featured

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/MVIDVOMG55CYBA7HXRCNVDZMYU)

Bayern Munich beat Arsenal 1-0 and advanced to the Champions League semi-finals

Bayern Munich beat Arsenal 1-0 at the Allianz Arena and, after drawing 2-2 in London, qualified for the semi-finals of the Champions League, where they will face Real Madrid. On the other side of the …

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/MVIDVOMG55CYBA7HXRCNVDZMYU)

Bayern Munich beat Arsenal 1-0 and advanced to the Champions League semi-finals

Bayern Munich beat Arsenal 1-0 at the Allianz Arena and, after drawing 2-2 in London, qualified for the … Read more

Tess Medina wins Sweden’s master chef 2024

After the shiver: She will do that for the prize money Published 2024-04-17 20.55 share-arrowDela unsaveSpara It was … Read more

Chernihiv What are the consequences of shelling rockets and what the locals say

Photo copyright: Reuters Photo caption, Consequences of the morning shelling of Chernihiv with rockets Article information Author, Olena … Read more

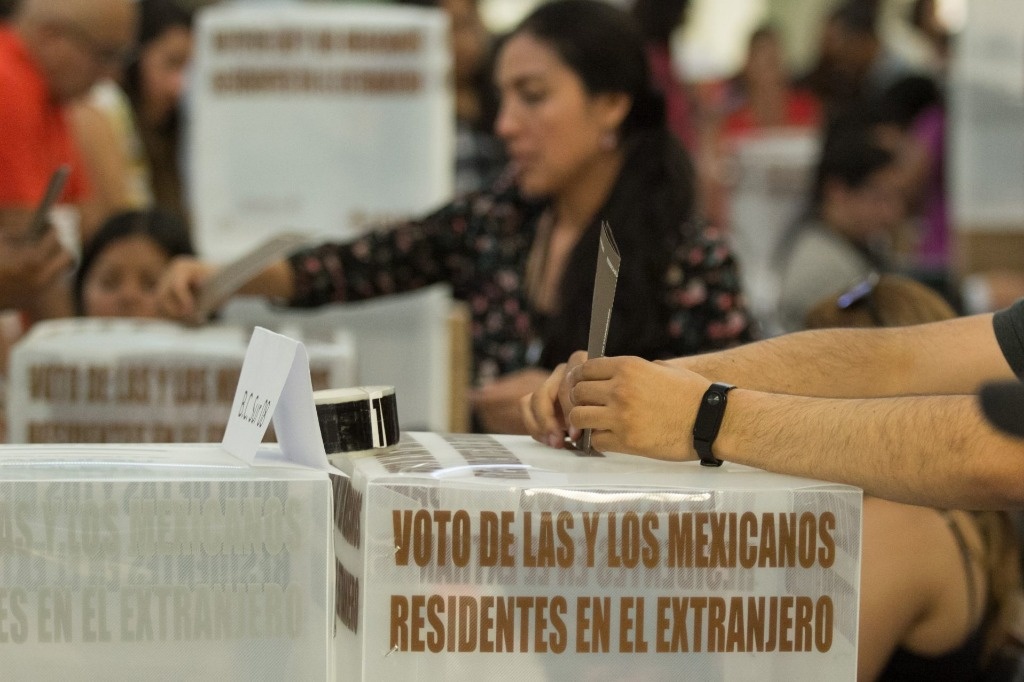

They will seek to facilitate the voting of Mexicans abroad: AMLO

The federal government will intervene to find a way to facilitate the voting of Mexicans living abroad, through … Read more

Founder of cryptocurrency platform FTX appeals sentence for fraud

NY. Disgraced cryptocurrency superstar Sam Bankman-Fried has appealed his 25-year prison sentence for fraud, according to a court … Read more