featured

Rembrandt oil painting captures the viewer in a multisensory experience

Mexico City. The experience of the stormy sea that rocks a small boat while the crew members cling desperately to avoid being shipwrecked in the painting The storm on the Sea of Galilee (1633), by …

Rembrandt oil painting captures the viewer in a multisensory experience

Mexico City. The experience of the stormy sea that rocks a small boat while the crew members cling … Read more

Pumas beats León 1-0 and remains in play-in positions

Mexico City. Pumas added three games without losing and managed to stay in the “play in” positions by … Read more

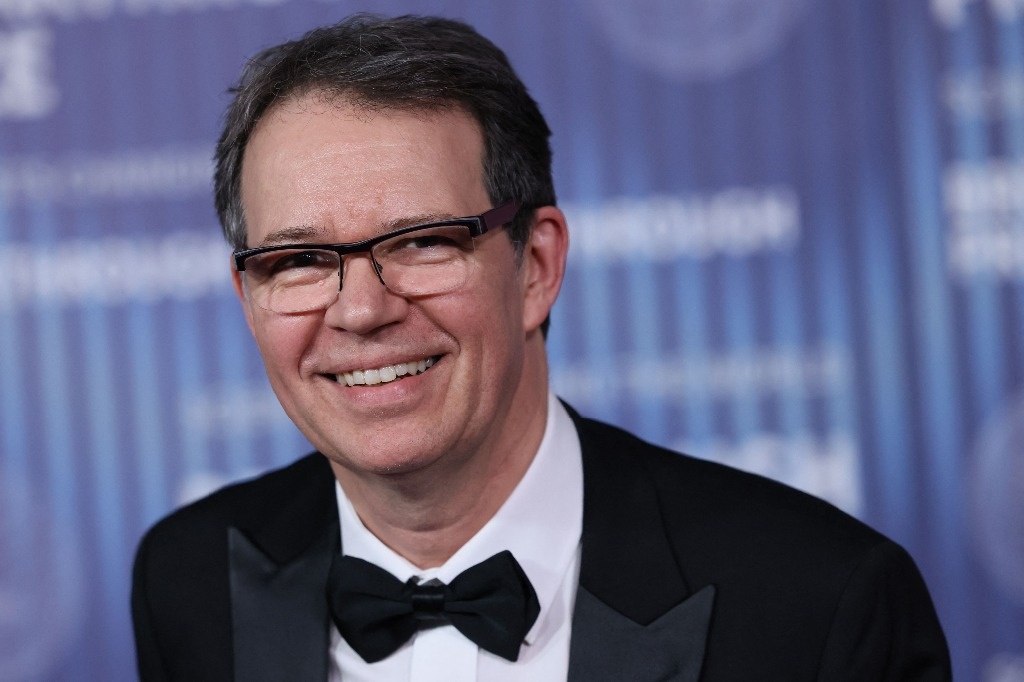

They reward “the most brilliant minds” with the so-called Oscars of science

The most brilliant minds in the world were awarded the Breakthrough Awards, called Oscars of scienceat a gala … Read more

Agriculture in Africa: Sadiki notes pressing need for robust adaptation strategies

The Minister of Agriculture, Maritime Fisheries, Rural Development, and Water and Forests, Mohamed Sadiki, noted, Monday in Meknes, … Read more

Pak-Iran presidents meet, express concern over the situation in Gaza

Web Desk: The presidents of Pakistan and Iran expressed deep concern over the worsening humanitarian situation in Gaza … Read more