Jakarta, CBNC Indonesia – The rupiah exchange rate strengthened sharply against the United States (US) dollar in early trading Thursday (10/3) continuing the strengthening of the last two days. The slump in crude oil prices made the sentiment of market players improve and became the energy for the rupiah to strengthen.

As soon as trading was opened, the rupiah immediately strengthened 0.45% to Rp. 14,280/US$, according to Refinitiv data. The rupiah’s appreciation then increased to 0.73% to Rp 14,240/US$, which was the strongest level since January 3.

The rupiah’s appreciation then eased to Rp 14,300/US$, strengthening 0.31% at 9:08 WIB.

Signs of the rupiah going down to Rp. 14,300/US$ were already visible before the opening of the trade. Exchange rate non-deliverable forward (NDF) 1 week and 1 month were already below that level, which made the rupiah immediately shoot up as soon as trading opened.

| Period of time | Wednesday (9/3) exchange rate at 15:03 WIB | Thursday (10/3) rate at 8:54 WIB |

| 1 week | Rp14.322,5 | Rp14.278,0 |

| 1 month | Rp14.349,0 | Rp14.281,0 |

| 2 months | Rp14.366,5 | Rp14.302,0 |

| 3 months | Rp14.392,6 | Rp14.330,0 |

| 6 months | Rp14.516,0 | Rp14.411,0 |

| 9 months | Rp14.596,0 | Rp14.516,0 |

| 1 year | Rp14.703,3 | Rp14.685,0 |

| 2 years | Rp15.222,5 | Rp15.154,0 |

Sentiment against the rupiah is actually quite good thanks to improving domestic fundamentals. However, the war between Russia and Ukraine which has a wide impact on the global economy has depressed the rupiah recently.

The war triggered an increase in the price of crude oil and other energy commodities, thereby triggering concerns over higher inflation in Western countries. This risks suppressing economic growth.

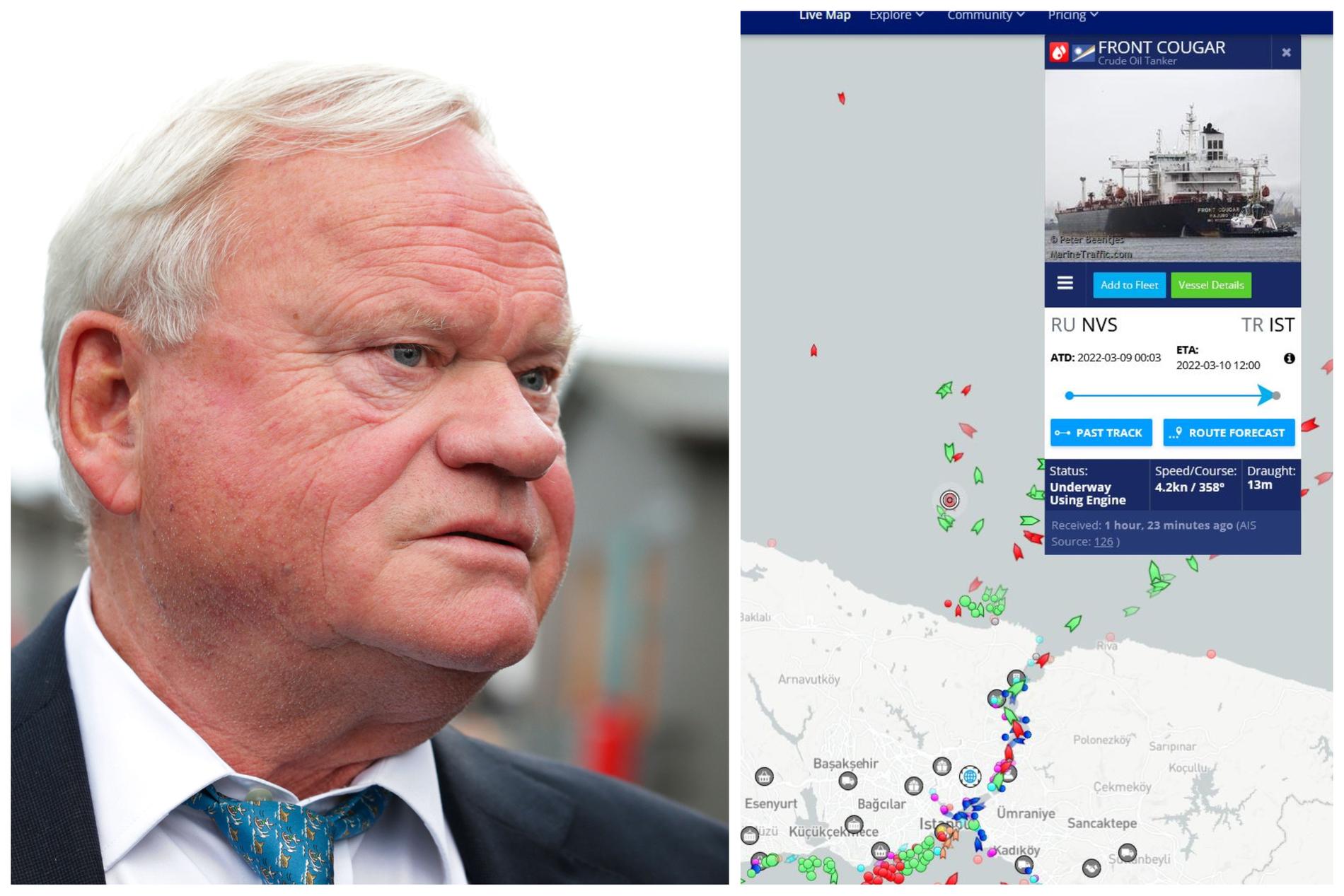

However, yesterday the price of crude oil collapsed which made the sentiment of market participants improve.

The United Arab Emirates and Iraq said they would support an increase in OPEC crude production to offset supply disruptions from Russia. This made the price of crude oil immediately plummeted, Brent oil even had minus 17%.

“We propose an increase in (oil) production and encourage OPEC countries to do so,” the United Arab Emirates’ Ambassador to the United States Yousuf Al Qtaiba said in a tweet.

In addition, as previously mentioned, sentiment towards the rupiah is quite good. This can be seen from the 2-week survey conducted Reuters.

The survey uses a scale of -3 to 3, a negative number means market participants are taking long positions (long) Asian currencies and sell (short) US dollars. The closer to -3 means position long which is taken getting bigger.

While a positive number means short Asian currency and long US dollar, and the closer to 3, the bigger the position short Asian currency.

The latest survey released Thursday (24/2/2021) showed the figure for the rupiah at -0.01, a reversal from the previous 0.46.

This is the first time market participants have taken a position long rupiah since mid-November last year.

Position long The increasing trend means that market participants are increasingly optimistic that the rupiah will strengthen in the future.

The survey results also show that the Thai bath leads the position long, followed by the Chinese yuan. Both currencies have also successfully strengthened against the US dollar so far this year.

CNBC INDONESIA RESEARCH TEAM

(pap/pap)

–