featured

Breakage of a pipe in the Escobar District

April 21, 2024 During the day, AySA detected the breakage of a 355 mm water distribution pipe on Saavedra Street at the intersection of Gelves and Gral. Paz, in the town of Belén de Escobar. …

Breakage of a pipe in the Escobar District

April 21, 2024 During the day, AySA detected the breakage of a 355 mm water distribution pipe on … Read more

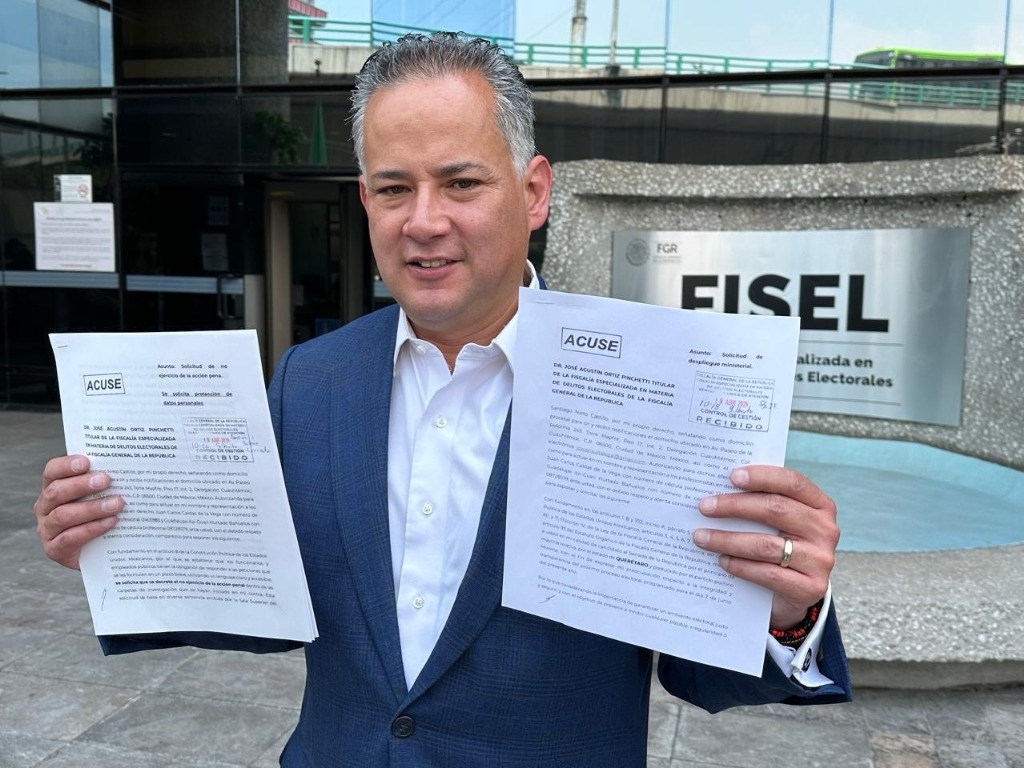

Santiago Nieto asks Fisel to guarantee a safe electoral environment in Querétaro

Santiago Nieto Castillo, candidate for the Senate of the Republic for the state of Querétaro, as Morena’s standard … Read more

Around 4,500 million pesos will go from Infonavit to the pension fund

Around 4.5 billion pesos, belonging to 2.2 million inactive accounts, will go from the Institute of the National … Read more

IS attack on military bus leaves 20 Syrian soldiers dead

Beirut. The Islamic State (IS) group killed 20 Syrian soldiers and fighters from pro-government forces in two attacks … Read more

Macron promises a “clean” Seine ahead of the Olympic Games

Champigny-sur-Marne. French President Emmanuel Macron promised this Tuesday that the water of the Seine River will be “clean” … Read more

/cdn.vox-cdn.com/uploads/chorus_asset/file/24401977/STK071_ACastro_apple_0001.jpg?fit=%2C&ssl=1)