featured

There is a lynching campaign against Zaldívar, maintains AMLO

President Andrés Manuel López Obrador maintained that there is a lynching campaign against the former minister-president of the Supreme Court of Justice of the Nation, Arturo Zaldívar, based on an anonymous complaint. To the express …

There is a lynching campaign against Zaldívar, maintains AMLO

President Andrés Manuel López Obrador maintained that there is a lynching campaign against the former minister-president of the … Read more

Peso recedes; trading at 16.61 per dollar

Mexico City. The Mexican peso depreciated this Friday for the fourth consecutive day in the face of a … Read more

Miles de turistas observaron el eclipse en distintas partes del país

Exploring the Wonders of a Solar Eclipse Witnessing a solar eclipse is a breathtaking experience that captivates people … Read more

Nearly 100,000 people fled Port-au-Prince in one month

United Nations, United States. Nearly 100,000 people fled the metropolitan area of Port-au-Prince in the last month due … Read more

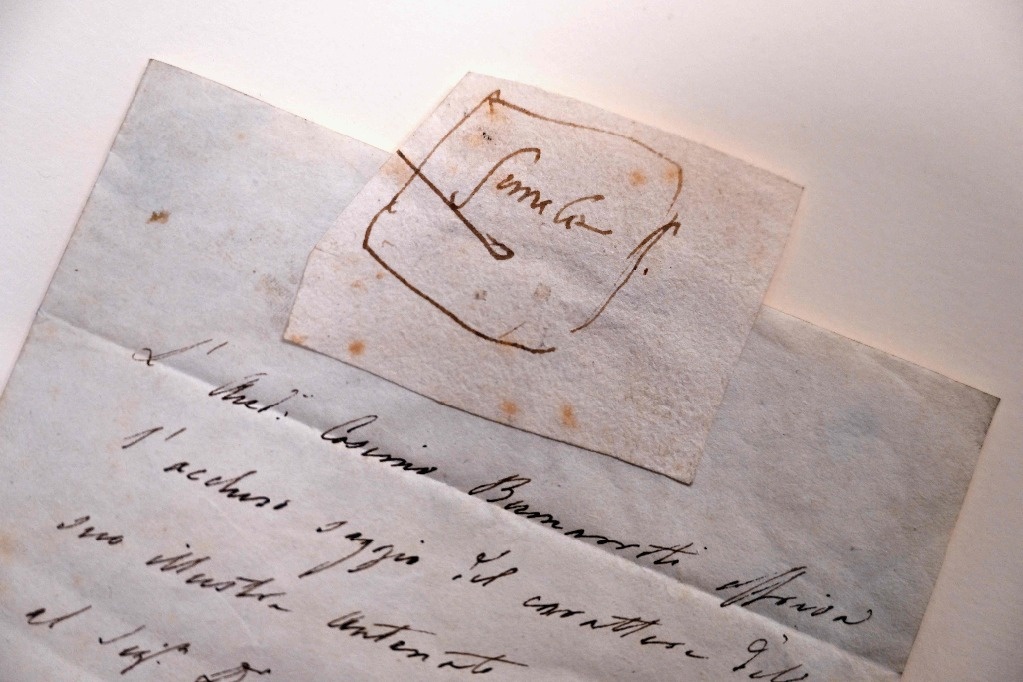

Michelangelo’s drawing auctioned for more than 200 thousand dollars in NY

NY. A small, simple drawing by the Italian Renaissance painter Michelangelo was sold for $201,600, 33 times its … Read more

:max_bytes(150000):strip_icc():focal(749x0:751x2)/Bryan-Kohberger-082423-9702d62f3c624d85be4f8a1650121389.jpg?fit=%2C&ssl=1)