украина не проиграет». Интервью главы ГУР Кирилла Буданова Би-би-си

О статье Автор, Оксана Тороп Должность, Украинская служба Би-би-си 22 апреля 2024 Кирилл Буданов — самый публичный руководитель военной разведки не только в истории Украины, но и в масштабах всего мира. Он регулярно дает интервью …

«Нас ждет тяжелый период, но Украина не проиграет». Интервью главы ГУР Кирилла Буданова Би-би-си

О статье Автор, Оксана Тороп Должность, Украинская служба Би-би-си 22 апреля 2024 Кирилл Буданов — самый публичный руководитель … Read more

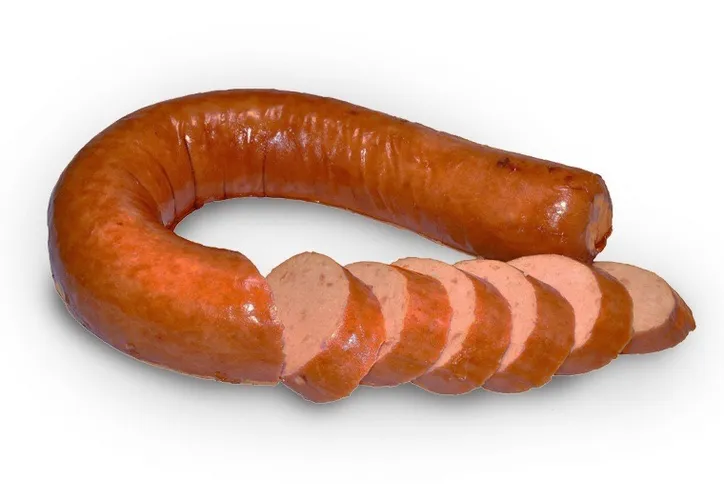

How unhealthy is smoked sausage

The smoked sausage is under fire. Because although the name suggests otherwise, these sausages have not been smoked … Read more

After Inter and Bayer: Tracking the remaining championship races

Inter today (Monday) completed a tremendous win in the Scudetto and thus it was decided – out of … Read more

Sara Benfares banned for five years – blamed on cancer

Published 2024-04-22 17.09 share-arrowDela unsaveSpara Sara Benfares, 22, ended up in a storm after a positive doping test. … Read more

The US restricts trips of its employees to Chiapas due to insecurity

Mexico City. Due to increased violence and security concerns in Chiapas, the United States government this Friday restricted … Read more