featured

The perception of insecurity rose in March, reports Inegi

Mexico City. After having reached its lowest level in December since the National Urban Public Safety Survey (ENSU) was carried out in more than a decade, the perception of insecurity of the population aged 18 …

The perception of insecurity rose in March, reports Inegi

Mexico City. After having reached its lowest level in December since the National Urban Public Safety Survey (ENSU) … Read more

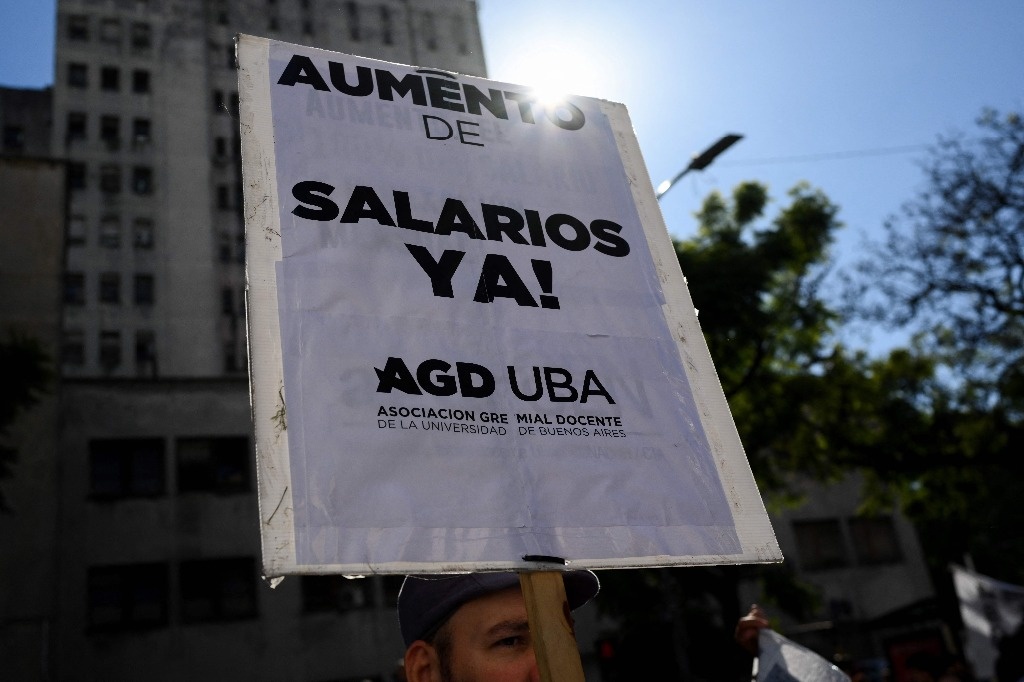

By show of hands and without debate, Argentine senators raise their salaries

Buenos Aires. The Argentine Senate approved this Thursday by show of hands and without prior discussion a resolution … Read more

Cruz Azul draws 2-2 with Atlas and remains in direct classification

Mexico City. Cruz Azul suffered too much, but managed to rescue a valuable 2-2 draw against Atlas to … Read more

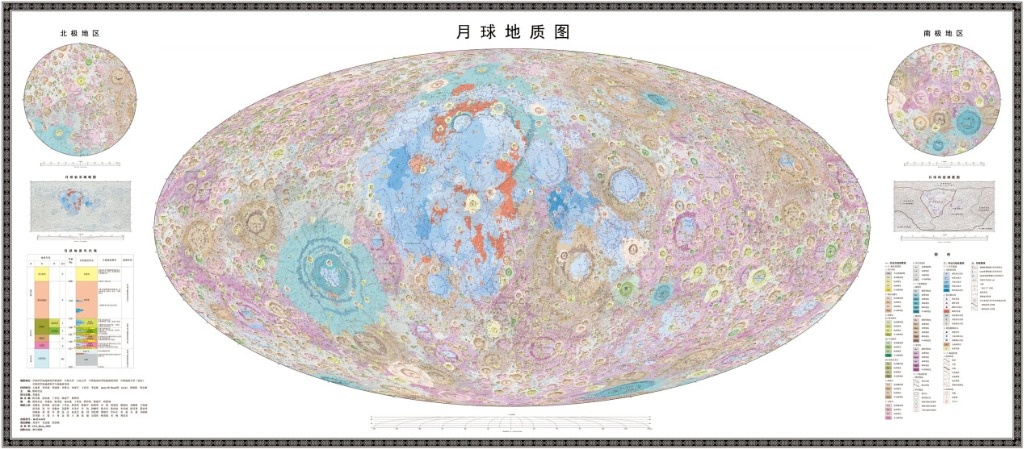

China published the atlas of the Moon with the highest precision and high definition in the world

Beijing. China published the world’s first set of maps of the Moon’s surface with the highest precision and … Read more

Food sovereignty and climate crisis, SIAM in the eye of the storm

Photo credits: Ahmed Boussarhane/LNT SIAM is above all a professional exhibition. This implies that for the many exhibitors, … Read more