featured

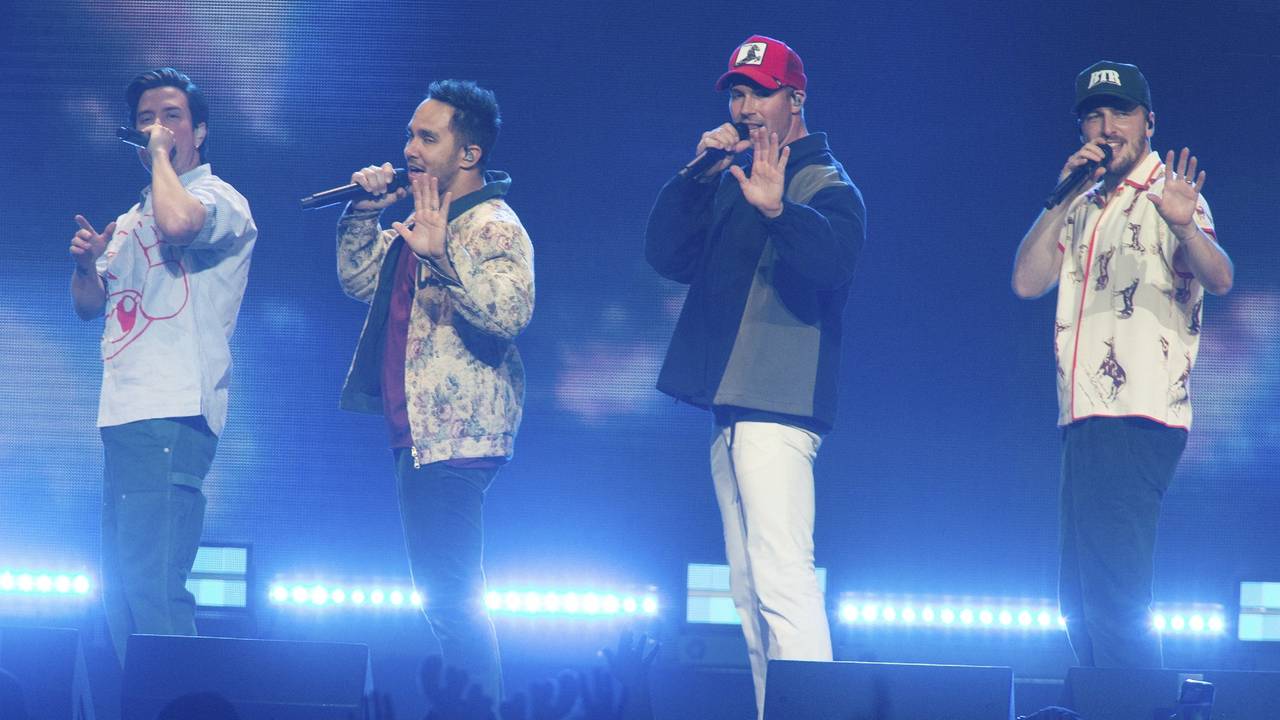

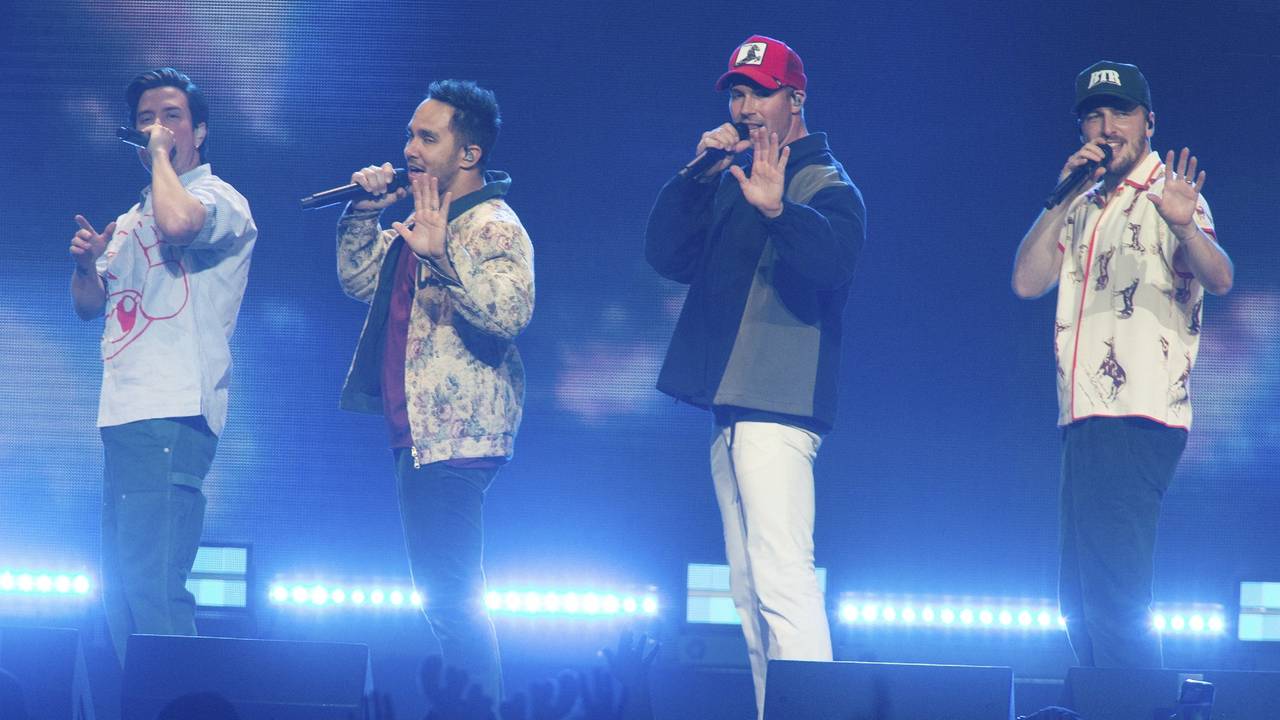

Big Time Rush concert in Tilburg moved to Ziggo Dome in Amsterdam due to overwhelming demand

The performance of the band Big Time Rush in the pop center 013 in Tilburg has raised so much interest that the band now has to change concert halls. The band was supposed to play …

Big Time Rush concert in Tilburg moved to Ziggo Dome in Amsterdam due to overwhelming demand

The performance of the band Big Time Rush in the pop center 013 in Tilburg has raised so … Read more

/i/2006660192.png?fit=%2C&ssl=1)

Men of War II Release Date Moved to May 15: Developer and Publisher Respond to Beta Criticism

Developer Best Way and publisher Fulqrum Publishing will release Men of War II for PC on May 15. … Read more

American Billionaire Steve Cohen Pushes for 24/7 Stock Market Opening: Potential Implications and Advantages

Stock markets are open 7 days a week, 24 hours a day, as the wish of American billionaire … Read more

New CEO Laura du Rusquec appointed to lead Ganni, replacing Andrea Baldo who signs with Balenciaga

Ganni renews his leadership by signing former Balenciaga. Laura du Rusquec has been appointed CEO of Ganni, replacing … Read more

:max_bytes(150000):strip_icc()/Rebel-Wilson-042324-576cd738f9f649b7bfbcacde62460711.jpg?fit=%2C&ssl=1)