Housing Market Shows Mixed Signals in May

New Zealand’s housing market displayed a blend of positive and negative trends during May. Sales saw an uptick compared to the previous month, yet prices experienced a downturn. This indicates a complex environment for both buyers and sellers.

Sales Volume Increases, Prices Dip

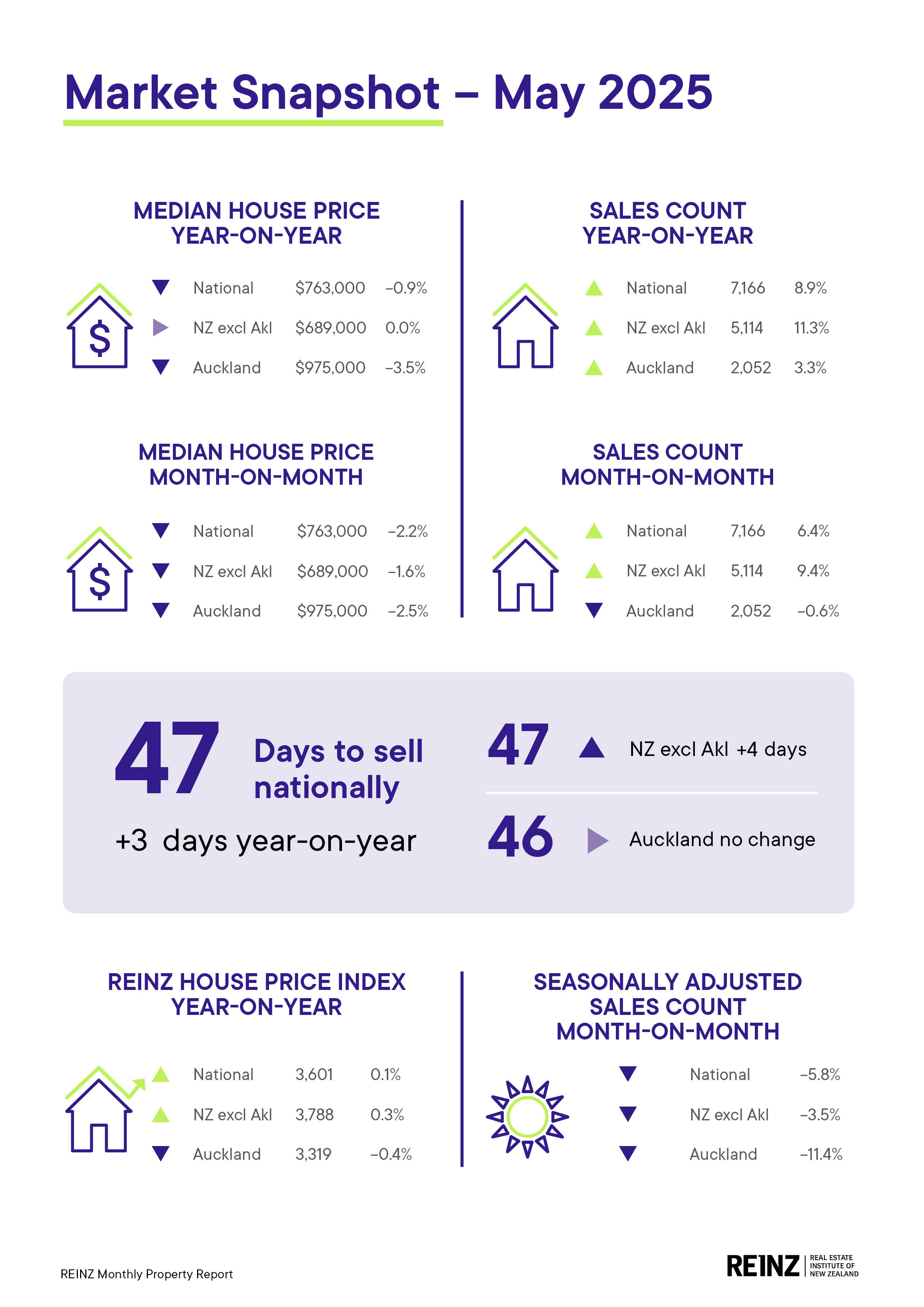

In May, the Real Estate Institute of NZ (REINZ) recorded a total of 7,166 sales nationwide. This figure represents a 6.4% increase from April and an 8.9% rise compared to May of the previous year. However, sales in Auckland remained sluggish, with just 2,052 residential properties sold, marking a 0.6% decrease from April.

The national median selling price stood at $763,000. This reflects a 2.2% decrease from April and a 0.9% drop compared to May of last year. The REINZ House Price Index (HPI), which accounts for variations in property types sold each month, decreased nationally by 0.6% compared to April but rose 0.1% year-over-year.

Regional Performance Variances

Across the country, eight of the REINZ’s 12 sales regions registered HPI declines in May versus April. Three regions saw increases, while one remained unchanged. The median time to sell a property also lengthened, rising to 47 days, up from 44 days in May last year.

“The increase in the median days to sell reflects a market that, while more active in terms of transactions, is also characterised by greater buyer caution,”

—REINZ, May Report

According to a recent report from CoreLogic, nationwide property values fell 0.8% in May, adding to the sense of market cooling (CoreLogic May Report 2024).

Market Dynamics and Buyer Behavior

The REINZ report suggests that buyers are taking more time to commit to purchases, potentially due to reduced urgency. This allows buyers to find properties that best meet their needs. Local agents have also noted this trend.

The mixed signals in the housing market suggest continued uncertainty. Buyers and sellers should carefully consider these trends when making decisions. The coming months will reveal whether the balance tips towards further price declines or a more robust recovery.